Economy

Economy

Shares tumbled yesterday on the two exchanges on rising investor caution, caused by uncertainties in the global markets.

|

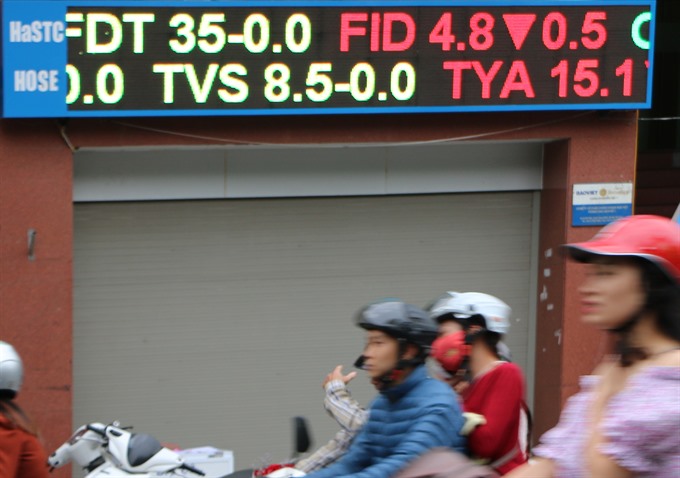

| An electronic stock board on Bà Triệu Street in Hà Nội. – VNS Photo Đoàn Tùng |

HÀ NỘI – Shares tumbled yesterday on the two exchanges on rising investor caution, caused by uncertainties in global markets.

The benchmark VN-Index, a measure of 314 stocks on the HCM Stock Exchange dropped 0.8 per cent to close at 671.4 points after increasing 0.1 per cent on Tuesday.

On the Hà Nội Stock Exchange, the HNX-Index tracking 379 shares was down 1.2 per cent to 81.3 points. It had rose 0.1 per cent the previous day.

Overall market conditions were negative with 273 of total 693 stocks declining while 133 advanced.

Market sentiment weakened as global stocks kept falling amid anxiety of the outcome of the US presidential election among other things.

“Although Việt Nam’s market typically lacks correlation with the world market, a solid trend may leave an effect,” analysts at FPT Securities Co wrote in a note.

Blue chips led the downturn as 23 of the top 30 biggest shares by market capitalisation dropped while only three increased. The biggest losers included insurer Bảo Việt Holding (BVH) and steelmaker Hòa Phát Group (HPG) each down more than 2 per cent. The second largest listed lender Vietcombank (VCB) and real estate giant VinGroup (VIC) both fell over 1 per cent.

Money focused on low-valued stocks as ten of the top 10 most active stocks on the two exchanges had value of below VNĐ10,000 per share.

Realty firms attracted the most attention. FLC Group (FLC), Tân Tạo Investment and Industry (ITA), Hoàng Quân Consulting-Trading-Service Real Estate (HQC), Sacomreal (SCR), Tasco (HUT) and PetroVietnam Construction (PVX) all were among the most heavily-traded stocks.

Liquidity improved with a total of 175.2 million shares worth over VNĐ2.7 trillion (US$121.1 million) exchanged in the two markets, up 13.3 per cent in volume and 22.7 per cent in value compared to Tuesday.

According to analysts at BIDV Securities Co, the VN-Index’s retreat to the support level of 670 points showed that the market is no out of a medium-term upswing.

“Increased market risks can make the market adjust to lower support thresholds of around 660 points,” they wrote in a note.

Foreign investors returned as net sellers in HCM City’s market yesterday after three consecutive net buying sessions, offloading shares worth a net value of VNĐ46 billion. They also extended net selling in Hà Nội’s market to three days in a row with net sell value of VNĐ6 billion. – VNS