Business Beat

Business Beat

|

| A staff member at the Petrolimex Hà Tĩnh gas station transmits sales data to the tax authority's system. — VNA/VNS Photo |

Compiled by Ly Ly Cao

HÀ NỘI — Việt Nam is accelerating its digital transformation in the tax sector by extending the use of electronic invoices (e-invoices) to household businesses, a significant move aimed at reducing revenue loss and enhancing transparency.

Since June 1, a wide range of business households have been required to issue e-invoices generated directly from cash registers. The e-invoice system allows transactions to be recorded in real time and automatically sent to the tax authorities.

This is a fundamental change in the tax authority's method of managing household businesses, as stipulated in Decree 70/2025.

In the first quarter of this year, more than 3.6 million business households across the country contributed nearly VNĐ8.7 trillion (US$334.5 million) to the State budget, marking a more than 30 per cent increase compared to the same period in 2024.

Household businesses, which include small traders, market vendors and service providers, have traditionally operated with minimal oversight, often issuing paper invoices or none at all.

Most of them support the new tax management regulations. They believe these changes will help reduce certain risks, such as mistakenly paying taxes due to confusion between personal and business finances, selling goods without issuing invoices and suffering financial losses from not controlling input materials or outgoing orders.

Many households have proactively started using sales management software like KiotViet, Sapo and Salesbook, which offer tailored solutions for various customer segments and industries.

However, a few still rely on integrated services like electronic invoices and comprehensive solutions provided by large companies such as Viettel, VNPT and Misa.

Despite this, some households remain hesitant about changing their business practices.

Nguyễn Huy Hùng, who operates a catering business on Lý Thường Kiệt Street in Hà Nội, said he invested about VNĐ10 million to install new equipment.

He also hired a young employee to manage the counter, making it easier to input information and process orders.

Hùng told the Saigon Times that hiring staff was a reluctant but necessary step since many older employees are not tech-savvy. He also expressed concerns about potential technical issues when the new system goes live, which could lead to mistakes on incoming invoices or delays in issuing invoices.

This could result in penalties from tax authorities if suppliers fail to provide timely support. Therefore, he hopes the tax authority will create binding agreements with equipment suppliers to ensure they assist business households.

Nguyễn Hữu Tài, who runs a mobile coffee business in Hà Nội, highlighted the challenges posed by his non-fixed location. He and his staff often face limitations with data transmission and equipment placement, making it difficult to install similar machines to those used in stationary shops.

As a result, he is exploring service options that can be integrated into phones or compact, user-friendly devices.

|

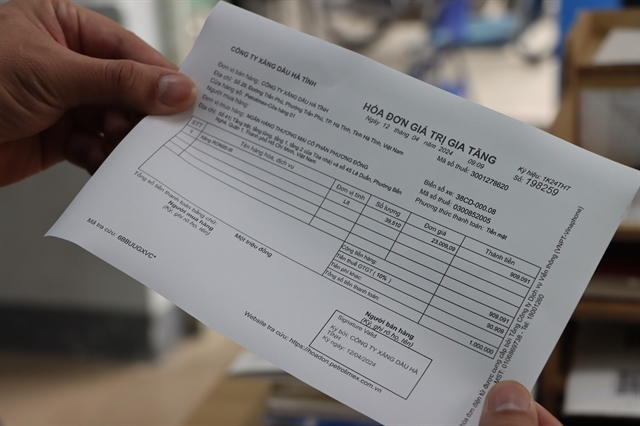

| A value-added tax invoice is issued to customers after each sale at Petrolimex Hà Tĩnh. — VNA/VNS Photo |

From an expert's perspective, Nguyễn Văn Được, general director of Trọng Tín Accounting and Tax Consulting Company, said that transitioning from paper invoices to electronic invoices may pose initial challenges for business households.

Not every household or individual business has the necessary technology or equipment, such as cash registers. This lack of resources complicates the transition, as they must invest in new equipment and learn how to use it.

Additionally, many business households have enjoyed lump-sum tax arrangements in the past, and now they must declare all revenue and expenses, which can create reluctance to comply.

Được noted that Decree 70/2025 requires business households to make this transition. If the tax authority provides support in terms of policy and technology, and taxpayers have the necessary conditions yet still delay compliance, penalties may be imposed. Thus, it’s essential to gradually ease these constraints to support business households while ensuring accountability.

Currently managing over 271,000 business households, nearly 30 per cent more than the same period in 2024, the Tax Department of Region I is actively collaborating with all districts and localities to ensure that no unregistered households are overlooked.

The authority is also adding to its management list all business households required to use invoices generated from cash registers.

"From now until June 1, we will launch public awareness campaigns to address the challenges faced by business households during this transition,” Nguyễn Tiến Minh, deputy head of the Tax Department of Region I under the Ministry of Finance, told vtv.vn.

“We will partner with electronic invoice solution providers to offer the best support tailored to the needs of these households, linking electronic invoices from cash registers with electronic tax declarations."

The Minister of Finance has also reached out to leaders of various provinces and centrally governed cities, urging them to support the tax sector in promoting the nationwide implementation of electronic invoices from cash registers.

Nevertheless, the mandate comes with clear enforcement measures. Household businesses that fail to register for or issue e-invoices as required may face administrative penalties, including fines and potential suspension of operations. — BIZHUB/VNS