Society

Society

Seventeen former leaders of Mekong Housing Bank (MHB) and Mekong Housing Bank Securities Company (MHBS) including former chairman of the bank’s management board Huỳnh Nam Dũng will be prosecuted for abusing power and irresponsibility that causes serious consequences.

|

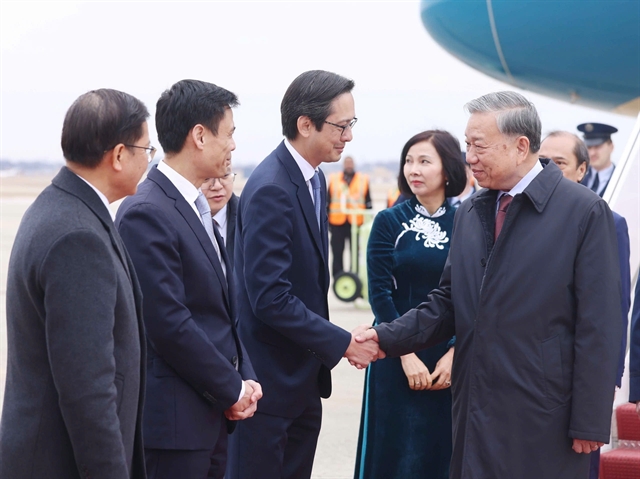

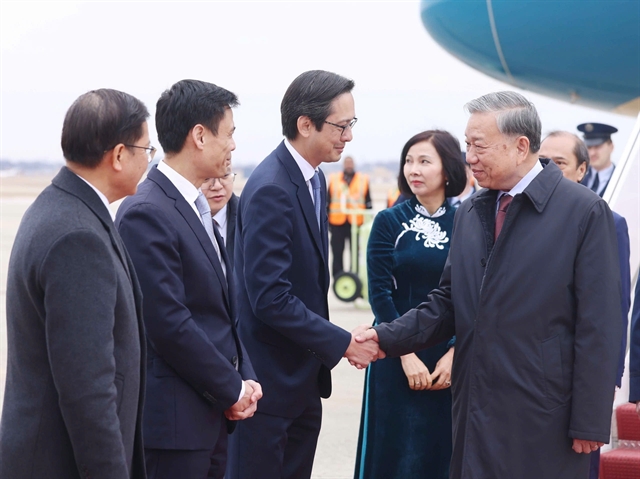

| Former chairman of Mekong Housing Bank’s management board Huỳnh Nam Dũng will be prosecuted for abusing power, mismanaging State’s asset. — Photo vietnamnet.vn |

HÀ NỘI — Seventeen former leaders of Mekong Housing Bank (MHB) and Mekong Housing Bank Securities Company (MHBS)-including former bank management board chairman Huỳnh Nam Dũng-will be prosecuted for abuse of power and irresponsibility that led to serious consequences.

The Public Security Ministry’s Investigation Police Department announced yesterday that they had finished investigations concerning power abuse at MHB, MHBS and other companies.

The investigation results show that Dũng – the top leader responsible for managing State-owned capital at the bank – abused power, violated laws and caused losses worth nearly VNĐ299 billion (US$13.22 million) to State assets.

Others involved include former director general Nguyễn Phước Hòa, former vice director general Bùi Thanh Hưng, former chief accountant Nguyễn Văn Thanh, former MHBS General Director Lữ Thị Thanh Bình and former MHBS vice general director Đặng Văn Hòa.

According to investigation results, before merging with the Bank for Investment and Development of Việt Nam (BIDV) in May 2015, the MHS founded had charter capital of VNĐ3.369 trillion ($149 million) with State capital making up 91.26 per cent.

In December 2006, MHB established MHBS, and the bank contributed 60 per cent of the charter capital of the securities company.

In November 2010, MHB’s internal auditing found that the MHBS suffered losses continuously – VNĐ36.6 billion in 2008, VNĐ41.5 billion in 2009 and VNĐ13 billion in the first nine months of 2010.

Dũng, instead of seeking solutions to address the MHBS’s problems, decided to transfer capital from MHB to MHBS through investing Government’s bonds. The MHBS opened accounts at MHB’s branches and earned money thanks to interest rate difference.

Leaders of MHB and MHBS also are being accused of withdrawing money from the companies’ bank account to spend for personal purposes. — VNS