Economy

Economy

MB Securities Corp’s (MBS) hopes to earn revenue and pre-tax profit of VNĐ1.17 trillion (US$50 million) and VNĐ360 billion in 2019, up by 11 per cent and 78 per cent year-on-year, respectively.

|

| MBS held its AGM of shareholders on Tuesday in Hà Nội. — Photo ndh.vn |

HÀ NỘI — MB Securities Corp’s (MBS) hopes to earn revenue and pre-tax profit of VNĐ1.17 trillion (US$50 million) and VNĐ360 billion in 2019, up by 11 per cent and 78 per cent year-on-year, respectively.

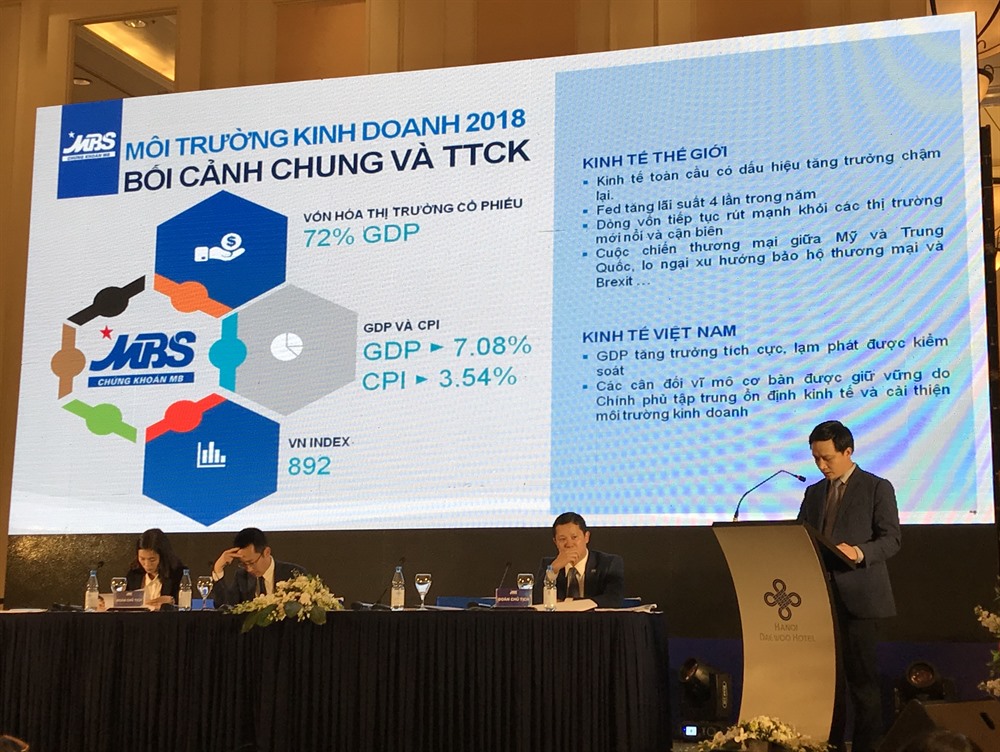

The information was released during the Annual General Meeting (AGM) of Shareholders of the company on Tuesday in Hà Nội.

Last year, MBS reported revenue of more than VNĐ1.05 trillion, up 24.5 per cent compared to 2017 and exceeding 19.6 per cent of the yearly plan.

Of the estimate, revenue from brokerage activities, including financial service revenue, exceeded VNĐ708 billion, accounting for 67 per cent. Revenue from investment banking services reached VNĐ88.7 billion, 8.4 per cent of total revenue.

Pre-tax profit in 2018 was VNĐ202.7 billion, 8.4 times higher than the previous year and exceeding 26.7 per cent of the yearly plan.

This year, MBS has set ambitious goals but the management board has a rather cautious view on the market in 2019.

The company plans to carry out three share issuances to increase its charter capital from VNĐ1.2 trillion to VNĐ1.74 trillion, including offering 35 million shares to existing shareholders, five million shares under Employee Stock Ownership Plans (ESOP) programme and dividend payments at a rate of 10 per cent.

Vũ Thị Hải Phượng, Chief of Supervisory Board of Military Commercial Joint Stock Bank, the major shareholder of MBS, praised the company for completing its restructuring process in 2018, seven years after beginning.

She said the company needed to make efforts to complete and exceed the 2019 goals.

At the meeting, MBS’s board of directors said that seeking partners had been the company’s mission in recent years. In the past five years, many investors from Japan and South Korea were interested in the financial investment segments of the company, especially securities.

MBS’s plan to move its shares from the Hà Nội Stock Exchange to the Hồ Chí Minh Stock Exchange (HOSE) would bring benefits, the company said.

When MBS trades on a floor with higher standards, it will attract more professional investors, MBS leaders said.

Last year, the company paid dividends in cash at a rate of 5 per cent but the company will pay in shares this year at a rate of 10 per cent.

Explaining this, the board of directors said MBS was currently in a strong development phase, needing to invest, to mobilise capital, so it is not reasonable to allocate money at this time.

The company is focusing on providing investment loans and advisory services for 70 to 100 leading companies in the sectors of banking, insurance, securities, real estate, construction, construction materials, retail, manufacturing, power distribution and export. — VNS