Economy

Economy

The COVID-19 outbreak has hit fast-moving consumer goods (FMCG) businesses but not all categories and retailers will suffer negative impacts, according to global data and consulting company Kantar Worldpanel.

|

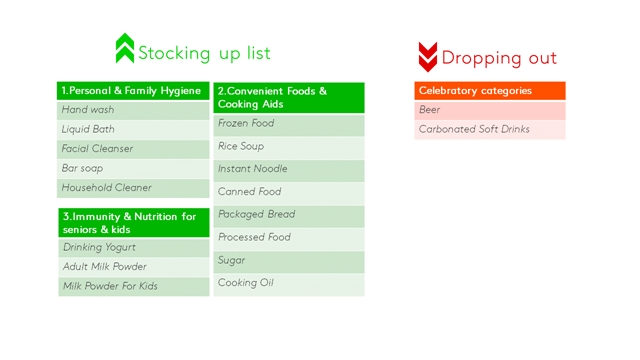

| Amid the Covid-19 pandemic, consumers increase stocks of personal and family hygiene, immune-boosting and nutrition products, and convenient food and cooking aids in HCM City. — Source Kantar |

HCM CITY — The COVID-19 outbreak has hit fast-moving consumer goods (FMCG) businesses but not all categories and retailers will suffer negative impacts, according to global data and consulting company Kantar Worldpanel.

The company said it is closely monitoring the impact of COVID-19 on FMCG categories across various shopping channels to shed light on how consumers’ behaviours are changing to help brands and retailers respond to them in this VUCA (volatile, uncertain, complex, ambiguous) time.

Growth in the FMCG market slowed down in the first two months of 2020 to 5.2 per cent compared to 6.3 per cent a year ago.

Dairy, packaged foods and personal care sectors have managed to sustain growth rates of 1.7-14.5 per cent, while beverages suffered a decline despite this being the high season (Lunar New Year or Tết).

It is possibly explained by the lower numbers of parties and celebrations as people avoided socialising and gathering.

By looking at consumer purchase behaviours in the four weeks after Tết compared to the same period last year, it is easy to see how COVID-19 has initially affected people’s FMCG spending and purchase behaviours.

Consumers in urban four key cities, Hà Nội, HCM City, Đà Nẵng, and Cần Thơ, showed a tendency to stock up three groups of categories.

Firstly, they spent more on categories that offered personal and family hygiene to remain clean and kill germs. Hand sanitisers, bar soaps and household cleaning products all saw double- and even triple-digit rises.

Secondly, convenient foods and cooking aids also saw sales surge during the outbreak, probably due to fear and anxiety amid the increasing number of confirmed cases and the extended home stay of children.

Frozen foods, canned foods, instant noodles, and cooking oils were a few categories enjoying impressive growth.

The other products that consumers sought during this time were those boosting immunity and nutrition, especially for seniors and kids who are at higher risk.

On the other hand, they cut down on celebratory categories from their basket. Thus, alcoholic and non-alcoholic drinks suffered the most in this period, with beer and carbonated soft drinks in particular experiencing sharp declines.

Channel movements

There were changes not only in product preferences but also channel choices, with online shopping prevailing as people shopped remotely, accelerating the growth of online FMCG spend to a triple digit rate in just one month since the official announcement of the epidemic in Việt Nam. The trend is expected to continue in the coming months with local authorities urging to shop online to avoid crowds and physical contact.

With the skyrocketing demand for face masks and hand sanitisers, it is no surprise to see the robust growth of consumer spending in pharmacies including Medicare and Guardian. More purchases of hygiene products were made as consumers’ priority was their safety.

As the number of affected people swells, there is panic buying in some areas, especially where there have been confirmed cases. It drives demand to stock up, leading to a notable growth in sales at hypermarkets, supermarkets and minimarkets, which are perceived to offer hygiene, variety and lots of support programmes such as home delivery, masks and hand sanitisers at stable prices, support for farmers, and so on.

Within the big retail format, Big C achieved the strongest performance, driven by increasing footfall and spend per trip.

MM Mega market (cash-and-carry retail model) also picked up despite its downturn in recent years.

Meanwhile, shops most commonly used for daily needs are losing customers since they prefer less physical contact and fewer shopping trips. So street shops, and convenience stores are seeing the impact of the COVID-19. — VNS