Brandinfo

Brandinfo

HCM City − Global tungsten prices have surged to unprecedented levels in late 2025, driven by tightening supply conditions and accelerating demand from defense, electronics, and high-tech manufacturing sectors.

Analysts are seeing this not as a short-term spike, but as a structural re-pricing of one of the world’s most critical industrial minerals.

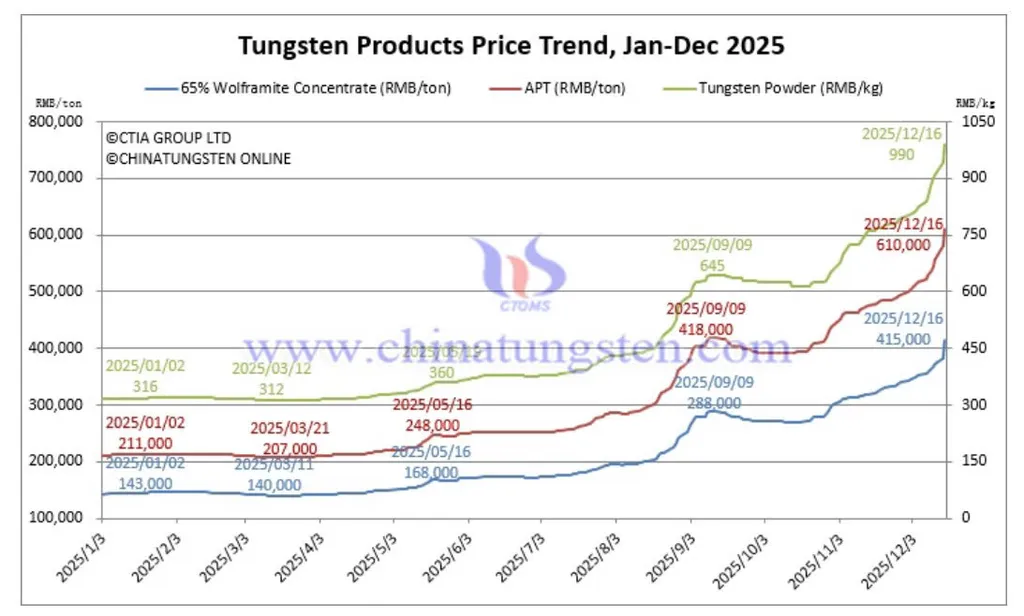

In mid-December, tungsten prices climbed sharply across key benchmarks. Ammonium paratungstate (APT), a critical intermediate used in tungsten metal production, rose to around US$400 per metric ton unit (mtu) in Europe, marking a significant increase compared with earlier in the year.

At the same time, prices for high-grade tungsten concentrate exceeded $50,000 per tonne, reflecting gains of well over 100 per cent since the beginning of 2025.

This rapid escalation is unfolding against a backdrop of persistent supply constraints. Unlike many base metals, tungsten production cannot be quickly scaled up in response to higher prices. The market remains highly concentrated, with a limited number of producing countries controlling the bulk of global output and downstream processing capacity.

Supply risks meet strategic demand

A key driver behind the current rally is heightened concern over access to supply. Export controls, quota adjustments and stricter resource management policies by major producing countries have added pressure to an already tight market.

These measures have amplified uncertainty for industrial consumers, particularly in advanced economies seeking secure access to critical raw materials.

At the same time, demand for tungsten continues to strengthen. The metal’s exceptional hardness, high melting point, and resistance to extreme conditions make it indispensable in strategic applications, ranging from aerospace and defense systems to semiconductors, advanced tooling and high-performance electronics.

Rising global defense spending is adding further momentum. Long-term commitments by NATO members to significantly increase military expenditure, alongside expanding defense budgets across parts of Asia, are expected to translate into sustained demand for tungsten-based materials well into the next decade.

Market observers note that tungsten is increasingly perceived not merely as an industrial input, but as a strategic asset – often described as the “black gold” of advanced manufacturing due to its scarcity, irreplaceability, and geopolitical relevance.

|

| Global tungsten prices have rose sharply in late 2025, and are expected to remain high in 2026. — Photo courtesy of Masan |

Tungsten prices likely to stay elevated

According to industry analysts, tungsten prices have now moved decisively above historical averages and are likely to remain elevated through 2026. The structural nature of supply tightness – reinforced by regulatory controls and long mine development timelines – contrasts sharply with demand that is both long-term and difficult to substitute.

As global supply chains are re-evaluated through the lens of resilience and national security, tungsten has emerged as a priority material for diversification efforts. This shift is reshaping investment flows and strategic partnerships across the sector.

Vietnam’s position in the tungsten supply chain

Vietnam is uniquely positioned to play a more prominent role in the international tungsten market.

The Nui Phao mine, one of the world’s largest tungsten deposits, accounts for nearly 30% of global tungsten resources outside of China. Operated by Masan High-Tech Materials (UpCOM: MSR), a member of Vietnam’s Masan Group, the asset forms the backbone of an integrated tungsten ecosystem that spans mining, chemical processing, and deep refining.

Rather than exporting raw materials, Masan High-Tech Materials focuses on producing higher-value tungsten products that meet stringent international standards required by advanced industrial and strategic sectors.

This vertically integrated model enables the company to offer customers stable, transparent, and responsibly sourced supply – a critical advantage in an increasingly volatile market.

The company’s performance in 2025 reflects these favorable dynamics. In the first nine months of the year, tungsten-related revenue reached VND 2.82 trillion, with third-quarter growth of 36 per cent year-on-year.

The results highlight both the impact of rising tungsten prices and the effectiveness of the company’s operational strategy, which prioritizes core mining and refining activities while improving efficiency and product quality.

|

| Tungsten products price trend in 2025. — Photo from China Tungsten |

A strategic role in a changing landscape

As global demand for high-tech and defense-related materials continues to expand, and supply constraints persist, the tungsten market appears to be entering a new long-term cycle. In this context, Vietnam’s role – anchored by large-scale, integrated operations such as Nui Phao – is gaining strategic significance.

Masan High-Tech Materials (UpCOM: MSR) is increasingly viewed as a key contributor to global efforts to diversify tungsten supply chains, supporting industries that are critical to economic security and technological progress.

For Vietnam, the current market environment represents not just a commodity upswing, but an opportunity to elevate its position in the global critical minerals landscape.