Economy

Economy

.jpg) |

| Goods containers waiting for export at Tân Vũ Port, Hải Phòng City. VNA/VNS Photo Tuấn Anh |

By Mai Hương

Despite escalating global uncertainties and the looming threat of reciprocal tariffs from the United States, Việt Nam remains committed to its ambitious GDP growth target of 8 per cent for 2025.

This determination, highlighted in a resolution issued by the Government on April 10, reflects not only optimism but also a strategic readiness to absorb external shocks through coordinated and flexible policies.

Amid growing geopolitical tensions, trade disputes and supply chain disruptions, Việt Nam is also contending with extreme weather events, inflation and exchange rate volatility. Nonetheless, the Government is calling on ministries, local authorities and businesses to stay optimistic, confront challenges head-on and seize emerging opportunities.

In particular, 37 provinces and cities that fell short of their Q1 growth targets have been directed to reassess their performance and revise strategies for the remainder of the year.

One of the gravest current concerns is the potential imposition of reciprocal tariffs by the US, with rates possibly reaching as high as 46 per cent. Although Washington has granted a temporary 90-day reprieve, the urgency remains.

According to the General Statistics Office, Việt Nam’s exports to the US were valued at US$119.6 billion in 2024, making it the country’s largest export market and accounting for nearly 30 per cent of total exports. The trade surplus with the US stood at $104.6 billion.

Given the significance of US trade as a key economic driver, any new tariffs could have serious consequences for Việt Nam’s major export sectors and overall growth.

In response, the Ministry of Finance is preparing support packages for affected workers and businesses, including a proposed extension of VAT reductions from July 2025 through to the end of 2026. The State Bank of Việt Nam is also planning to manage exchange rates flexibly and ensure access to credit for firms under pressure.

Phí Vĩnh Tường, deputy director of the Institute of Vietnam and World Economy, said the politicisation of trade policy – particularly amid ongoing US–China tensions – had disrupted financial markets and weakened investor confidence.

“For an economy as open as Việt Nam’s, the impact is immediate, especially for foreign-invested enterprises which have long been the backbone of our export sector,” Tường told Việt Nam News.

Unpredictable tax policies could lead foreign investors—many of whom shifted operations from China to Việt Nam during Trump’s first term—to reconsider their strategies or even withdraw, he said. Domestic firms, although less globally integrated, would also face risks as international partners adjust supply chains to reduce exposure.

“The Fourth Industrial Revolution is further reshaping global supply chains. As Việt Nam currently occupies many midstream links, the risk of disintermediation is high,” Tường said, adding that the country must enhance domestic supply chains and develop independent export capacity to remain competitive.

|

| Producing sportswear for export at a company in Quảng Ngãi Province. VNA/VNS Photo Quốc Khánh |

Calm and proactive

Following Prime Minister Phạm Minh Chính’s call for calm and proactive measures, the Government has adjusted trade policies, bolstered relations with the US, and lowered tariffs on key imports such as LNG and cars, while increasing agricultural imports to reduce trade tensions.

This proactive stance is most visible in HCM City, Việt Nam’s economic engine. Despite concerns about tariffs, the city is pushing ahead with its 8.5 per cent regional GDP growth target.

Nguyễn Văn Được, chairman of the HCM City People’s Committee [Administration], said the city had formulated multiple response scenarios and was working closely with both local and international experts to revise policies and production plans.

Key industries were working to accelerate shipments within the 90-day grace period, while also adapting operations for longer-term resilience. At the same time, the city was promoting sustainable competitiveness by boosting domestic consumption, upgrading logistics systems and supporting higher value-added exports.

Experts believe this is a crucial moment to restructure the export economy.

Phạm Bình An, deputy director of the HCM City Institute for Development Studies, said Việt Nam must tighten enforcement of rules of origin and crack down on firms abusing export loopholes. He emphasised the need to shift goods label from “Made in Việt Nam” to “Made by Việt Nam”, with HCM City leading the push to build a self-reliant manufacturing sector through coordinated public-private strategies.

Nguyễn Bích Lâm, former director general of the General Statistics Office, said that to stay on track, Việt Nam must make full use of free trade agreements to boost exports, diversify export products, reduce the service trade deficit, accelerate public investment, stimulate domestic demand through tax and welfare measures, and ensure macroeconomic stability.

