Economy

Economy

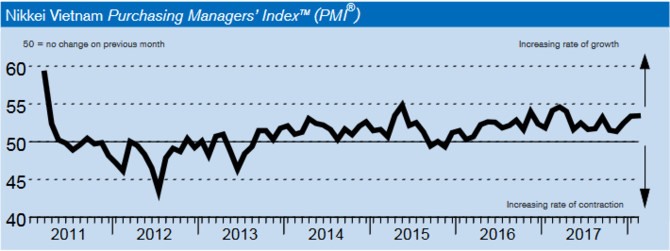

Local business conditions have strengthened continuously since December 2015, pushing the Vietnam Manufacturing Purchasing Managers’ Index (PMI) to a 10-month high of 53.5.

|

| Vietnam PMI hit a 10-month high of 53.5 in February. - Photo IHS Markit |

HÀ NỘI – Local business conditions have strengthened continuously since December 2015, pushing the Việt Nam Purchasing Managers’ Index (PMI) to a 10-month high of 53.5.

According to a survey of Nikkei’s IHS Markit released on Thursday, this was a fractional increase from a PMI of 53.4 in February.

“The Vietnamese manufacturing sector continued its solid start to the year in February, with many of the survey’s indices pointing to gathering growth momentum,” said Andrew Harker, Associate Director at IHS Markit.

Output rose at the fastest pace in 10 months, while the expansion in purchasing activity was the sharpest since the end of 2016 as firms reported efforts to build inventories, Harker said, adding this was suggestive of manufacturers being optimistic regarding near-term prospects for client demand, while data on output expectations also signalled positive sentiment.

The survey showed that a pick-up in the rate of production growth was recorded as panellists reported stronger client demand. There was evidence of stock building in February as manufacturers raised their purchasing activity sharply, and pre-production inventories increased at the fastest pace for a year. Meanwhile, the rate of input cost inflation remained elevated and firms raised their selling prices again, albeit at a slightly reduced pace.

The rate of growth in manufacturing output quickened to a 10-month high during February, with panellists reporting improved customer demand. This was also a factor behind another solid increase in new orders. New business has now risen in each of the past 27 months, with new export orders also expanding solidly in February.

Despite further growth of new orders, backlogs of work decreased amidst reports from firms of efforts to clear outstanding businesses. Moreover, the rate of depletion was the sharpest in 20 months. Employment continued to rise at a solid pace in February, although the rate of job creation eased from that seen in January. Where employment increased, this was mainly linked to higher output requirements.

Alongside higher employment, firms also raised their purchasing activity to support output growth, while efforts to build inventories were also mentioned. The rise in input purchase supported a solid increase in stocks of purchases, the most marked for a year. Meanwhile, stocks of finished goods decreased, but at a marginal pace that was the weakest in the current eight-month sequence of decline.

A further steep rise in input costs was recorded in February, with the rate of inflation only slightly lower than January’s 81-month high. Panellists mainly attributed higher input prices to a rise in raw material costs. There were some reports that suppliers had responded to a stronger demand for inputs by raising their prices.

With input prices increasing, manufacturers raised their output charges accordingly. Selling price inflation was recorded for the sixth month running, with the latest rise only slightly slower than at the start of the year.

Suppliers’ delivery times were broadly unchanged over the month. While a reported scarcity of raw materials resulted in longer lead times in some cases, other respondents noted faster deliveries. Vietnamese manufacturers remained optimistic that output would increase over the coming year in line with company plans. That said, sentiment dipped to the lowest since last June. – VNS