Society

Society

The Ministry of Public Security is investigating 210 loan shark gangs who are lending money to around 2,000 people and demanding payback at extortionate rates.

|

| The Ministry of Public Security is investigating 210 loan shark gangs who are lending money to around 2,000 people and demanding payback at extortionate rates.— Photo vietnamnet.vn |

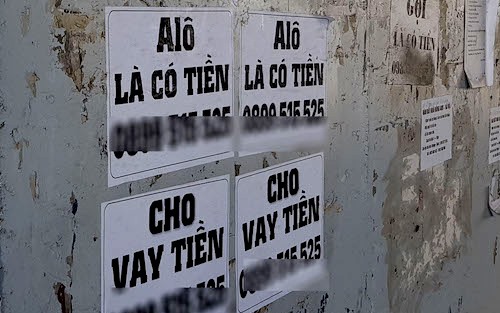

HÀ NỘI — The Ministry of Public Security is investigating 210 loan shark gangs who are lending money to around 2,000 people and demanding payback at extortionate rates.

Known as ‘black credit’, the figures were released by Lương Tam Quang, head of the office of the Ministry of Public Security (MoPS).

“Black credit operates in a very sophisticated manner, spreading from rural to highland areas and ethnic minorities. Worse still, black credit often associated with organised crime, hiding under the cover of pawn shops, debt collecting company, financial companies, " Quang told online Vietnamnet newspaper.

Quang also pointed out several ways to identify black credit operations including lending, borrowing, capital mobilisation with interest rates 10 times higher than the maximum rate allowed in the banking system, leading to insolvency.

This type of crime also existed in such form as promotions, commissions with very high interest rates as a lure for people who do not understand the law. Individuals mobilise capital illegally.

According to Quang, to lure borrowers, some black credit groups use social networks, and mobile applications to entice customers.

Many people have lent their own money or tried to raise money from others to lend the “mastermind borrower”, the black credit’s mastermind in order to earn high interest. If the borrowers failed to pay the interest or fled, the middleman (who helped introduced lenders to borrowers) would have their property confiscated to pay back the debt.

Nguyễn Văn Viện, deputy director of Hà Nội Police said the capital city was reviewing pawn shops and financial companies involved in loan-sharking and illegal debt collection.

At the recent conference organised by the Steering Committee for National Target Programme to set forth tasks for 2019, the MoPS said it was holding documents indicating that black credit in rural areas involved more than VNĐ1 trillion but varied in many forms.

Relevant agencies were asked to cooperate with the ministry in dealing with loan sharks in rural areas to enhance its effectiveness.

Deputy Prime Minister Vương Đình Huệ said Resolution No. 01 of the Government stated "there should be is a suitable credit solution to meet the legitimate needs of the people regarding to loans, contributing to limiting black credit".

He requested the banking sector and the relevant ministries and agencies to coordinate in fighting crimes related to “black credit” in rural areas.

In late November last year, police in Thanh Hóa Province busted an illegal lending racket which involved more than 200 people across Việt Nam with total loans worth more than VNĐ510 billion (US$22 million).

Nam Long Financial Company, unlicensed and collecting up to 1,000 per cent interest, is considered the biggest of its kind in the country with a presence in 63 out of the country’s 64 provinces and cities. — VNS