Economy

Economy

|

| A Wigo model of Toyota, the company led the market in August with 3,922 units, up 16.7 per cent from the previous month. It was followed by KIA, Huyndai, Mazda and Ford. — Photo courtesy of the company |

HÀ NỘI — Automobile sales in Việt Nam faced difficulties in August, after growing slightly in July despite a 50 per cent reduction of the registration fee, according a report of Vietnam Automobile Manufacturers Association (VAMA).

The VAMA reported that its members sold 22,549 vehicles in August, down 9 per cent against the previous month and 27 per cent over the same frame last year.

The breakdown of vehicle sales in August was as follows: 17,335 passenger cars, down 10 per cent; 5,036 commercial vehicles, down 5 per cent; and 169 special-use vehicles, up 14 per cent month-on-month.

This indicates that the automotive market in Việt Nam has faced difficulties in maintaining stable sales, especially in the two key segments of passenger cars and commercial vehicles.

In terms of vehicle origin, sales of domestically-assembled automobiles reached 13,118 units, down 3 per cent, while the number of imported completely built up (CBU) autos was 9,422, down 15 per cent month-on-month.

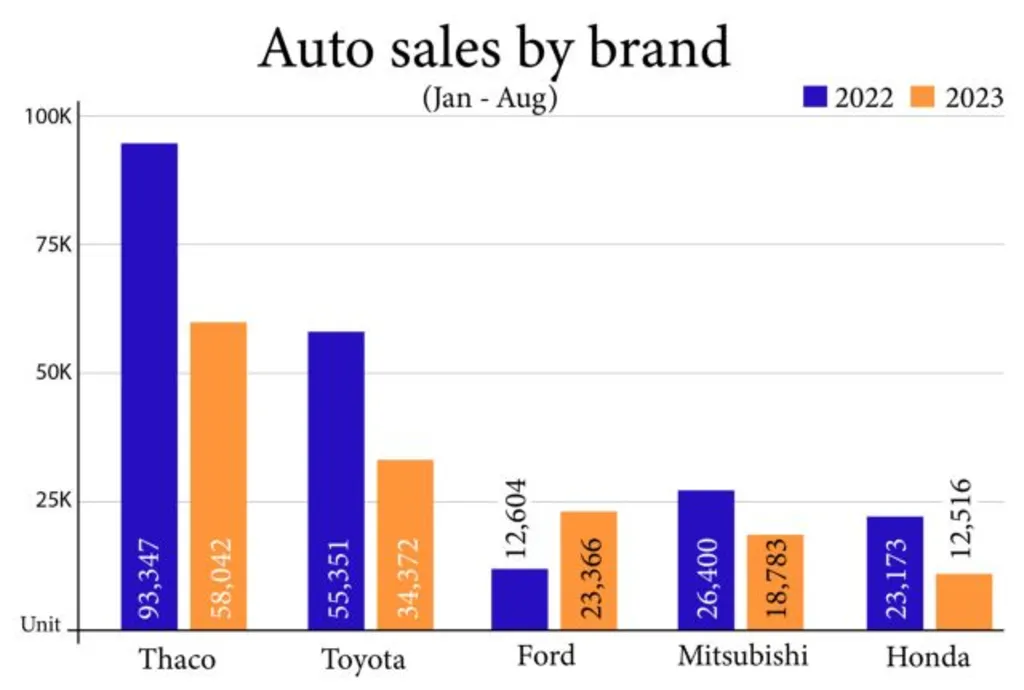

In the first eight months of this year, VAMA members sold a total 184,554 vehicles of all kinds, down 30 per cent against 2022. Of this amount, passenger cars experienced a 34 per cent decrease, while commercial vehicles and special-use vehicles dropped by 13 per cent and 61 per cent, respectively.

Besides VAMA member units, the Vietnamese auto market also includes other automakers such as Audi, Jaguar Land Rover, Mercedes-Benz, Nissan, Subaru, Volkswagen, and Volvo, but they do not disclose business results.

Meanwhile, Thành Công Group (TC Group) announced its sales of 3,145 units in August, and 35,191 in the January-August period.

Based on sales reports from VAMA and TC Group, 25,685 units were sold in August, lifting total sales in the first eight months to 219,745 units.

Toyota led the market in August with 3,922 units, up 16.7 per cent from the previous month. It was followed by KIA, Huyndai, Mazda and Ford.

|

| Total car sales in 2022-2023. — VNS graphic Đoàn Tùng |

According to industry insiders, the overall decline in sales is attributed to several factors, including economic difficulties and consumer spending constraints. Despite the Government support with a 50 per cent reduction in registration fees for domestically-manufactured and assembled vehicles, sales decreased. The decline in sales was also influenced by cultural factors. The seventh lunar month, which often falls at the end of August in the Gregorian calendar, is the month of the ghost in Vietnamese people's perception. This is traditionally considered a month of reduced spending.

To stimulate the market, car manufacturers have been reducing prices and offering incentives across various product lines. For example, B-segment car models such as Honda City, Hyundai Accent, and Toyota Vios have received incentives from the 50 per cent registration fee reduction, in addition to further support from manufacturers and distributors. Other models, such as the Honda CR-V and Subaru Outback, have also experienced price reductions and discounts. Luxury brands, such as Mercedes-Benz and Volkswagen, have been offering discounts and incentives to attract buyers.

While there are signs of hope for the future, with predictions of a potential improvement in the domestic auto market in September, industry insiders remain cautious about the overall situation. Purchasing power is not expected to increase significantly in the last months of the year due to economic factors.

Obtaining the same sales volume in 2022 (400,000 vehicles per per year) is considered difficult, and increased inventory pressure may lead to production and business cuts, impacting employment and worker incomes.

According to Nguyễn Trung Hiếu, a senior expert of VAMA, the market is facing challenges, and although there may be some improvements in the coming months, the overall outlook for the entire year of 2023 is unlikely to match the sales levels of 2022. The market's dynamics will depend on factors such as the expiration of certain policies and the introduction of new vehicles with attractive prices and incentives. — VNS