|

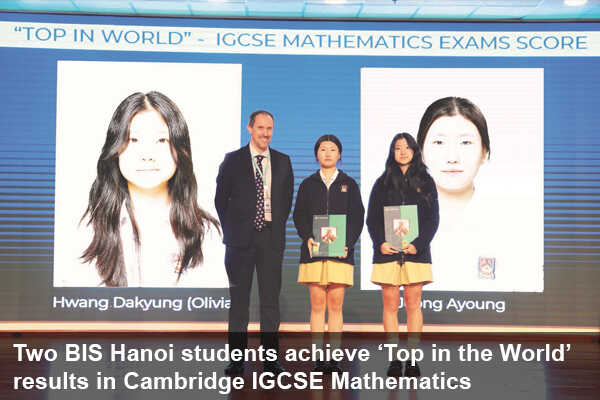

| Workers of Petro Vietnam Cà Mau Fertiliser loading products on a boat. Shares of the fertiliser producer hit the ceiling price yesterday, limiting the market's losses. Photo pvcfc.com.vn |

HÀ NỘI — Shares continued to trade in different directions as many pillar stocks still faced strong selling pressure, but losses were capped by the good performance of many real estate and manufacturing stocks on Friday.

On the Hồ Chí Minh Stock Exchange (HoSE), the VN-Index settled 1.66 points, or 0.13 per cent, lower to 1,241.48 points.

However, the market's breadth was positive on the southern bourse as the number of gainers outnumbered that of decliners.

Liquidity, on the other hand, improved compared to the previous session. In particular, the trading value increased slightly by 6.2 per cent to over VNĐ26.3 trillion (US$1.1 billion). Nearly 1.1 billion shares were traded on HoSE during the session.

The benchmark index extended losses as profit-taking pressure weighed on many large-cap stocks.

The VN30-Index, which tracks the 30 biggest stocks on the southern exchange, declined by 6.08 points, or 0.48 per cent, to 1,249.14 points. In the VN30-basket, 17 ticker symbols inched down, while 12 advanced and one stayed unchanged.

Leading the market's downtrend on Friday was Vingroup (VIC). Shares of the property developer fell 2.8 per cent. The other two members in the trio stocks of the Vin family also posted big losses, with Vinhomes (VHM) down 2 per cent and Vincom Retail (VRE) down more than 2.3 per cent.

Similarly, many large-cap stocks in the banking industry saw a bearish trend, such as BIDV (BID) dropped 0.74 per cent, Techcombank (TCB) decreased 1.12 per cent, Sacombank (STB) fell 1.52 per cent, and MBBank (MBB) was down over 1 per cent.

The index pared losses on gains of some realty and manufacturing stocks, led by Becamex (BCM) with a gain of 2.25 per cent.

It was followed by Đức Giang Chemicals (DGC), Petro Viet Nam Ca Mau Fertiliser JSC (DCM), Vietnam Rubber Group (GVR), and Petrovietnam Fertiliser & Chemicals Corporation (DPM), with DCM and DPM hitting the maximum daily rise of 7 per cent.

On the Hà Nội Stock Exchange (HNX), the HNX-Index extended rallies to the eight-day of gaining. It closed the week at 256.2 points, up 0.06 points, or 0.02 per cent.

During the session, investors poured nearly VNĐ2.1 trillion into the northern exchange, equal to a trading volume of 104.4 million shares.

Foreign investors returned to the market after net selling more than VNĐ880 billion on HoSE. Particularly, they injected more than VNĐ77 billion into HoSE and VNĐ29.72 billion on HNX. — VNS

.jpg.JPG)