Economy

Economy

|

| An SCB branch in HCM City’s District 3. Trương Mỹ Lan, chairwoman of Vạn Thịnh Phát, owned a 91.5 per cent stake in SCB and obtained loans worth VNĐ545 trillion from it using a network of over 1,000 affiliated companies. |

HCM CITY — The police are scouring the country for over 42,000 victims of a massive bond fraud thought to involve VNĐ30 trillion (US$1.24 billion) by property developer Vạn Thịnh Phát.

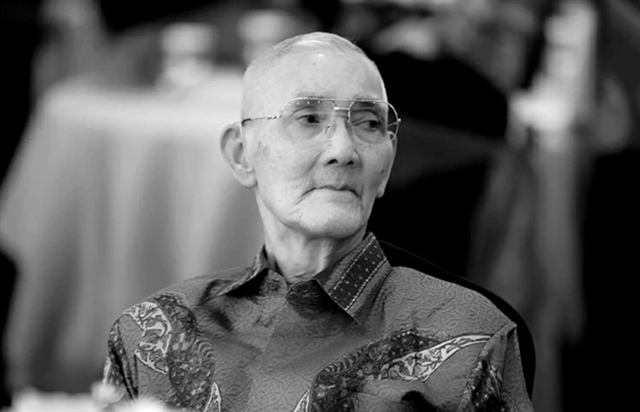

They have been trying to reach the victims since early October to gather evidence in the largest fraud case in Việt Nam’s history, the one involving Trương Mỹ Lan, 66, chairwoman of property company Vạn Thịnh Phát.

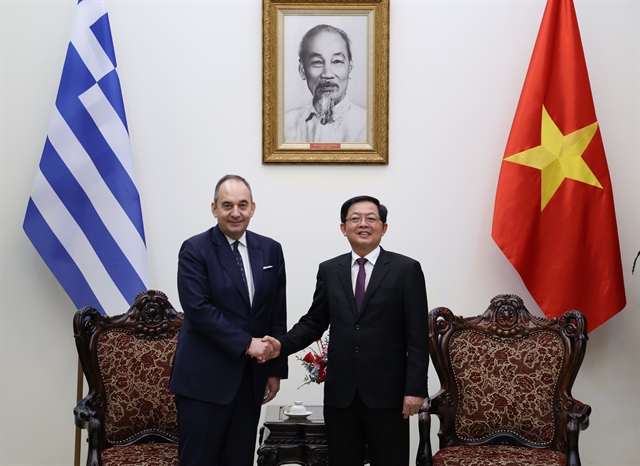

Speaking at a press conference last week, Major General Nguyễn Văn Thanh, head of the Investigation Police Department for Corruption, Smuggling, and Economic Crimes (C03), told the victims: “Any money recovered from the company will be considered evidence in the case and returned to the rightful owners on court orders.”

According to C03 investigators, Lan’s company made 25 bond issuances worth $1.24 billion, all through fake companies, and sold to buyers through Saigon Commercial Joint Stock Bank (SCB).

The chairwoman of Vạn Thịnh Phát, who has a major stake in SCB, was found to be linked to these fraudulent activities, misappropriating funds and controlling the bank’s activities to obtain loans.

Depositors at SCB were the primary targets of the bond sales, making them victims in the case.

Specific details of the fraudulent activities have not been disclosed, as investigations are ongoing. However, it is obvious that the scale and sophistication of the fraudulent bond issuances have had far-reaching consequences for the victims involved.

The Police have identified the buyers of these bonds as victims but are struggling to identify them, and are urging anyone who holds bonds from the 25 issuances to come forward soon and provide information, documents and related contracts.

“Failure to do so may result in the bondholders’ rights and interests being disregarded.”

The victims have not received any interest or principal payments they were supposed to get through their accounts at SCB since the arrest of Lan in October 2022.

SCB has said all accounts associated with Vạn Thịnh Phát and its associate companies have been frozen by the police since October 2022, which is why bondholders have not received their payments.

SCB repeatedly said it is only an “intermediary involved in selling the bonds” to investors and “does not guarantee bond repayment.”

After the arrest of the chairwoman, depositors flocked to SCB to withdraw their deposits, leading to a surge in deposit interest rates at the end of 2022.

Nguyễn Thị Hồng, governor of the State Bank of Vietnam (SBV), had reassured the public, saying that all savings accounts, including certificates of deposit, are secured and guaranteed by the central bank irrespective of the circumstances.

Nevertheless, she refused to offer any guarantees for the bonds purchased through SCB by investors and declined to comment on the matter.

|

| Trần Bữu Nữu, an officer belonging to the Bình Thạnh District police, helps a victim file a complaint against SCB. VNS Photo Bồ Xuân Hiệp |

Trần Bữu Nữu, a police officer from Bình Thạnh District, told Việt Nam News that in early October an overwhelming number of victims came to complain.

Though the number has decreased in recent times, the police are still receiving complaints every day, which they forward to C03 in Hà Nội, he said.

Lan and 85 others, including top and mid-level managers at SCB, officials at the SBV and Government Inspectorate, and a State Audit official are charged with a variety of crimes.

According to the police, Lan did not hold any position at SCB but owned a 91.5 per cent stake in it, and between 2012 and 2022 received over 2,500 loans worth over VNĐ1 quadrillion (around $44 billion) from it, or 93 per cent of all the loans it gave, using a network of over 1,000 companies affiliated to Vạn Thịnh Phát.

She paid bribes to relevant authorities to conceal the bank’s precarious financial situation, including allegedly $5.2 million to the head of the central bank’s department of inspection and supervision, Đỗ Thị Nhàn.

The police have seized millions of US dollars in cash and frozen millions in assets linked to the chairwoman. In addition, the Police have made a record of over 1,200 property developments owned by the chairwoman, primarily in prime locations in HCM City and other provinces.

The funds and assets are intended to be used to repay the victims as ordered by the court, according to the Police.

Her company, Vạn Thịnh Phát Co., Ltd., operates in commerce, hospitality and real estate, and owns major projects and buildings in prime locations in HCM City.

C03 has said she laundered the money she obtained from SCB by buying large properties and transferring it overseas.

Two new cases are being investigated and there are over 100 suspects.

|

| The construction of a building near Bến Thành Market, believed to be owned by Viva Land, a subsidiary of Vạn Thịnh Phát Group, stalled at the end of 2022 following the arrest of Trương Mỹ Lan. — VNS Photo Bồ Xuân Hiệp |

The investigation is ongoing and the outcome would be announced later, Major General Thanh said at the press conference.

Experts estimated it would take the Government three to five years to deal with all problems related to the Vạn Thịnh Phát-SCB scandal.

Prime Minister Phạm Minh Chính has blamed the Ministry of Finance, the State Securities Commission and the central bank for their lack of oversight.

He said the government would be aggressively stepping up criminal proceedings against those involved in the scam. — VNS