Economy

Economy

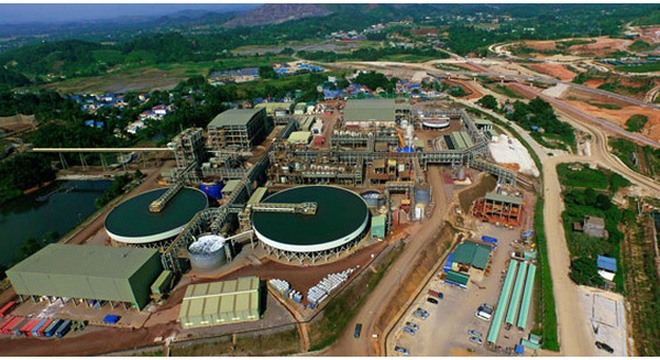

In late February Indian state-owned mining giant, the National Mineral Development Corporation (NMDC), was in talks with Masan Resources Corporation(MSR) to buy a stake in the latter’s Núi Pháo tungsten mine.

|

| A view of Núi Pháo tungsten mine in Thái Nguyên Province. — Photo cafef.vn |

In late February Indian State-owned mining giant, the National Mineral Development Corporation (NMDC), was in talks with Masan Resources Corporation(MSR) to buy a stake in the latter’s Núi Pháo tungsten mine.

The mine located in the northern province of Thái Nguyên has the biggest tungsten reserves in the world with an estimated 66 million tonnes, or a full third of all known global reserves.

The negotiations mark the beginning of the 2017 mergers & acquisitions (M&A) season, which is expected to be hectic thanks to the State Capital Investment Company (SCIC)’s plan to sell off many major State-owned companies this year.

SCIC’s auction of 9 per cent stakes in Vinamilk late last year saw Thailand’s Fraser&Neave (F&N) snapping up 5.4 per cent of the shares, raising its ownership of the dairy giant to 16.35 per cent.

The Thai company bought more VNM shares in March to raise its ownership to 17.7 per cent.

There is talk that F&N wants to take control of VNM and is likely to take part in SCIC’s next VNM share auction.

The Bình Minh Plastics Company (BMP) is one of 10 firms the SCIC plans to sell off. It holds a 29.5 per cent stake in BMP and 37.1 per cent another company in the industry, Tiền Phong Plastic Joint Stock Company (NTP).

The sovereign fund’s auctions of shares of these two companies are expected to attract many foreign investors, especially since it appears that BMP will vote to allow 100 per cent foreign ownership to at its upcoming shareholders meeting.

Thailand’s Nawaplastic Industries (Saraburi) Company owns a 20 per cent stake in BMP to be its biggest foreign shareholder.

If it manages to buy more stakes in BMP and NTP when they are sold by SCIC, it would be able to control the Việt Nam’s plastics industry’s two leading players.

Analysts foresee many major M&A deals this year, with foreign investors being involved.

The fact that several large companies plan to launch their initial public offering this year is also expected to have an impact on M&A activities. They include MobiFone, PV Oil, Satra, and Becamex IDC.

The increase in the number of M&A deals involving foreign investors indicates two things: firstly the attractiveness of the Vietnamese market, and secondly that foreign investors are targeting companies that have good brands, big market shares or the right to exploit some precious natural resource.

The involvement of foreign investors means the Government can speed up its pull-out from companies, while the companies could benefit from the management skills the foreigners bring.

Many domestic investors too are eyeing M&A deals to perfect their value chains, enlarge their market shares and acquire a going concern.

Though M&A activities between domestic companies often take place without much fanfare the number of such deals is expected to increase significantly this year, particularly in the banking sector.

The first deal in the sector this year is due to take place between PGBank and VietinBank, with the latter fully acquiring the former.

The Asian Development Bank plans to buy weak Vietnamese banks.

In the real estate sector, many M&A deals are being done between domestic investors, with long-delayed projects being the focus of attention.

For instance, Novaland is carrying out the necessary procedures to buy shares in projects like ICON, Galaxy 9, The Tresor, Lexington, and RiverGate Residence.

Stock market recovery allows companies capital hike

Phạm Quang Dũng, chairman of the Tasco Joint Stock Company (HUT), revealed that his company plans to issue some 80 million shares this year to strategic investors and retail investors to expand its chartered capital and business operations.

Last year Tasco had planned to sell 50 million shares but the plan was shelved for certain reasons.

Việt Mỹ Medical Diagnostics Biological Manufacturing Business Joint Stock Company, Kido Frozen Foods Company (KDF), Apax Holding Joint Stock Company (IBC) are also planning to go down this route or make an initial public offering.

The positive signs shown by the economy and the recovery of the stock market are the main reasons for their expansion plans.

In the first quarter of the year the consumer price index was up 1.66 per cent year-on-year. Credit growth was 3 per cent, much higher than the 1.54 per cent seen in the same period last year. Exports were up 12.8 per cent to US$43.7 billion.

The stock market has also been buoyant, with all the bourses posting steady gains and the prices of many shares breaching the VNĐ10,000 par level.

On April 13, the VN-Index on the HCM Stock Exchange closed at 727.31 points.

On the Hà Nội Stock Exchange, the HNX-Index closed at 90.03 points.

Analysts said what the companies need to do now to safeguard investors’ interest and prevent dilution is ensure commensurate growth in profits so that the EPS remains at comparable levels post-issuance of stocks. - VNS