Still, challenges lie ahead.

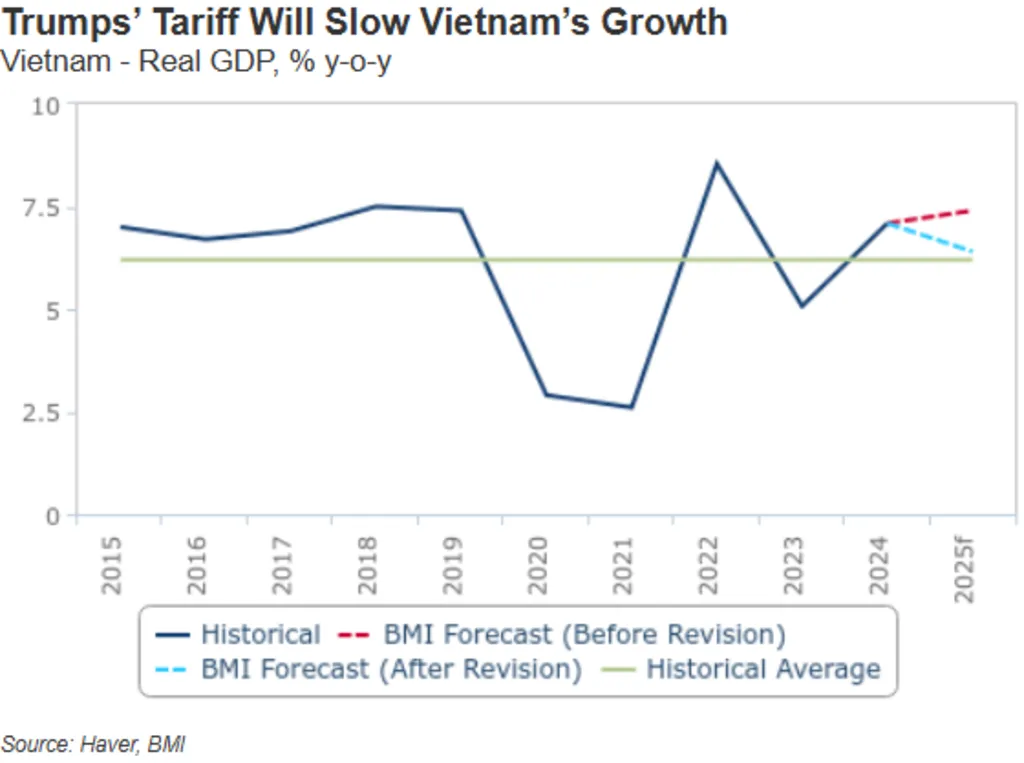

A recent report by BMI Research, a subsidiary of Fitch Solutions, downgraded Việt Nam’s 2025 GDP growth forecast from 7.4 per cent to 6.4 per cent, citing slower-than-expected export and FDI growth in Q1. GDP was 6.9 per cent in the first quarter, down from 7.6 per cent in Q4 2024. FDI increased by just 7.2 per cent, while export growth slowed to 9.7 per cent.

|

| BMI's projection for Việt Nam's growth amid Trump's tariff imposition. — BMI graphic |

Investor sentiment remains cautious, with many adopting a wait-and-see approach due to tariff uncertainties.

However, a bright spot remains: domestic consumption, which rose by 7.5 per cent thanks to relatively low inflation. Economists said this internal demand could serve as a stabilising force against external volatility if further supported.

In the long run, Việt Nam’s growth will depend on its ability to nurture strong, tech-savvy domestic enterprises capable of weathering global trade fragmentation.

Tường said that as global markets split into separate regulatory spheres—especially between the US and China—Vietnamese firms might face rising compliance costs. In this context, government support for access to finance, technology, and global integration would be essential.

While full decoupling from global trade is unlikely in the short term, Việt Nam must prepare for possible long-term scenarios. Deepening bilateral ties, expanding the domestic market and enhancing productivity is the best path forward to achieve the 8 per cent growth target—not just in principle, but in practice. VNS