Economy

Economy

|

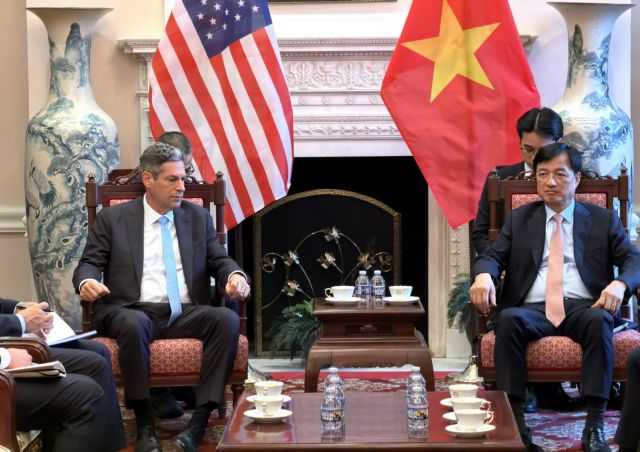

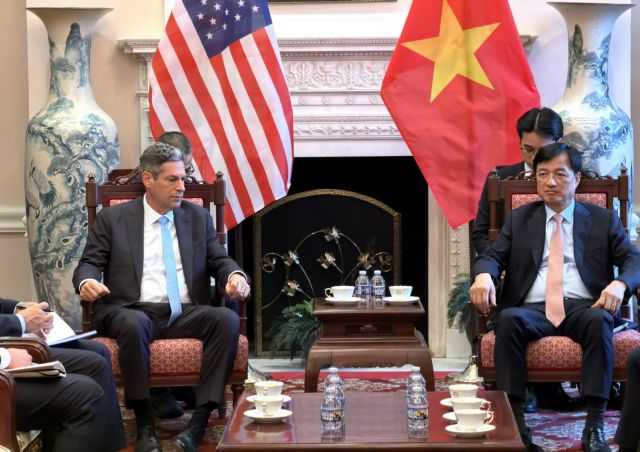

| Computer Vision Vietnam received an investment of US$500,000 from NextTech Group and Next100.tech fund to promote digital transformation in the finance and banking sector. — Photo courtesy of the group |

HÀ NỘI — NextTech Group and Next100.tech fund on Tuesday officially announced their investment of US$500,000 into Computer Vision Vietnam (CVS eKYC) – a start-up providing artificial intelligence (AI) and computer vision solutions for financial technology companies (fintech).

The investment aimed to maximise convenience for companies in electronic Know Your Customer, or eKYC, thus promoting digital transformation in the finance and banking sector.

Established only three months ago, CVS eKYC has offered AI to recognise face and characters; detecting invalid papers and faces to provide a complete and fully automated eKYC solution.

CVS solution is based on intelligent image processing technology, providing identification and customer verification solutions for fintech and banks.

CVS eKYC has the ability to extract information from photos to help fintech companies automatically process customer records more quickly and systematically. In addition, the project also includes many solutions related to images such as searching a database of millions of related images of customers for businesses, face attendance, licence plate recognition and analysing facial features.

With this technology, CVS' partners could fully control customer identification through photos or videos of selfies, collating with ID documents as a basis for making decisions on opening trading accounts for customers.

Computer vision has been applied widely around the world in recent years. However, the market is quite new in Việt Nam.

Nguyễn Văn Việt, CEO and Co-Founder of Computer Vision Vietnam, said: “Customers choose CVS because we always try to understand their problems and solve them in the best way. CVS actually solves customers' core business.”

After only three months of establishment, CVS has many customers such as Fiin (Fintech), Mofin (Fintech), BPech (software solution), Cozrum (hotel management).

With the investment, CVS would continue to invest to upgrading their current products and develop new services for fintech and digital transformation. In addition, it would co-operate with members of NextTech’s ecosystem to promote access to customers in fintech, banking, insurance, security, network providers, data digitalisation and automated check-in industries.

CVS is implementing its expansion to the southern region and Southeast Asian countries.

It targeted to become one of the leading companies in the sectors of eKYC, fintech, digital transformation using AI and Big Data in Việt Nam and Southeast Asia.

Shark Nguyễn Hòa Bình, CEO of NextTech Group, said eKYC is a necessary foundation for digitalising transactions in the finance and banking sector.

He said eKYC could bring huge benefits to finance and banking institutions by maximising human resources, reducing risks and costs for customers.

“With the investment from Next100 and support from NextTech Group’s ecosystem, we expect that CVS would bring a modern technology solution for fintech and banks in improving service quality as well as convenience for Vietnamese people,” he added. — VNS