bizhub

bizhub

After the transaction, ASKA's ownership in the Vietnamese pharmaceutical company increased to nearly 27 million shares (32.56 per cent of capital).

|

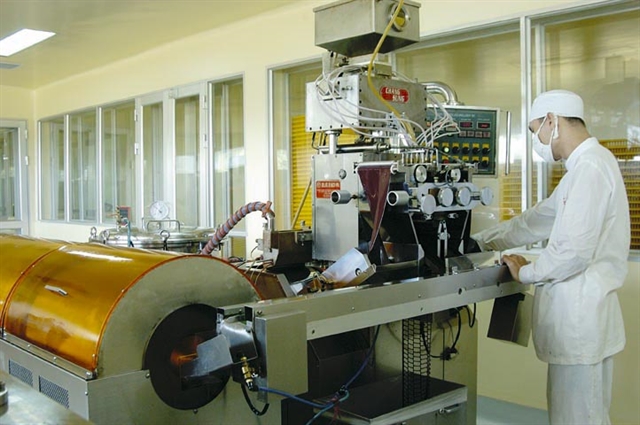

| Inside a factory of Hà Tây Pharmaceutical Company. — Photo hataphar.com.vn |

HÀ NỘI — ASKA Pharmaceutical Co., Ltd (Japan) has just announced the completion of purchasing 8.4 million shares of Hà Tây Pharmaceutical (DHT).

After the transaction, ASKA's ownership in the Vietnamese pharmaceutical company increased from 18.4 million shares (24.9 per cent of capital) to nearly 27 million shares (32.56 per cent of capital).

This is a private offering of DHT, with the number of additional shares issued of 8.4 million units, priced at 21,500 VNĐ/share and ASKA was the only party joining in the entire purchase.

With the offering price according to the announced plan of VNĐ21,500 per share (US$0.89 a share), the Japanese company has to spend about VNĐ181 billion for the purchase. The amount of newly issued shares will be restricted from transfer for three years.

As for DHT, the company's charter capital increased to more than VNĐ8.2 trillion after completing the transaction.

Hà Tây Pharmaceutical would invest VNĐ78 billion in the Hataphar high-tech Pharmaceutical Factory project in Hataphar, and use the remaining VNĐ102 billion to restructure bank debts in order to alleviate financial strain and improve capital autonomy.

Previously, in 2021, ASKA became a strategic investor of Hà Tây Pharmaceutical after buying nearly 5.3 million newly issued shares at a price of VNĐ70,000 per share, 18 per cent higher than the market price of DHT shares at that time.

After that, ASKA held 24.9 per cent of the charter capital of Hà Tây Pharmaceutical, equivalent to 6.6 million shares, and was the largest shareholder in this company.

By June 2023, Hà Tây Pharmaceutical paid bonus shares at a rate of 180 per cent, meaning that a shareholder holding 100 shares received 180 new shares. The number of shares held by ASAKA increased to more than 18.4 million shares.

On the stock market, DHT shares closed Friday at VNĐ23,000 a share. — VNS