Economy

Economy

|

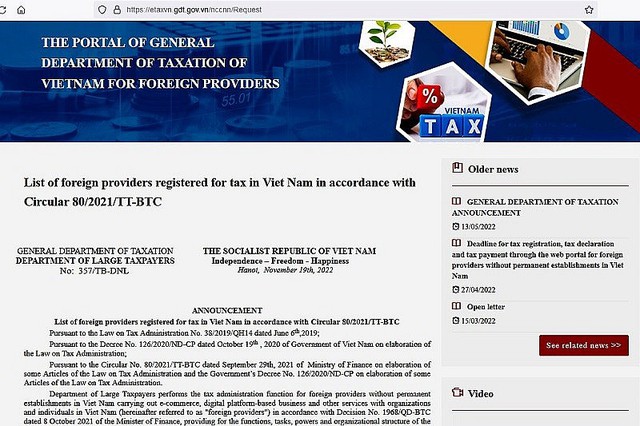

| A view of the portal https://etaxvn.gdt.gov.vn/nccnn/Reques. Foreign providers have so far paid total tax of some US$22.2 million via the portal. Photo baochinhphu.vn |

HÀ NỘI — A total of 39 foreign providers have registered for tax in Việt Nam via the portal https://etaxvn.gdt.gov.vn/nccnn/Reques, according to the Tax Agency for Large Businesses at the General Department of Taxation.

Among them are Meta (Facebook), Google, Microsoft, TikTok, Netflix, and Apple which account for up to 90 per cent of the market share in the field of cross-border e-commerce.

Other names in the list include iHerb, LLC; Netflix Pte. Ltd; Tiktok Pte. Ltd; Blizzard Entertainment Inc; Educational Testing Service; Ezviz International Limited; and LinkedIn Singapore Tte. Ltd, among others.

The General Department of Taxation put the portal, which was exclusively developed for foreign providers, in place on March 21. Foreign providers have so far paid total tax of some US$22.2 million via the portal.

According to the department, the portal makes it easier for foreign providers with business on digital platforms in Việt Nam to register, declare and pay taxes.

Through the portal, foreign providers can also learn about Việt Nam’s tax laws and policies on e-commerce.

Finance Minister Hồ Đức Phớc said the portal was launched to keep up with the strong development of e-commerce in Việt Nam. Many major groups like Google have forecast that the Vietnamese digital economy will reach more than $52 billion and rank third in ASEAN in 2025.

Phớc has asked the agency to ensure round-the-clock operations of the portal, while working on upgrading the services, meeting the demand of foreign suppliers during the observance of local tax laws.

The tax agency will step up the communication work to further facilitate tax registration, declaration and payment in Việt Nam in line with the country’s commitments and regulations on added value and corporate income taxes for cross-border services.

According to the Finance Ministry, tax payments made by foreign providers between 2018 and December 2021 exceeded VNĐ4.4 trillion ($192.47 million). — VNS