Economy

Economy

|

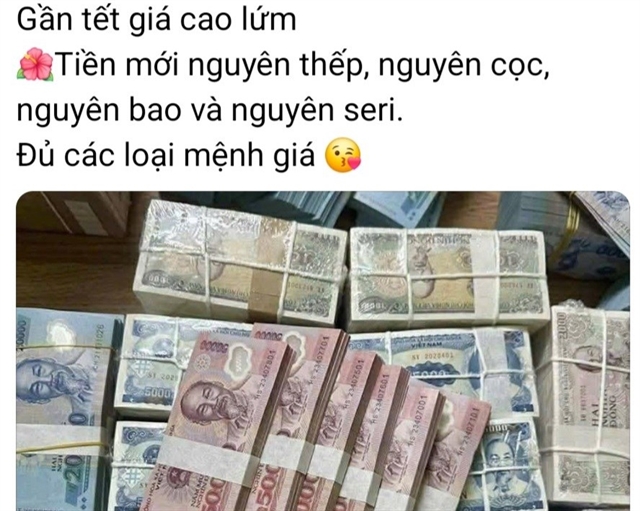

| A screengrab of a small-money exchange service advertised on a social media platform. VNA/VNS Photo |

HÀ NỘI — With Tết (Lunar New Year) 2026 approaching, the trade in exchanging new and small banknotes is heating up, particularly on social media platforms such as Facebook, Zalo and Threads, prompting a police warning that the widely advertised service carries growing risks of fraud and legal violations.

On a year-end morning amid the bustle of Tết shopping, Nguyễn Thanh Phương, an office worker in Hà Nội, searched online for exchange new banknotes for lucky money. Within moments, dozens of offers appeared, promising crisp notes, full denominations, fast delivery and reasonable fees. For many families, slipping fresh banknotes into red envelopes remains a cherished Tết tradition. Few, however, are aware of the risks behind the apparent convenience, which range from scams and counterfeit cash to breaches of the law.

As the holiday draws nearer, the market for exchanging new and small denominations has become increasingly active online. A quick search reveals countless advertisements offering everything from VNĐ500 to VNĐ200,000 notes, neatly bundled and delivered to customers’ doors. Fees typically range from 5 to 10 per cent and can be higher for smaller notes or sought-after serial numbers.

Police say this booming market has also become a hotspot for scams. A common tactic sees fraudsters set up social media accounts, complete a few small transactions to build trust, then ask customers to transfer larger deposits before cutting off contact and disappearing. In other cases, buyers receive cash only to later discover that some notes are counterfeit or unfit for circulation, often when they try to spend the money or give it as lucky money. Because these transactions are informal and lack legal contracts, victims find it extremely difficult to seek compensation.

Beyond the risk of fraud, authorities stress that exchanging money for profit is illegal. Lawyer Nguyễn Thanh Hà of SBLAW said that while using new or small banknotes is not prohibited, organising money exchange services and charging fees violates the law. Under the Law on the State Bank of Việt Nam, only licensed banks are authorised to issue and manage currency circulation. Individuals who breach these rules can face fines of up to VNĐ40 million, about $1,500, while organisations may be fined up to VNĐ80 million, with all illegal profits confiscated.

Enforcement is set to tighten further under new regulations. From February 9, 2026, Decree 340/2025/NĐ-CP will take effect, replacing earlier rules and imposing administrative penalties on those who collect service fees in violation of the law. As a result, informal money exchange services during Tết will face greater legal risks than before.

Police also warn that illegal money exchange often overlaps with other year-end financial scams, particularly illegal lending. Loan sharks frequently advertise quick loans or instant disbursement without collateral, targeting people short of cash for Tết spending. While borrowers may receive money rapidly, they can quickly fall into debt traps due to extremely high interest rates and hidden fees.

Given these risks, authorities advise people to exchange money only at banks or official transaction counters. Although supplies of new banknotes may be limited, these channels are legal, safe and do not charge fees. People are also urged not to transfer money in advance to unknown individuals or use unofficial online services.

In recent years, digital lucky money sent via banking apps and e-wallets has emerged as a popular alternative. With a few taps, users can send money along with new year wishes quickly and securely, reducing the need to exchange cash. — VNS