Business Beat

Business Beat

|

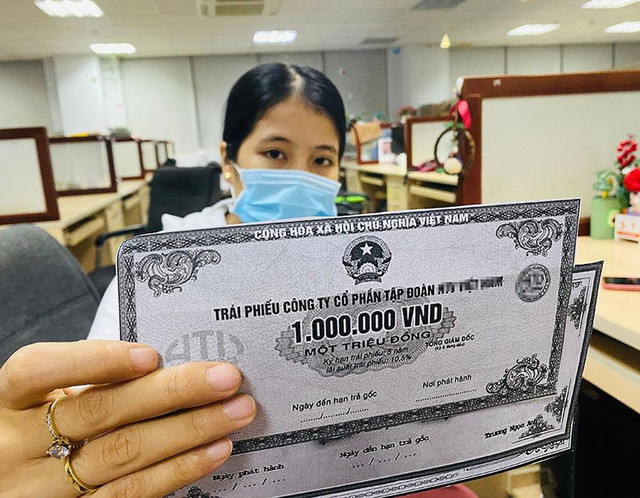

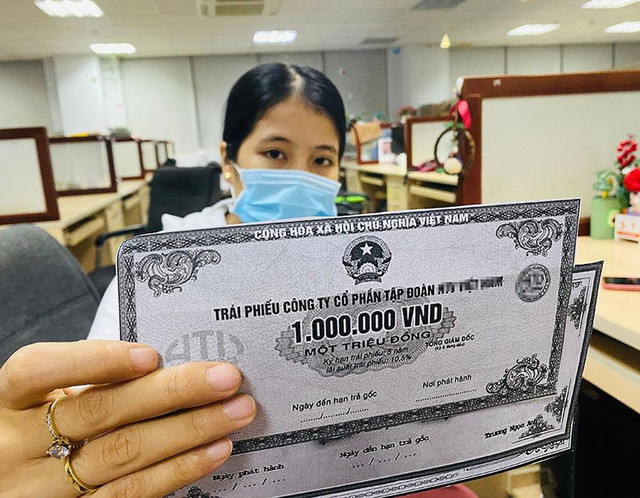

| An illustrative image of Bitcoin. Việt Nam has made steady and notable progress in developing institutions and a legal framework for digital assets and blockchain technology. — REUTERS/VNA Photo |

Complied by Mai Linh

A wave of optimism is sweeping through the digital asset market as the Government inches closer to legalising the digital asset market which is expected to create a regulatory breakthrough that could make Việt Nam one of the leading crypto and blockchain hubs of the region.

The newly passed Law on Digital Technology Industry together with a draft framework to legalise the pilot operation of digital asset exchanges scheduled to be realised within August will mark a transformative shift for a market long operating in the shadow and now eyeing explosive growth to capitalise on the billions-of-dollars market.

At the Government’s conference on Wednesday, Deputy Minister of Finance Nguyễn Đức Chi said that the pilot project on crypto asset market had been basically completed in terms of criteria for market participants, technical conditions, operation procedures, financial capacity and expertise of service providers.

The project had been reported to the Government with a resolution expected to be issued within August or September.

Chi added that during the pilot phase, there would be more than one exchange allowed to operate in order to create a healthy competitive environment. However, there wouldn't be too many exchanges in the pilot phase to facilitate the management and efficiency evaluation.

The Ministry of Finance proposed that the private economic sector be encouraged to participate in providing services in the crypto asset market, he said.

According to Deputy Governor of the State Bank of Vietnam Phạm Tiến Dũng, over the past year, steady and notable progress has been made in developing institutions and a legal framework for digital assets and blockchain technology.

Crucially, the Law on Digital Technology Industry, effective from January 1, 2026, defines digital assets in law for the first time, establishing ownership rights, business conditions, and information safety regulations. This breakthrough provides a transparent legal foundation for blockchain-based business and research in Việt Nam.

In addition, the National Assembly has passed a resolution on the establishment of an international financial centre (IFC), covering innovation and specialised digital asset exchanges.

The draft resolution on the pilot implementation of digital asset market is being finalised and submitted to the Government for approval in August. Crypto asset exchanges will be piloted in the IFC which is being pushed to go operational in HCM City and Đà Nẵng by the end of this year.

Tô Trần Hoà, Deputy Head of the Market Development Department under the State Security Commission, said that the draft would regulate the establishment of businesses providing digital asset services with strict requirements.

For example, companies must meet high cybersecurity standards to operate a crypto asset exchange, according to Hoà. The minimum capital for an exchange is VNĐ10 trillion (US$381 million), three times higher than establishing a bank and 33 times higher than an airline.

In the draft, the management of digital assets will focus on trading, transfer and serving anti-money laundering. Digital assets will not be recognised as a means of payment.

