Economy

Economy

|

| Coffees harvested at a farm in Kon Tum Province. — VNA/VNS Photo |

HÀ NỘI — Coffee prices, both domestically and internationally, are continuously hitting record highs due to unfavourable harvests in Việt Nam and Brazil, prompting close watch of major coffee-producing countries.

Domestic coffee prices have now surpassed VNĐ130,000 per kg (US$5.12), exceeding the price of black pepper.

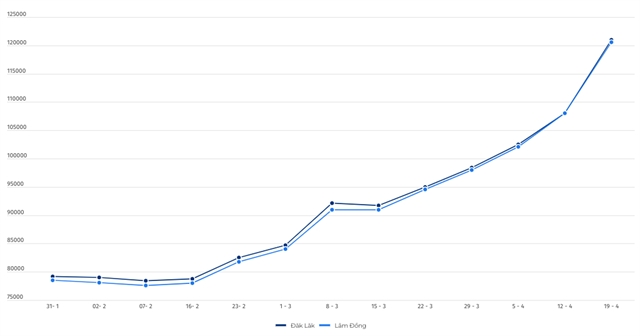

Robusta coffee prices in Đắk Lắk Province were quoted at VNĐ103,000 per kg last Friday, while in Lâm Đồng Province it was VNĐ102,500 a kg.

|

| Coffee prices in Đắk Lắk and Lâm Đồng Province from January 31 to April 19. Graphic and compiled by Ly Ly Cao |

Statistics from the General Department of Customs showed that as of April 15, Việt Nam exported about 660,000 tonnes of coffee, with a value of over $2.23 billion. The average export price of coffee in the first quarter of 2024 reached $3,289 per tonne, a 48 per cent gain from the same period last year.

However, in the first half of April only, the average export coffee price soared to $3,790 per tonne.

Prices are rising amid the supply of Vietnamese coffee is gradually depleting, according to the Vietnam Coffee-Cocoa Association (Vicofa). Stockpiles in businesses and among farmers are low, resulting in a reduction in export volume from now until the end of the crop season.

Đỗ Hà Nam, Vice Chairman of the Vicofa, said that in the first six months of the 2023-2024 coffee crop, which is from October 2023 to March 2024, Việt Nam exported 956,000 tonnes of coffee, with a total value of over $3 billion. As a result, the country has exported approximately 60 per cent of the estimated total production of around 1.6-1.7 million tonnes for the current crop season.

With current domestic coffee prices, coffee farmers in the Central Highlands of Việt Nam stand to benefit if they have stored inventory. However, many farmers regret not having any stock left to sell. The limited market supply makes it challenging for enterprises to find coffee.

General Director of Simexco Daklak Lê Đức Huy said that farmers' plantation restructuring has affected the domestic coffee supply. While some households still have supply, it is scarce.

“Predicting future coffee prices is challenging as the new harvest season is six months away,” Huy added.

According to the leader of Simexco Daklak, many businesses are hesitant to sign contracts if they cannot secure a stable source of supply. Most businesses have already made their purchases as they anticipated difficulties in production volume.

With the current sharp price increase, buyers are more cautious and will only make purchases when absolutely necessary.

Nguyên Nam Hải, Chairman of the Vicofa, said that coffee prices have never been as high as they are this year. The surges have capped the purchasing capacity of businesses and have led to supply chain disruptions for those involved in long-distance buying and selling, while future contracts carry a high level of risk.

While Việt Nam’s new coffee harvest is expected in October, the current severe drought conditions in the Central Highlands are causing concerns among farmers regarding the upcoming crop's production volume.

Despite the high investment costs for coffee plants due to expensive fertilisers and ongoing drought conditions increasing irrigation expenses, many farmers who had previously neglected coffee cultivation are now returning to invest in it.

Moreover, concerns about supply shortages due to prolonged hot and dry weather in major coffee-producing countries in Southeast Asia, including Việt Nam, have pushed the price of Robusta coffee futures on the London market above $4,000 per tonne. This is a record high since coffee futures trading began in 2008.

|

| Robusta coffee futures on the London market. Source: investing.com |

Robusta coffee futures closed last week at $3,555 per tonne, down 21.8 per cent from the peak of $4,546 hit on April 25 but increasing 18.2 per cent from the beginning of the year.

Carlos Mera from Rabobank said that prolonged hot weather in Southeast Asia is severely affecting the coffee crop, leading to supply constraints and increased stockpiling by processors.

Additionally, processors are preparing for the European Union (EU)’s upcoming ban on coffee grown on deforested land.

Global coffee consumption is expected to rise by 20 per cent during 2023-2024, particularly in Asia. Major coffee-consuming countries like Indonesia and China are experiencing significant consumption increases, according to the US Department of Agriculture (USDA).

The market is closely watching the developments in Brazil, the world's largest coffee supplier.

Despite challenges like shrinking land area and climate change impacting coffee yields, Huy from Simexco DakLak emphasises the need for collaboration and shared development among coffee supply chain members.

It is important to eliminate unreliable partners and focus on improving production through seed selection, garden renovation and adopting new cultivation techniques in coffee-growing regions, he added. — VNS