Society

Society

|

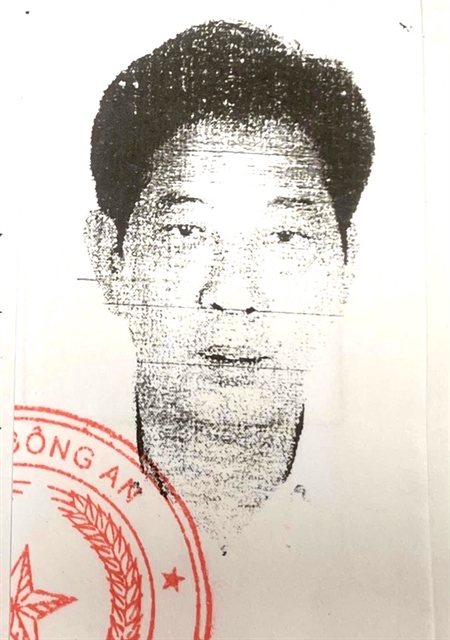

| Photo of Vũ Thế Bình on the Ministry of Public Security’s information portal. – Photo bocongan.vn |

HÀ NỘI — Việt Nam's top prosecutors have filed charges against five former banking and business executives accused of arranging illegal loans that left a commercial bank with losses exceeding VNĐ1 trillion (about US$38 million).

Those indicted include Dương Thanh Cường, the former chairman and chief executive of Bình Phát Company; Nguyễn Thế Bình, a former bank chairman who is now wanted by police; Hồ Đăng Trung, a former bank branch director; Hồ Văn Long, the former head of credit at the branch; and Đỗ Ngọc Dũng, a former credit officer.

Prosecutors say Cường allegedly sought financing for a property project in 2007 and was introduced to Bình, who agreed to arrange a VNĐ500 billion ($19 million) loan.

Because the branch could approve only a fifth of that amount, Trung signed papers requesting that the limit be lifted – a move that allowed the deal to go through. The loan file listed land as collateral even though ownership documents were incomplete.

Cường then padded the paperwork, inflating the land’s price from around VNĐ2–3 million a square metre to VNĐ12–13 million. Plots worth roughly VNĐ65 billion were suddenly valued at VNĐ358 billion.

After the bank released more than VNĐ302 billion, Cường withdrew most of it in cash. Only about VNĐ70 billion went into the stated project; the rest vanished into other uses.

Later that year, Cường asked to convert his short-term borrowings into a five-year loan. The bank agreed and released another VNĐ303 billion at the end of 2007 – money that Cường immediately used to clear the earlier debts.

Prosecutors say the so-called 'new' loan was simply a way to roll over old debt. The Bình Phát project itself had never been approved for construction or land use, yet the defendants valued it at VNĐ1.46 trillion. The scheme tricked the bank about VNĐ86 billion out of pocket.

The pattern repeated in 2010. With Bình Phát already in default and its assets frozen, Cường joined forces with Vũ Thị Bích Loan, director of THY Company, to secure another loan – VNĐ385 billion ($14.6 million) this time – using THY as a front to buy Bình Phát’s land.

The bank freed ten of Bình Phát’s plots so they could be re-pledged under THY’s name, then released the funds. THY transferred the money straight back to Bình Phát to settle old debts.

When THY failed to repay, the loan turned bad as well. By early 2024, its outstanding balance had swollen to VNĐ1.14 trillion ($43.4 million).

Prosecutors estimate that, across the two schemes, the bank advanced more than VNĐ1.22 trillion in loans that can no longer be recovered. The confirmed losses top VNĐ1.05 trillion. — VNS