Society

Society

Accelerating the development of the private sector and expanding domestic private finance are key priorities for Việt Nam to meet the financial requirements of the Sustainable Development Goals (SDGs), a United Nations Development Programme (UNDP) report launched yesterday reveals.

|

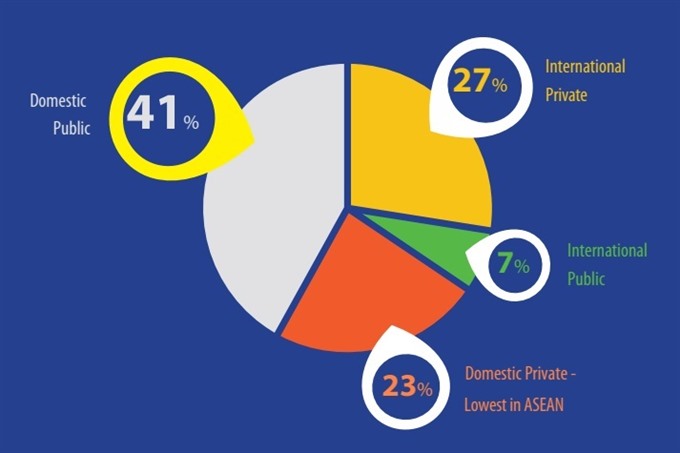

| Việt Nam’s development finance landscape. — Source UNDP |

HÀ NỘI — Accelerating the development of the private sector and expanding domestic private finance are key priorities for Việt Nam to meet the financial requirements of the Sustainable Development Goals (SDGs), a United Nations Development Programme (UNDP) report launched yesterday reveals.

The Development Finance Assessment Report entitled ‘Financing Sustainable Development in Việt Nam’ uses the lens of the Integrated National Financing Framework to analyse the composition, characteristics and trends of Việt Nam’s development finance and development investment resources with comparisons to other countries mainly from ASEAN.

According to the report, the development finance landscape in Việt Nam has witnessed changes. Việt Nam’s Foreign Direct Investment (FDI) and remittance inflows have remained high compared to other ASEAN countries while Official Development Assistance (ODA) is declining. Government revenue is not increasing fast enough to sustain the high level of public investment needed to meet increasing spending obligations and rising public debt.

Domestic private investment in Việt Nam is lagging behind the ASEAN average and is yet to fulfill its increasingly important role as a driver of lower middle-income economic growth, the report says.

Dr Hồ Đình Bảo, national consultant and lecturer at the National Economics University, one of the team’s researchers, said “Việt Nam’s domestic private finance share accounts for 23 per cent of total development finance resources and stands below the ASEAN average (31 per cent).”

"This fact is due to the structure of the Vietnamese economy. The size of enterprises in Việt Nam remains small," he said.

An important point in the report, according to Bảo, is that the domestic private share of total investment in HCM City – the growth engine of the country – was around 65 per cent in 2015-16 and similar to other ASEAN countries.

Haoliang Xu, Assistant Secretary General of the United Nations and director of the UNDP’s Regional Bureau for Asia and Pacific said that the per capita domestic private investment of Việt Nam, which stands at US$490 in 2015 compared to the ASEAN average of $690, is among the lowest in the region.

He called for urgent action, including incentives for increasing domestic private investment, public investment crowding in private investment and attracting FDI that helps link domestic firms to global value chains.

He proposed enhancing tax collection, State asset management and introducing property and environmental taxes and integrated national financing framework for SDGs.

Deputy Minister of Planning and Investment Lê Quang Mạnh said “The Vietnamese Government has conducted measures including restructuring public investment, cutting down regular expenditures, updating ODA mechanisms aiming at better public debt management.

"The report helps the Vietnamese Government gain a comprehensive insight into the country’s financial structure in the future and provides useful information for the Government to devise plans for national socio-economic development between 2021 and 2030," he said. — VNS