Economy

Economy

|

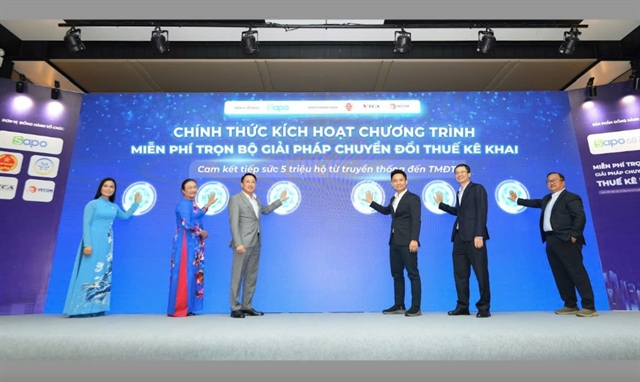

| Delegates activate Sapo’s digital tax transition solutions programme at the event. — Photo vneconomy.vn |

HÀ NỘI — The Department of Taxation (GDT) under the Ministry of Finance is preparing to launch a pilot version of its online tax declaration portal later this month, a move seen as pivotal in replacing the decades-old lump-sum tax system with a digital self-declaration model from January 1, 2026.

The upcoming launch is expected to ease concerns among household businesses, particularly older shop owners and traditional market traders who are accustomed to manual bookkeeping and may lack digital or accounting skills.

Deputy Director General Mai Sơn said the pilot platform would help millions of household businesses familiarise themselves with the online process of filing and paying taxes before the system becomes mandatory.

Sơn added that the key task for tax authorities was to assess the actual situation of household businesses—including their access to devices such as computers and smartphones, their use of software, understanding of new policies and practical concerns like inventory management or error correction— in order to provide direct and hands-on guidance.

“To make this policy a reality, the partnership of technology companies is crucial in translating it into practice and ensuring a smooth, effective transition for household businesses,” he said at a tax digitalisation workshop in Hà Nội on Tuesday.

The initiative is part of a nationwide 60-day peak transition campaign, during which tax officers are visiting local businesses to assess readiness in terms of devices, software and understanding of digital procedures.

According to the tax department, 98 per cent of declarant households already submit tax payments electronically, while 18,500 have switched from lump-sum to self-declaration and 133,000 have begun using e-invoices issued from point-of-sale systems. Officials said these figures reflect strong momentum toward full digitalisation.

To support the transition, the Ministry of Finance has urged provincial authorities to assist small traders with training and infrastructure upgrades. The ministry also called on technology firms to offer free or discounted digital tools such as e-invoicing, accounting software and digital signatures to reduce costs for small operators.

|

| Tax officials in Hải Phòng guide household businesses on shifting from flat-rate tax to self-declaration and using e-invoices. — VNA/VNS Photo Hoàng Ngọc |

At an event on Tuesday, tech company Sapo launched a free tax-management package known as Sapo 6870. The package includes digital sales management, e-invoice issuance and automatic tax declaration on mobile devices. Participating household businesses will receive 24 months of free software use, 2,000 e-invoices and a three-month digital-signature licence.

Other technology providers such as Misa, Bkav and Viettel are joining the effort.

Viettel Telecom has launched Tendoo, an AI-driven platform integrating sales, accounting and tax filing, featuring seven auto-updating ledgers compliant with Finance Ministry standards and a three-month free trial with digital-signature and insurance tools.

Tax departments in Hà Nội and HCM City are simultaneously implementing localised transition programmes.

Hà Nội’s tax office has established a three-tier Zalo communication network connecting tax officials directly with household businesses, while HCM City has classified its 363,000 household taxpayers into three income groups based on annual revenue for customised support and digital training.

The Ministry of Finance is also developing a new legal framework for household taxation centred on three pillars, including revising the Law on Tax Administration, drafting a specific policy regime for household taxpayers and introducing a simplified accounting system compatible with digital tools.

Nguyễn Thị Cúc, chairwoman of the Vietnam Tax Consultants’ Association, said household businesses should consider upgrading to enterprises to access greater tax incentives and growth opportunities.

Registered firms can deduct all assets as input costs and claim double deductions for research expenses, she said, adding that they may also set aside up to 20 per cent of pre-tax profit for a science and technology development fund – a benefit not available to household businesses.

“Tax reform is not about supervision – it’s about partnership,” Sơn added. “We want taxpayers to see digital tax declaration as an opportunity, not an obligation.” — BIZHUB/VNS