Economy

Economy

.jpg)

|

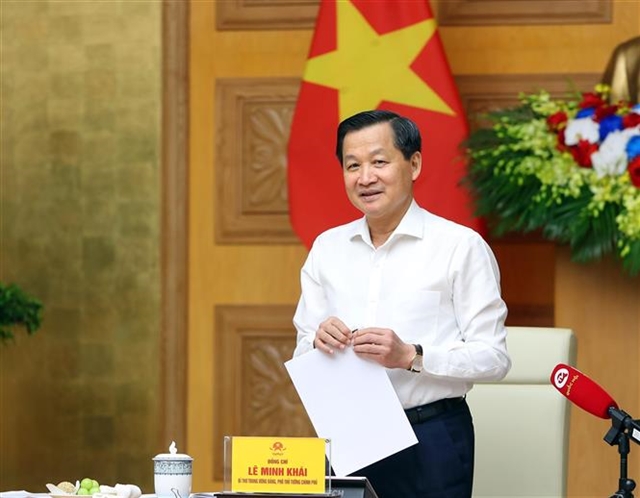

| Deputy Prime Minister Lê Minh Khái chaired a meeting of the steering committee for money laundering prevention and combat on Thursday. — VNA/VNS Photo |

HÀ NỘI — Deputy Prime Minister Lê Minh Khái has urged drastic measures to lift Việt Nam out of the Financial Action Task Force (FATF)’s list of Jurisdictions under Increased Monitoring (grey list) within two years.

Chairing a meeting of the steering committee for money laundering prevention and combat on Thursday, he said the FATF added Việt Nam to the list in June 2023. In response, the Government sent a commitment to the FATF President about the implementation of an FATF-recommended action plan over two years.

The inclusion in this list will have adverse impacts on Việt Nam, especially in terms of economy, trade, investment, and international cooperation, he noted. The Asia/Pacific Group on Money Laundering (APG) recently worked with the State Bank of Vietnam (SBV) and relevant agencies to seek ways to help remove the country from the grey list, he said.

Khái stated that Việt Nam has integrated into the world and must comply with common international standards. Numerous solutions are required to have the country removed from the list, and the most complex issue is institutional reform.

The requirements set by the FATF are highly urgent, and Việt Nam has very little time to carry them out. If the country does not take proactive and effective actions, the situation will become very complicated, the Deputy PM pointed out.

He asked the SBV, the standing body of the steering committee, and related ministries and sectors to carry out the tasks as soon as possible.

Highlighting the significant impacts of the FATF’s official inclusion of Việt Nam in the grey list, SBV Deputy Governor Phạm Tiến Dũng called on ministries and agencies to coordinate with the central bank to perform tasks.

Việt Nam might be named in the EU’s list of high-risk country jurisdictions in terms of money laundering and in the FATF’s black list if it fails to prove that it is cooperating in implementing the FATF’s recommendations. If that happens, particularly severe consequences will arise, forcing companies to pay more for business expenses or even suspend operations, he warned.

This would also undermine Việt Nam’s political stature and reputation in the international arena and negatively affect the country’s external relations and finance-banking systems, Dũng added.

He continued by saying that in October 2023, the FATF also added Việt Nam to the list of countries with significant activities of virtual asset service providers. Therefore, it may request the country to implement priority measures to establish a legal framework for combating money laundering in terms of virtual assets.

Echoing the SBV’s view, Deputy Minister of Foreign Affairs Nguyễn Minh Hằng opined that there remains a significant workload ahead. The implementation of recommendations is a highly technical and legal issue requiring substantive measures.

The EU also named Việt Nam in its grey list on 18 August. Apart from the FATF’s grey list, inclusion in the EU list will also have major impacts as Việt Nam’s trade, financial, and banking relations with EU countries are substantial, she said.

Hằng suggested Việt Nam consider the implementation of commitments as beneficial for not only minimising risks but also aiding in perfecting regulations and policies, combating corruption and crimes, improving the investment and business climate, and enhancing the country’s prestige.

At the meeting, officials examined the draft national action plan for addressing the risks of money laundering and terrorist financing for the 2023-28 period. They also discussed measures for ministries and sectors to implement the Prime Minister’s decision on issuing a national action plan on combating money laundering, terrorist financing, and the financing of the proliferation of weapons of mass destruction. — VNS