Economy

Economy

.jpg)

|

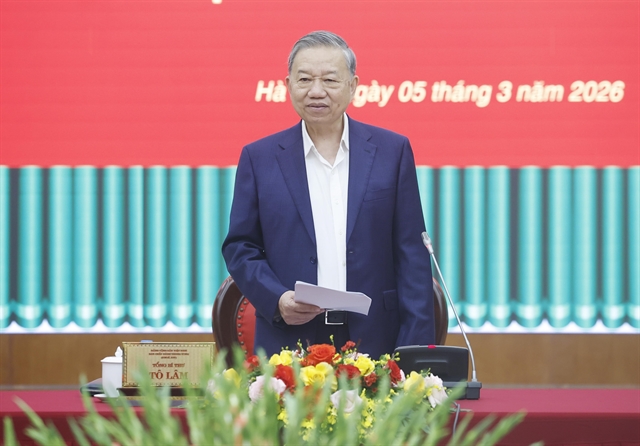

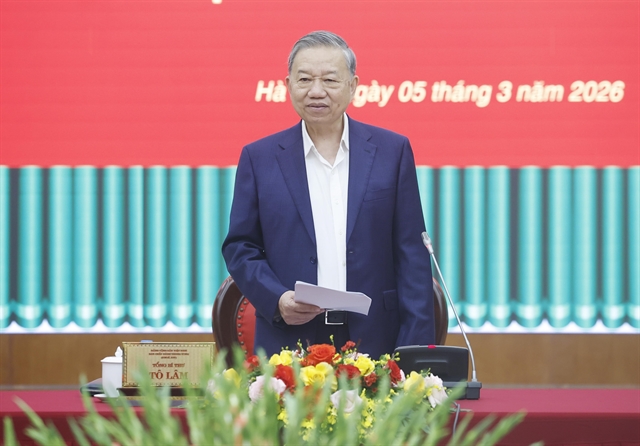

| Customers at an SHB office. As of June 30, SHB’s total assets reached nearly VNĐ825 trillion. Photo courtesy of the bank |

HÀ NỘI — Saigon – Hanoi Commercial Joint Stock Bank (SHB) has reported a strong performance for the first half of 2025, with robust growth across key financial indicators and a clear roadmap for digital and sustainable transformation.

At its latest financial disclosure, SHB announced a pre-tax profit of more than VNĐ4.5 trillion (US$172 million) in the second quarter, up 59 per cent year-on-year. This brought its six-month cumulative pre-tax profit to over VNĐ8.9 trillion, up 30 per cent compared to the same period last year and achieving 61 per cent of its full-year target.

The bank attributed its strong momentum to both sustainable growth in scale and improvements in asset quality and operational efficiency.

As of June 30, SHB’s total assets reached nearly VNĐ825 trillion, with outstanding customer loans exceeding VNĐ594.5 trillion, a 14.4 per cent increase from the beginning of the year and a 28.9 per cent rise year-on-year. Customer deposits rose 12.4 per cent — double the industry average of 6.11 per cent.

SHB has also actively aligned with Government policies, including Resolution 68, which encourages commercial banks to expand lending, especially to small and medium-sized enterprises, and support digital transformation and sustainable development efforts.

Credit growth at SHB has been diversified and focused on priority sectors, while asset quality continued to improve. The non-performing loan ratio measured under Circular 31 remains low, and special mention loans (Group 2) dropped sharply to just 0.3 per cent, reflecting prudent risk management.

The bank maintained strong safety indicators. Its loan-to-deposit ratio and medium- and long-term loan ratio from short-term capital remain within the State Bank of Việt Nam’s regulatory limits. The capital adequacy ratio has consistently stayed above 11 per cent, well above the minimum requirement of 8 per cent.

SHB also made strides in capital expansion, with charter capital reaching VNĐ40.66 trillion, placing it among the top five privately owned banks in Việt Nam. It recently secured approval from the central bank to increase its charter capital to VNĐ45.94 trillion via a 13 per cent stock dividend for 2024. This follows a 5 per cent cash dividend earlier this year, resulting in a total payout ratio of 18 per cent for 2024, with a similar target set for 2025.

Operational efficiency improved significantly. The cost-to-income ratio was kept at a low 16.4 per cent, among the best in the industry, while return on equity reached over 18 per cent.

SHB is also ramping up its risk governance. The bank has completed the development of credit risk measurement models and capital calculation methods under the advanced Internal Ratings-Based (IRB) approach of Basel II, and is aiming to fully comply with Basel II's IRB standards by 2027.

Additionally, SHB has effectively implemented Basel III liquidity risk management frameworks, including the liquidity coverage ratio and net stable funding ratio, as well as advanced asset and liability management tools such as funds transfer pricing, enhancing its ability to manage cash flow and prepare for market volatility.

On the capital market, SHB continued to assert its position with a market capitalisation exceeding $2.6 billion. Its shares remain highly liquid, consistently ranking among the top of the VN30 and banking sector. The stock saw record high trading volumes in Q2/2025, with one session alone hitting nearly 250 million shares. Foreign investors net bought 95 million SHB shares in July, with a historic peak of 41 million shares on July 7.

SHB's long-term vision is captured in its strategic shift toward becoming a 'Bank of the Future' — a leading digital, green and retail bank in the region — by 2035. This involves the integration of AI, Big Data and Machine Learning across operations, products and services, enabling personalised, seamless customer experiences and innovative financial offerings.

The bank is also deepening partnerships with major domestic and international economic groups, developing comprehensive ecosystems and supply chains that include SMEs and retail customers.

SHB has been recognised as one of the top five private banks contributing to the State budget and remains committed to social responsibility. Over the years, the bank and its ecosystem have contributed more than VNĐ1.5 trillion to COVID-19 relief, disaster recovery and social welfare initiatives. These include support for poor households, education, housing and healthcare across mountainous, border and disaster-prone regions.

Thanks to its sustained contributions and strategic vision, SHB has received numerous accolades, including 'Best Bank for People', 'Best Public Sector Bank in Việt Nam' (FinanceAsia) and 'Best Sustainable Finance Bank for SMEs in Việt Nam' (Alpha Southeast Asia). It was also listed by Brand Finance among the world’s top 500 most valuable banking brands in 2025.

With a strong financial foundation, bold transformation strategy and growing market influence, SHB is positioning itself to break into the top tier of Việt Nam’s banking sector in the near future. — VNS