Economy

Economy

|

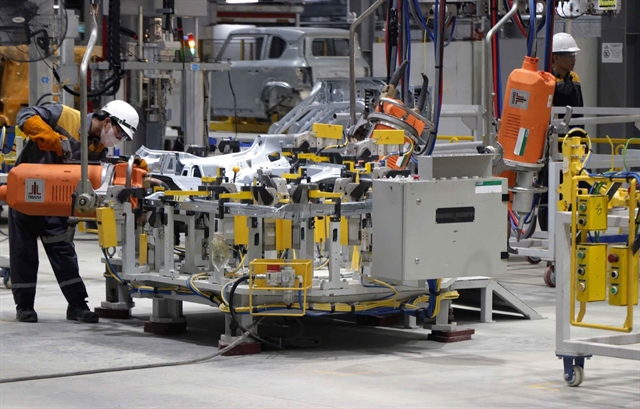

| Việt Nam’s manufacturing sector maintains its recovery momentum, with output and new orders continuing to rise amid improving business conditions. — VNA/VNS Photo |

HCM CITY — The manufacturing sector maintained its growth momentum in January 2026, with output, new orders and employment all recording solid increases, and business confidence rising to the highest level in nearly two years.

According to data released by S&P Global, the Purchasing Managers’ Index (PMI) stood at 52.5 points in January, slightly down from 53.0 in December.

Despite the modest decline, the index remained comfortably above the 50-point threshold, signalling continued improvement in overall business conditions.

January marked the seventh consecutive month of expansion for the manufacturing sector, underscoring the resilience of the recovery and a firm start to 2026.

Although the headline PMI edged lower, manufacturing output continued to rise sharply.

Survey respondents attributed the strong increase in production mainly to higher volumes of new orders, which expanded at a faster pace than in December, driven by improving consumer demand.

Total new orders were further supported by a recovery in new export orders.

Several manufacturers reported receiving additional orders from other Asian economies, including India, indicating a gradual improvement in external demand.

Rising output was accompanied by continued growth in employment.

Manufacturing employment increased for the fourth month in a row, with the rate of job creation the fastest since June 2024, although overall growth remained modest.

Some firms noted that newly hired workers were mainly employed on a temporary basis.

To meet higher production requirements, manufacturers stepped up purchasing activity, extending the current expansion in input buying to seven months.

However, input inventories fell for the first time since September 2025, as raw materials were drawn down to support higher output levels.

Stocks of finished goods also declined, and at the fastest pace in four months, reflecting relatively swift delivery of products to customers.

Suppliers’ delivery times continued to lengthen, and was largely attributed to strong input demand and shortages of raw materials.

These factors continued to drive up input costs in January, with inflation easing only slightly from the three-and-a-half-year high recorded in December.

In response to rising costs, manufacturers raised their selling prices further.

Notably, the pace of output price inflation accelerated to its highest level since April 2022.

Looking ahead, business optimism regarding output over the next 12 months improved for the fourth consecutive month, reaching its highest level since March 2024.

Around 55 per cent of surveyed firms expect output to increase in the year ahead, supported by expectations of stronger new orders amid improving market conditions.

Commenting on the results, Andrew Harker, economics director at S&P Global Market Intelligence, said Việt Nam’s manufacturing sector has made a solid start to 2026, with firms ramping up production to meet rising new orders and responding promptly to customer demand.

But he cautioned against potential inflationary pressures, as ongoing shortages of raw materials continue to push up costs and selling prices.

While demand has yet to show signs of weakening, he noted that developments in new orders in the coming months will need to be closely monitored. — VNS