Economy

Economy

Experts have warned that a firm legal framework and strict punishment measures are needed to manage virtual financial investment platforms, which they say are now out of control.

|

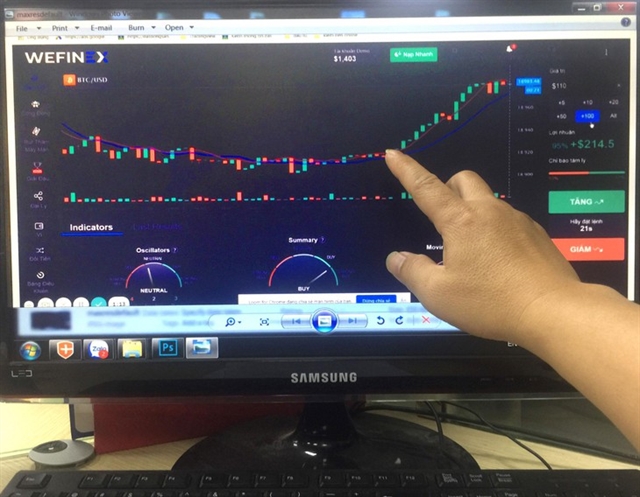

| An investor is looking at a financial investment website on his desktop. Several platforms suddenly collapsed recently, showing signs of fraud. — Photo baodauthau.vn |

HÀ NỘI — Experts have warned that a firm legal framework and strict punishment measures are needed to manage virtual financial investment platforms, which they say are now out of control.

Several platforms suddenly disappeared in recent months and thousands of investors claimed they lost huge sums of investment.

Economic experts and management agencies have consistently warned about the risks of virtual financial investment platforms, but investors have been tempted by skyrocketing returns.

Busstrade and Coolcat were among platforms that suddenly disappeared during the past two weeks. These websites can't be opened, investors can't access their accounts and withdraw their money and they have no way to contact the websites’ admins.

Advertisements for financial investment platforms are abundant on websites, Facebook, Zalo and other social networks with many offering returns of up to 30 per cent per month.

Finance and banking expert Nguyễn Trí Hiếu said financial investment platforms often used traps to attract investors. At first, investors were paid interest on time and adequately but when they put a large amount of money in their accounts, these platforms suddenly collapsed and investors lost their money.

Hiếu said some platforms did not have a specific address and could not be traced when collapsed.

He warned that this was a fraud.

“If it is not clear who you are dealing with and where you put the money in, only through websites, this is certainly a trap," he said.

According to economic expert Phan Phương Nam, this was a form of investment related to foreign exchange (forex) which was not recognised under the laws of Việt Nam. Until now, no company is officially recognised as a forex investment company in Việt Nam and allowed to directly collect investment from individual investors.

Nam also pointed out there was a lack of mechanisms to protect investors on these platforms.

Nguyễn Hồng Bách from Hồng Bách and Partners Law Firm said that similar to forex, cryptocurrencies were also not recognised as a legal means of payment and all transactions related to cryptocurrencies were not protected by law in Việt Nam.

The State Bank of Việt Nam and the Ministry of Public Security have warned about the risks of investing in cryptocurrencies, he said, urging investors to be very cautious when investing in these platforms.

The management agencies also warned about some forex and cryptocurrency platforms such as wefinex.net, raidenbo.com and bitono.io.

Experts said that it was important to increase awareness for citizens to keep away from these forms of frauds.

For the long term, Việt Nam needed to develop a legal framework to put the operation of these platforms under control together with strict punishment measures to prevent violations.

Hà Nội Police late last week prosecuted two people in HCM City and one in Hà Nội for the alleged appropriation of property through the internet. The initial investigation found they appropriated investment worth a total of US$4.3 million from 12,000 accounts on four gold and forex platforms, namely rforex.com, Yaibroker, Vistafore and Exswiss. — VNS