|

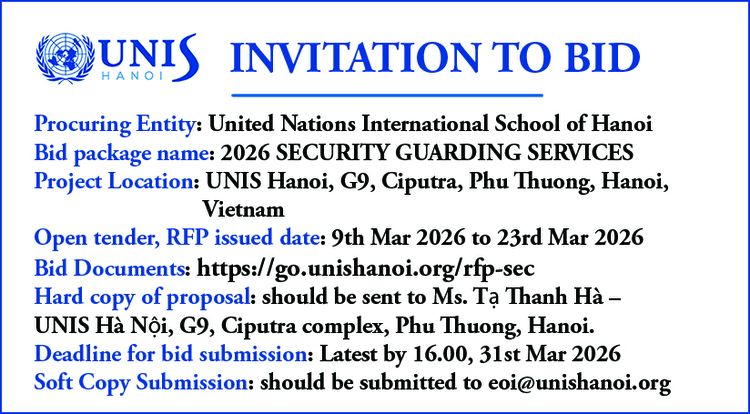

Given the insufficient public finance for climate ambitions, credit institutions play an increasingly important role in supporting the country's move towards a net zero economy through promoting green financing and capital markets to tap climate investment opportunities. — VNA/VNS Photo

HÀ NỘI — Việt Nam needs to develop a proper regulatory framework to pave the way for credit institutions to increase green financing and contribute to accelerating the transition to a low-carbon economy, attendees heard at the Việt Nam Climate Forum organised by the International Finance Corporation (IFC) in collaboration with the State Bank of Việt Nam (SBV) yesterday in Hà Nội.

At COP26 in November 2021, Việt Nam announced the target to achieve net-zero emissions by 2050, phase out coal power by 2040, and reduce methane emissions by 30 per cent from 2020 levels by 2030.

The Government of Việt Nam has introduced several policies, strategies, and plans to support environmentally sustainable development, including the establishment of a National Steering Committee for implementing Việt Nam’s commitments at COP26, Decree No 06/2022/NĐ-CP on greenhouse gas reduction, ozone layer protection, and carbon market development, action plan for methane emissions reduction by 2030, the national strategy for climate change by 2050, and the implementation plan for the Just Energy Transition Partnership (JETP).

To successfully meet its new climate objectives, IFC said that Việt Nam must focus on scaling green infrastructure, particularly green energy, green transport, energy efficiency and green buildings, and on the transition from “brown” and heavy industries toward sustainable and low carbon pathways, exposing an enormous long-term funding gap.

However, the country faces a significant climate finance gap to successfully meet these commitments, according to IFC.

The World Bank estimates the shift to a climate-resilient, low-carbon economy will require investments of around US$368 billion through 2040, or 6.8 per cent of GDP a year.

Climate finance in Việt Nam, however, faces significant challenges in aligning with large investment opportunities and environmental goals. Likewise, the scale, effectiveness and efficiency of the current public financing efforts are insufficient to address Việt Nam’s key climate challenges with public finance becoming increasingly scare due to the impacts of the COVID-19 pandemic.

Given the insufficient public finance for climate ambitions, credit institutions played an increasingly important role in supporting the country moving towards a net zero economy through promoting green financing and capital markets to tap climate investment opportunities, according to IFC.

“Financing solutions for green infrastructure and low-carbon transition of the real economy will need to come largely from banks and from capital markets,” IFC said.

According to Phạm Nguyên Hùng, Deputy Director of the Electricity and Renewable Energy Authority under the Ministry of Industry and Trade, Việt Nam has strengthened energy transition in recent years with the focus on promoting the development of renewable energy and the transition away from coal–fired power.

In particular, the Government approved the National Power Development Plan (PDR8), which would require $135 billion for the development of power sources and transmission grids.

To implement this ambitious plan, it was critical for Việt Nam to raise private investment, including green financing from credit institutions, Hùng said.

JETP provides significant opportunities for Việt Nam, which would help raise an initial $15.5 billion of public and private finance over the next three to five years to support the country’s green transition, he added.

Phạm Thị Thanh Tùng, Deputy Director of the Credit Department under the State Bank of Việt Nam, said that SBV would improve the legal framework to create an environment for credit institutions to increase green financing and contribute to the national green growth strategy.

The green growth strategy should be integrated into the credit policies of SBV and the green transition programme of credit institutions, Tùng said.

The SBV was waiting for the Ministry of Natural Resources and Environment’s instructions on standards for projects eligible for green financing as a base to provide detailed instructions to credit institutions, she said. She said that green credit was expected to increase significantly after the instructions were issued.

Tùng said that it was also necessary to enhance international cooperation to raise resources for green financing.

Võ Hằng Phương, director of the Financial Markets and Transaction Banking Division of VP Bank, said that the lack of regulations on green standards and criteria as the base to define a project to be green or not, as well as the framework on emissions to credit institutions causes difficulties in providing green financing.

She said that the introduction of green standards was important to increase green lending.

Phan Thanh Hải, executive vice president of BIDV, said that the Government should consider policies to encourage credit institutions to provide sustainable finance such as refinancing, risk ratio and exemption for credit growth rate cap. — VNS

.

.jpg)