Economy

Economy

The VN Index on the HCM Stock Exchange struggled to rise for a third day as investors tried offloading their stakes in large-cap stocks and shifted focus to penny and mid-cap shares.

|

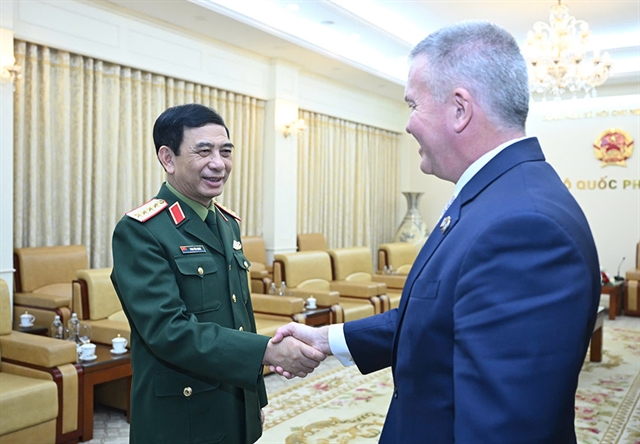

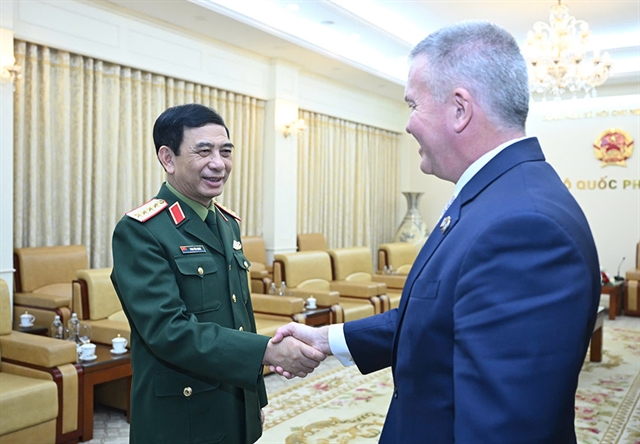

| Investors watch stocks move at Maybank Kim Eng Securities Company. — VNA/VNS Photo Hoàng Hải |

HÀ NỘI — The VN Index on the HCM Stock Exchange struggled to rise for a third day as investors tried offloading their stakes in large-cap stocks and shifted focus to penny and mid-cap shares.

Việt Nam’s benchmark index ended up 0.05 per cent at 706.26 points, lifting its gain to a third day with a total growth of 0.8 per cent.

More than 175 million shares worth VNĐ3.27 trillion (US$145.5 million) were traded on the southern bourse, an increase of 8.6 per cent in trading volume and 18 per cent in trading value compared to Monday.

Half of the large-cap stocks in the VN30 basket, which tracks the performance of the 30 largest companies by market capitalisation, suffered losses yesterday and weighed down the benchmark index.

Among those companies, dairy producer Vinamilk (VNM), Vietcombank (VCB) and Sài Gòn Securities Inc (SSI) edged down between 0.4 per cent and 0.7 per cent.

Other large-cap companies, including insurer Bảo Việt Holdings (BVH), Refrigeration Electrical Engineering Corporation (REE) and KIDO Group (KDC), also recorded losses in share prices after recent gains.

BVH dropped 2.3 per cent following a two-day increase of 2.7 per cent, REE slid 1.1 per cent after rising a total 7.3 per cent in a six-day period, and KDC retreated 0.4 per cent from a six-day rally of 6 per cent.

“The VN Index is undergoing heavy pressure created by investors’ selling after the benchmark index reached the nine-year high level of 700 points,” Bảo Việt Securities Corp (BVSC) said in a note.

Meanwhile, mid-cap and penny stocks proved to be attractive to investors. Eight of the 10 most active stocks with the highest trading volume were mid-cap and penny stocks.

The three most active stocks were property developer FLC Group (FLC) with 18.8 million of its shares being exchanged, agriculture real estate group Hoàng Anh Gia Lai (HAG), and finance corporation Ocean Group JSC (OGC) with around 10.8 million of their shares being traded.

Among the three most active stocks, HAG gained 4.5 per cent to advance a total 9.6 per cent after the last three sessions after confidence in the company was bolstered by higher rubber prices on global trading and expectations for better performance in 2017.

On the Hà Nội Stock Exchange, the HNX Index pulled back 0.3 per cent to close at 86.19 points. The northern market index had rallied 1.7 per cent in the previous five days.

More than 44.3 million shares were exchanged on the northern bourse, worth VNĐ436.5 billion. — VNS