Economy

Economy

Despite being seen as a potential blockchain development nation, Việt Nam lacks a proper legal framework which may prevent the country maximise benefits from the emerging industry.

|

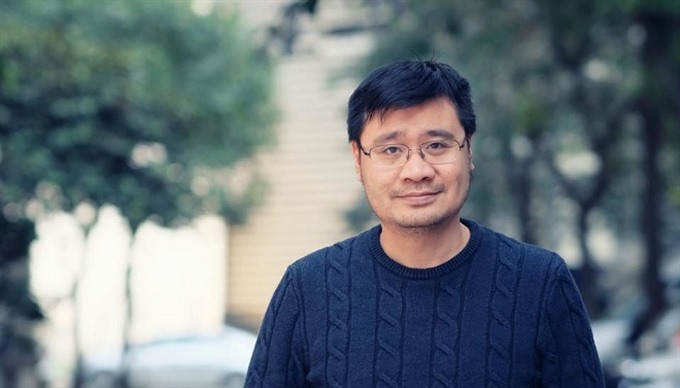

| CEO of blockchain technology platform company Vương Minh Long. Vietnamese blockchain firms are expecting the Government will soon fully develop a legal framework that supports the development of the blockchain industry. — Photo khoinghiep.org.vn |

HÀ NỘI — Despite being seen as a potential blockchain development nation, Việt Nam lacks a proper legal framework which may prevent the country maximise benefits from the emerging industry.

Vietnamese business man Vương Quang Long runs Tomochain but is headquartered in Singapore because he says the government there has better policies to attract international investment.

“When it came to initial coin offering (ICO), Tomochain needed lawyers understanding the country where the company is headquartered and registered. We could not find that in Việt Nam,” Long told baodautu.vn.

He said he expects Việt Nam to soon develop a legal framework that allows local firms to draw foreign investment and develop their business.

He suggested government agencies recognise the valuation of digital assets, set up a cross-sector committee to track the development of the industry and issue policies on the establishment of an investment pool.

A large number of Vietnamese people are not fully aware of blockchain and crytocurrency bitcoin and often mistake them, according to Nguyễn Văn Vững, founder of tech firm Bigbom.

Blockchain tech experts say, the use of technology could help users save 30-50 per cent of their expenses as those apps would help them improve the quality of production and transparency in finance and management.

For example, if Uber and its partner drivers run the app on blockchain technologies, it would be easier for regulators to monitor the market and the information of both drivers and trips would be more transparent.

QNET is developing a system to manage lending portfolios for commercial banks, according to the firm’s head of blockchain development centre Đặng Minh Tuấn.

“When developing the programme, we have to make sure each portfolio is unique, and no one is authorised to edit the profile,” Tuấn said.

“So the banking system’s transparency is guaranteed and it minimises the chance of risks such as a lending profile is used at different banks or a banker can switch the profile for one another for illegal transactions.”

But there is plenty of room for the industry in other countries to further develop, even though applications are still in the early stage. Japan issued a law on payment services, which was amended in 2016, saying digital currencies are considered payment instruments for necessities, not large-scale deals.

That may be the reasons why Vietnamese lawmakers have remained hesitant developing a legal framework that suits the needs of the companies using blockchain technologies and applications.

Nguyễn Thanh Tú, Director of the Economic and Civil Legislation at the Ministry of Justice, said the ministry started developing a regulation on cryptocurrency management in 2016-17. The ministry is reviewing all digital assets and legal practices to propose the best solutions to the Prime Minister.

Long at Tomochain said the issue of digital assets was determined by the market, not the regulator. This is a trend and if Việt Nam fully develops its own legal framework to support blockchain firms, the industry will grow strongly and attract big support from the private sector in both local and international markets. — VNS