In the shadows

A youthful population, high internet penetration and growing tech enthusiasm are propelling Việt Nam into the global spotlight as one of the most dynamic markets for digital assets and blockchain technology in recent years.

In its 2024 Global Crypto Adoption Index, Chainalysis Statista ranked Việt Nam 5th worldwide in overall interest in digital assets, third in usage of international crypto platforms and 6th in decentralised exchange trading volume (DEX).

Data of Chainalysis Statista also showed that users have transacted more than $100 billion through digital assets, a significant figure when compared to Việt Nam’s remittance flow which stood at just $14 billion in 2023.

The number of Vietnamese using digital accounts has increased from just 2.06 million in 2019 to an estimated 10.15 million, excluding the non-fungible token (NFT) market, making Việt Nam 4th globally in term of users in 2023.

In comparison, there were around 10 million domestic securities accounts as of May 2025 after 25 years of the stock market development, according to statistics of the Việt Nam Securities Depository.

This marked a significant shift to digital asset investment although it has not been legally recognised in Việt Nam.

Due to the lack of regulatory framework, operation in the grey zone poses significant risks to businesses and investors, according to Nguyễn Trung Thuật, CEO of venture investment fund Kyros Ventures.

A number of startups were forced to register in crypto-friendly countries such as Singapore.

"Vietnamese is incredibly quick to spot trends but most of the value they create ends up abroad," Thuật said, adding that his fund has supported over 200 Vietnamese blockchain projects, but nearly all are located overseas.

Thuật emphasised the need for a domestic asset exchange that ensures technological robustness, transparency, security, and a fair listing mechanism.

“If there’s a regulation but no product, users will leave. If there’s a product but no regulation, start-ups won’t dare to go public,” Thuật said.

“Việt Nam needs both, and can learn from international experiences.”

In the context that traditional capital raising channels such as banks and securities are under pressure, the flow of money into digital assets and crypto currencies is described as a giant underground economy that cannot be ignored, according to Trần Dinh from Việt Nam Blockchain Association.

“Improving the regulatory framework will also help Việt Nam attract a huge amount of foreign capital into the fintech sector, create more momentum for economic growth and activate a wave of start-ups and develop the domestic digital technology ecosystem,” he added.

Excitement for a new industry

The recognition of crypto assets is expected to open up a new industry in Việt Nam which will appeal to international investors.

Trần Xuân Tiến, Vice President of the HCM City Blockchain Association said that legalising digital assets would help startups move out of the grey zone to compete fairly with traditional businesses while expanding beyond fintech to apply digital assets into other industries.

The new legal framework would also push traditional businesses to apply blockchain and form new industries, Tiến added.

The law sent a signal, but other factors needed to be put into consideration including incentive policies, tax policies and market openness, he said.

According to Lynn Hoàng, country director of Binance in Việt Nam, many countries began to pay attention and develop regulatory framework for digital assets, generally believing that blockchain will be the technology of the future.

“We are eagerly awaiting a legal framework that would allow the pilot launch of digital asset exchanges,” said Mai Huy Tuấn, general director of SSI Digital, adding that digital asset businesses would have the opportunity to test new products within a clear regulatory environment.

Preparations had been made for many years, and a green light button was needed to activate, he said.

Developing a legal framework requires a balance between management to protect investors while ensuring innovation is not stifled, according to Minister of Finance Nguyễn Văn Thắng.

Việt Nam also faces a shortage of resources and talents in digital assets and blockchains.

Establishing a clear, consistent and flexible inter-agency coordination mechanism is essential to ensure efficiency in pilot implementation of digital asset market because digital asset market spans multiple sectors, including finance, technology, risk management and investor protection.

Developing a comprehensive legal framework for digital assets has become an urgent priority, not only to foster the digital economy and protect users but also to achieve broader economic goals. Besides, an appropriate regulatory framework will help minimise the risks related to fraud, scams and asset loss, according to the minister.

Vũ Ngọc Sơn, head of research, consulting, and technology development and international cooperation at NCA, highlighted Việt Nam’s strong logic and mathematical skills, especially among engineers, as a key advantage in cybersecurity, with local developers known for their persistence in identifying vulnerabilities in open-source blockchain systems.

He outlined four pillars to establish Việt Nam as a blockchain security centre, including a strong legal framework, robust technical standards, a well-trained human resource base and international cooperation, particularly in intelligence-sharing and cross-border cybercrime prevention.

According to data from crypto asset information provider CoinMarketCap, more than 118 million digital assets are currently issued and actively traded with a total market capitalisation of more than $3.37 trillion and daily trading volume of $100 billion.

Bitcoin, Ethereum, Tether, XRP and BNB are the five largest cryptocurrencies by market capitalisation, altogether accounting for more than 80 per cent of the total value of the global digital asset market.

A report by Triple A showed that global average crypto ownership rate is 6.8 per cent with more than 560 million people worldwide holding cryptocurrencies. — VNS