Economy

Economy

|

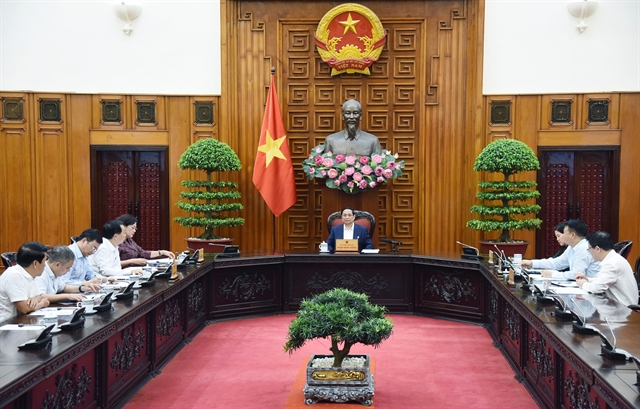

| Prime Minister Phạm Minh Chính chairs the meeting on monetary policies on Monday. — VNA/VNS Photo Dương Giang |

HÀ NỘI — Prime Minister Phạm Minh Chính has asked proactive, flexible, timely and effective monetary policies to be continued to promote the country’s socio-economic development while ensuring the safety of the national financial and banking system.

PM Chính was speaking while working with the State Bank of Việt Nam, the Ministry of Finance, the Ministry of Planning and Investment and relevant agencies on the management of monetary policies on Monday afternoon.

In the context that difficulties and challenges outnumber advantages and opportunities, the Government leader said that the monetary polices must be reviewed for adjustments to improve efficiency with special focus on credit growth.

To accelerate economic growth in the remaining months of this year, money supply must be increased, he said. However, the increase of money supply must ensure the inflow into sectors considered to be traditional and new growth drivers and control bad debts which are on the rising trend.

Bank deposits have now exceeded VNĐ15 quadrillion (US$625 billion), and this capital has been actively channelled into the economy through credit provision. The Prime Minister stressed the importance of further enhancing credit availability and directing capital into production and business sectors to ensure these resources are utilised more effectively.

The PM emphasized that the monetary policies have recently worked effectively in managing the goal market but in the long term, it is critical to raise methodical and fundamental solutions to prevent dollarization and goldization. “Policies must encourage people to invest their money in production and business to create jobs, thereby generating incomes and improving living standards rather than hoarding gold or dollars,” the PM stressed.

The State Bank of Việt Nam said that it has closely and proactively watched the domestic and global economic developments to synchronously deploy solutions to create favourable conditions for enterprises and the people to access banking credit and recover production and business.

Efforts have been made to increase the capital absorption capacity, promote growth associated with ensuring macroeconomic stability, control inflation and ensure the safety of the credit institution system, Governor of the State Bank of Việt Nam Nguyễn Thị Hồng said.

As of July 31, the central parity rate was at VNĐ24,255 buying a dollar, increasing by 1.63 per cent against the end of 2023. This is a low average level and more stable than other countries in the region and in the world.

Interest rates for new and existing loans continue to decrease. By the end of June, the average lending rate was at 8.3 per cent per year, down 0.96 percentage point compared to the end of 2023. Deposit rates averaged 3.59 per cent, down 1.08 per cent.

Credit growth target began to increase from the end of March and has since been on an upward trend. Statistics of the State Bank of Việt Nam showed that credit growth reached 6 per cent as of the end of the second quarter of 2024. The total outstanding loan was estimated at nearly VNĐ14.33 trillion as of the end of July, up 14.99 per cent over the same period last year and 5.66 per cent over the end of 2023.

The central bank has joined with relevant ministries, agencies and localities to implement credit stimulus package such as the VNĐ120 trillion credit package for social housing and credit programmes for forestry and fishery sectors wroth totally VNĐ34.4 trillion.

However, the central bank said that it is not easy to further lower lending rates. The challenges also come from difficulties in stabilising exchange rates, rising inflationary pressure, low credit growth in several localities as well as bottlenecks in speeding up the disbursement of the VNĐ120 - trillion social housing credit package.

In response, PM Chính asked the State Bank of Việt Nam to continue the implementation of proactive, flexible, timely and effective monetary policies, stressing that these policies are appropriate in haronisation with reasonable, focused expansionary fiscal policy to achieve socio-economic development goals.

In the context that rates are tending to increase, Chính asked for solutions to prevent lending rates from rising in the remaining months of this year when demand for capital is often higher. The PM even asked for lower lending rates for prioritized sectors. “Monetary policies must be synchronised, coordinated and supportive of each other with create policy messages.”

He also required efforts to effectively implement digital transformation to enhance the State management efficiency as well as tax and fee extension, reduction and exemption policies. The focus must be on speeding up public investment disbursement and credit growth and promoting exports to reach new record of around $750-800 billion in 2024.

In addition, efforts must be made to effectively exploit free trade agreements (FTAs), promote negotiations of new FTAs, accelerate domestic consumption, diversify markets and supply chains, improve investment environment and attract investments, he asked.

Especially, it is necessary to enhance the enforcement of new laws, including the laws land, housing and real estate market.

PM Chính urged commercial banks to further reduce operation costs to lower rates for prioritised sectors, sectors considered to be growth drivers, major infrastructure development projects on the basis of harmonizing benefits and sharing risks.

Stressing the importance of harmonious and reasonable management of exchange rates and interest rates, the PM requires credit management to be consistent with ensuring macroeconomic stability, controlling inflation and bad debts, drastically deploy incentive programmes, ensure the system security and safety, and fundamentally control the goal market and foreign currency market.

With regard to the VNĐ120 trillion social housing credit package, PM Chính asked appropriate and reasonable policies to enable homebuyers to access preferential loans, especially after new laws on land, housing and real estate market took effect. — VNS