Media-OutReach Newswire

Media-OutReach Newswire

SINGAPORE - Media OutReach - 7 November 2019 - Singapore's top SME financing platform ValidusCapital (Validus)today announced that small and medium-sized enterprises (SMEs) that received financing through their platform has enabled them to grow theirbusiness. It was found that these SMEscontributed S$

|

The study was conducted by Steward Redqueen, a leadingconsultancy firm focused on impact management and sustainable entrepreneurship.

SMEs are the backbone of Singapore's economy andworkforce. In 2018, SMEs contributed 48 per cent to Singapore's GDP and employ72 per cent of the country's workforce[1].However, many of them continue to face challenges in gaining access tofinancing required to grow their business. Many do not have a solid trackrecord of having credit and collateral, and this prevents them from securing abank loan to grow their business. SMEs being light in fixed assets means thatbanks will often take a longer period to approve their request.

Steward Redqueen's study demonstrates howValidus' financing positively impact both the SMEs and wider economy. SMEs thatobtained financing from the platform experienced

SMEs are seeking financing solutions todrive sales, expand their local operations and internationalise their business.Validus is filling a critical financing gap for SMEs across differentindustries by leveraging the use of Validus' proprietary technology to provideefficient and flexible financing solutions that are customised to the needs ofthe respective SME borrower.

Nahata added, "Many businesses continue tohold the belief that having debt on their balance sheet is detrimental. Ourstudy reinforces that debt can be a growth-enabler when prudent capitalmanagement is exercised. In order for us to continue serving the SME community,we are partnering with banks and corporates

"To estimate the impact results, we tracehow financial flows associated with Validus' financing circulate in theSingaporean economy. These flows are traced using the input-output (IO)methodology; which is to a great extent developed by the Nobel Prize winningeconomist Wassily Leontief and is commonly used by economists to quantifyindirect impacts. Notwithstanding its limitations, this approach providesrobust estimations and is the 'go-to' approach for many development financeinstitutions around the globe," said Tias van Moorsel, Managing Director ofSteward Redqueen Singapore.

Singapore's economy grew by 0.1 per cent year-on-year (y-o-y) in the third quarterof 2019,narrowly avoiding a technical recession[2].On an annual basis, the Ministry of Trade and Industry (MTI) revised its growthestimates to be between 0 and 1 per cent in 2019. Furthermore, SMEs are expecting their turnovers to be lower in the next twoquartersowing to global macroeconomic conditions.

Earlierin February 2019, Validus raised S$20.5 million in an oversubscribed Series Bfunding round led by Dutch public-private development bank FMO and invests inprivate sector growth in emerging markets. In July, Validus announced its plansto be among the first Singapore fintechs to apply for a digital bank licence inSingapore, with a vision to createan inclusive, 360-degree solution for SMEs inSoutheast Asia.

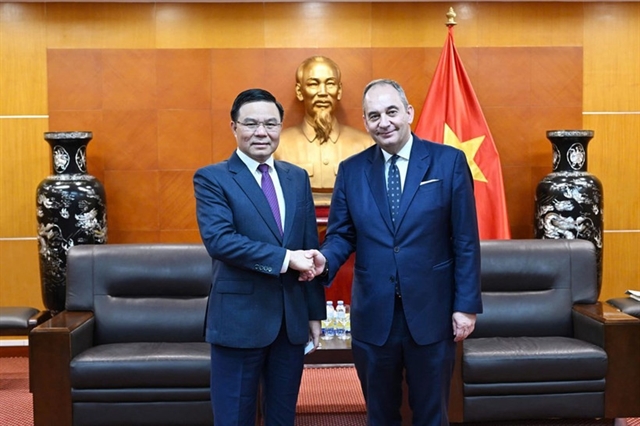

Validus also officially launched itsVietnam entity, Validus Vietnam,

[1] Singapore Department ofStatistics, 2018

[2] A technical recession isdefined as two consecutive quarters of negative quarter-on-quarter growth.

Founded in 2015, Validus Capital isSingapore's largest SME financing platform, and has facilitated over S$300million in business financing to SMEs in Singapore to date. Backed by AAA-ratedDutch Development Bank FMO and Vertex Ventures, Validus holds a Capital MarketsServices Licence by the Monetary Authority of Singapore (MAS), and itsIndonesian arm Batumbu has received OJK registration in April 2019. As acatalyst of sustainable growth for SMEs, Validus connects accredited investorsto SMEs through its peer-to-business lending platform, that is powered byproprietary technology leveraging a secure and robust cloud infrastructure as adelivery mechanism. For more information, please visit www.validus.sg.