Economy

Economy

Economy

Economy

Economy

Economy

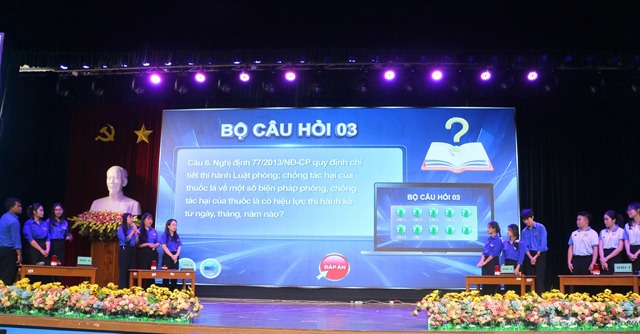

Politics & Law

Politics & Law

Economy

Economy

Media-OutReach Newswire

Media-OutReach Newswire

Economy

Economy

Opinion

Opinion

Economy

Economy

Media-OutReach Newswire

Media-OutReach Newswire

Politics & Law

Politics & Law

Economy

Economy

Opinion

Opinion

Politics & Law

Politics & Law

Economy

Economy

Economy

Economy

Politics & Law

Politics & Law

Economy

Economy

Economy

Economy

Economy

Economy

Economy

Economy

Opinion

Opinion