Economy

Economy

|

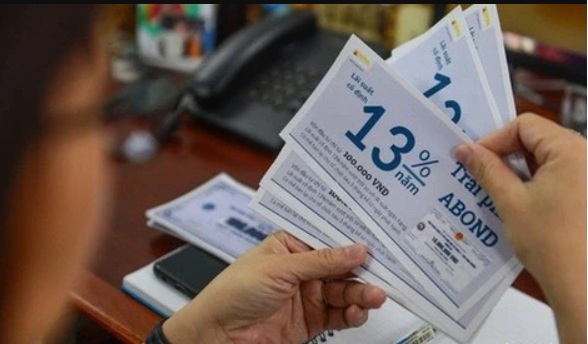

| The inspection found many firms issued bonds illegally and misused the funds through complex dealings. — Photo tuoitre.vn |

HÀ NỘI — Việt Nam’s Government Inspectorate has revealed widespread violations and weak oversight in the corporate bond market, warning that urgent reforms are needed to restore transparency and stability.

The review, covering 67 issuers between 2015 and mid-2023, found that many companies, particularly in the real estate sector, issued bonds without meeting legal requirements, used the funds for unrelated purposes, or routed money through complex intermediary deals.

Investigators said such practices distorted the market and posed serious threats to individual investors.

The report identified slow regulatory development as a root cause. Credit-rating rules introduced in 2014 were not made compulsory until 2024, leaving a prolonged period when financially weak firms could freely issue risky bonds. Oversight agencies were also criticised for failing to update monitoring mechanisms or ensure transparency in the use of funds.

The inspection highlighted a lack of accountability among supervisory bodies. The Hanoi Stock Exchange, tasked with overseeing information disclosure, was criticised for inadequate enforcement, allowing violations at major private conglomerates to persist unchecked.

To close these gaps, the Inspectorate urged the Government to tighten control and hold both organisations and individuals accountable. The Ministry of Finance was asked to review and amend Decrees 153/2020/NĐ-CP, 65/2022/NĐ-CP and 08/2023/NĐ-CP, as well as Circular 76/2020/TT-BTC, to strengthen legal safeguards for bond issuance and fund management.

It also recommended introducing stricter rules on how companies use bond proceeds, clearer reporting obligations, limits on issuance volumes, and closer coordination between the Ministry of Finance and the State Bank of Việt Nam to monitor cash flows. Developing a robust credit-rating system was deemed essential to help investors assess risks and restore trust in the market.

The Inspectorate stressed that years of weak regulation had allowed some businesses to exploit loopholes for profit, eroding market transparency and investor confidence. It called for decisive reforms to build a safer, more disciplined and sustainable bond market. — VNS