Economy

Economy

|

| Lawmakers at the 39th session of the NA Standing Committee on Tuesday. — VNA/VNS Photo |

HÀ NỘI — The recent discussions within Việt Nam's National Assembly (NA) have brought to light significant amendments concerning taxation and regulatory frameworks that will impact both domestic and foreign e-commerce platforms.

On Tuesday, during the 39th session of the NA Standing Committee, lawmakers reviewed a draft law aimed at amending several existing laws, including those governing securities, accounting, independent auditing and tax management.

The Standing Committee has submitted to the NA a legislative project titled 'Amendments and Additions to Several Provisions of the Securities Law, Accounting Law, Independent Audit Law, State Budget Law, Public Asset Management Law, Tax Management Law, Personal Income Tax Law, National Reserve Law and Law on Administrative Violations.'

This law will be effective from January 1, 2025.

Meanwhile, specific regulations in Article 9 and Article 11 of the Securities Law will be enforced starting January 1, 2026.

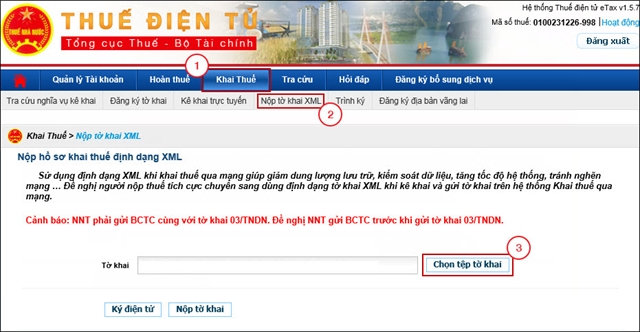

One of the most critical changes proposed is the requirement for e-commerce platforms to withhold and remit taxes on behalf of sellers operating on their sites.

Currently, sellers are responsible for declaring and paying their taxes independently. However, the government has recognised the need for a more streamlined approach to ensure compliance and reduce tax evasion.

The proposed amendment would require platforms like Facebook, Apple and Netflix, which generate revenues in Việt Nam, to register and pay taxes directly or through authorised representatives.

According to the Ministry of Finance this shift aims to combat tax evasion and simplify administrative processes. By centralising tax collection through e-commerce platforms, the Government anticipates a more efficient system that could potentially enhance revenue collection from a vast number of individual sellers.

While this may lead to increased operational costs for these platforms, due to necessary system upgrades, such expenses would be minimal compared to hiring additional personnel for tax compliance.

Furthermore, Deputy Prime Minister Hồ Đức Phớc highlighted ongoing efforts by the tax authorities to curb revenue losses in e-commerce through advanced technologies such as artificial intelligence.

This initiative had already seen positive results, with foreign companies having declared over VNĐ18.6 trillion (US$732.1 million) in taxes since March 2022.

Regarding the domestic e-commerce sector, the taxation authorities started tax collection this year. Notably, Hà Nội alone had gathered approximately VNĐ35 trillion by the beginning of November, said the Deputy Prime Minister.

The amendments are part of a broader legislative effort to modernise Việt Nam’s financial regulations.

The Standing Committee has called for thorough reviews to ensure that all proposed changes align with national policy objectives and legal consistency.

This includes addressing issues related to public asset management and budgetary oversight, which are crucial for maintaining fiscal discipline and transparency within government operations.

Specifically, regarding amendments to Article 8, Section 10 of the State Budget Law, which involve adding regulations for programmes and projects beyond the medium-term public investment plan, the Standing Committee recommended refining these changes to uphold the Prime Minister's authority over state budget reserves and the NA Standing Committee's jurisdiction over revenue increases and expenditure savings as currently outlined.

With respect to the inclusion of Section 10a, Article 8 of the State Budget Law, the Standing Committee emphasised incorporating provisions that adhere to relevant legal statutes and government guidelines for demonstrating state budget expenditures, covering both public investment sources and recurrent expenses.

Concerning the additions in point d of Section 5, Article 19, and point d of Section 2, Article 30 of the State Budget Law, which address the allocation of undetailed state budget estimates, the committee proposed further examination.

Regarding decentralisation and empowerment in managing and utilising public assets, it agreed on oversight mechanisms and urged swift consideration by the Government for specific amendments.

These changes should transition from decentralisation to empowerment in compliance with the Government Organisation Law and the Law on Local Government Organisation. — VNS