bizhub

bizhub

The Manulife Vietnam app represents the company’s latest effort to provide maximum convenience while ensuring the safety of all customer transactions involved in their insurance policies.

|

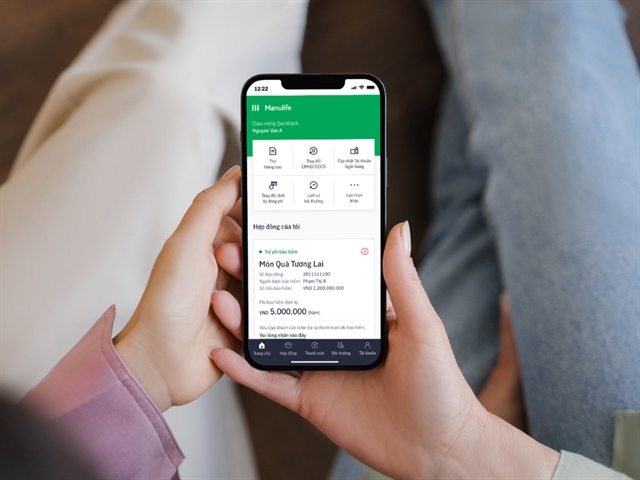

| With just a few taps, customers can easily check their Manulife policy details, make premium payments online, track claim statuses, update personal information, and download digital policy documents.— Photo courtesy of Manulife Vietnam |

HÀ NỘI — Manulife Vietnam has announced its new mobile app, ‘Manulife Vietnam’, designed to empower customers with convenient access to their insurance policies on handheld devices.

With just a few taps, customers can easily check their Manulife policy details, make premium payments online, track claim statuses, update personal information, and download digital policy documents.

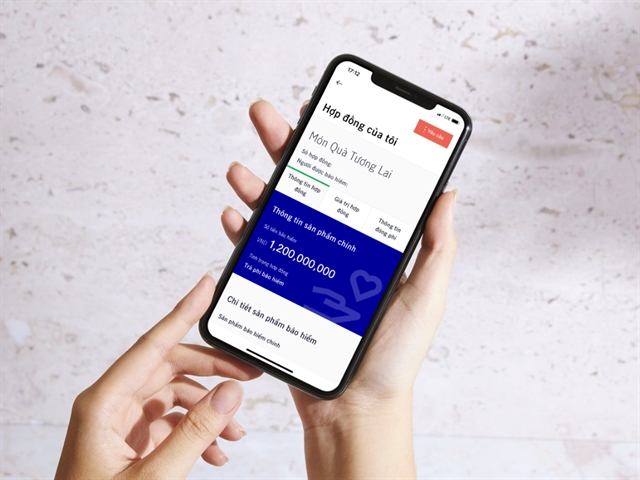

The app also includes features such as withdrawing dividends, coupons, cash value, and making online loans based on the policy’s value, among others.

To enhance security and user experience, the Manulife Vietnam app supports biometric login via fingerprint (Touch ID) or facial recognition (Face ID), along with OTP verification for all transactions. The app’s intuitive interface and advanced security measures are tailored to meet the evolving needs of customers throughout their insurance journey.

Tina Nguyễn, CEO of Manulife Vietnam, said that the Manulife Vietnam app represents the company’s latest effort to provide maximum convenience while ensuring the safety of all customer transactions involved in their insurance policies.

Positioned as a comprehensive and multifunctional insurance platform, the Manulife Vietnam app demonstrates the company's commitment to providing innovative and efficient solutions for its customers.

|

| The app includes features such as withdrawing dividends, coupons, cash value, and making online loans based on the policy’s value, among others. — Photo courtesy of Manulife Vietnam |

More new features, such as an integrated medical eCard and navigation to nearby hospitals and clinics, are set to be introduced soon. The app is available for download on both iOS and Android.

This customer app launch marks another milestone in Manulife's digital transformation journey, the company said.

Previously, the company’s pioneering sales verification and supervision process, M-Pro, which ensures thorough customer consultation during policy sales, was recognised as the "Digital Transformation Initiative of the Year" at the Insurance Asia Awards 2024. Additionally, the upgraded eClaims platform, now reduces claim processing time to just 1.1 days.

As the largest foreign-owned life insurance company in Vietnam by invested capital, Manulife Vietnam serves nearly 1.5 million customers through a nationwide network of modern offices.

In the first half of 2024 alone, the company paid out nearly VNĐ4 trillion in insurance benefits. On average, Manulife Vietnam processes over 41,000 insurance claims per month. — VNS