Economy

Economy

|

| The Mê Linh Social Housing Area in Hà Nội has been completed and put into use. VNA/VNS Photo Tuấn Anh |

The development of social housing remains a key government priority to ensure social security and boost economic growth. However, progress is lagging due to administrative delays and challenges in accessing preferential credit for developers.

The objective of the project approved on April 3, 2023 by the Prime Minister is to "build at least one million social housing units for low-income groups and industrial park workers between 2021 and 2030", averaging over 100,000 units per year.

Experts and businesses have called for special policies to accelerate progress and meet targets.

According to the Ministry of Construction, from 2021 to 2024, only 103 projects with 66,755 units have been completed nationwide, reaching just 6.2 per cent of the target of about 1,062,200 units by 2030.

On average, more than 30 projects with about 22,250 units have been completed per year. In 2024 alone, 28 projects with 21,874 units were completed.

However, by the end of 2024, progress remained behind schedule by around 230,000 social housing units, which will have to be carried over into the 2025-2030 period.

Deputy Minister of Construction Nguyễn Văn Sinh said the target for 2025 was to complete 100,000 social housing units. As of March, 37 out of 63 provinces and cities had announced 90 social housing projects, with total disbursements exceeding VNĐ2.8 trillion (US$109.9 billion).

Sinh proposed that the Prime Minister assign the Ministry of Construction to study and pilot a special mechanism and policies for social housing development to resolve existing obstacles in the sector.

Streamlining the process

The development of social housing projects remains hindered by lengthy administrative procedures.

According to Đậu Minh Thanh, chairman of the Members’ Council of the Housing and Urban Development Corporation (HUD), which has completed and handed over around 3,500 social housing units, the procedures and timeline for developing such projects remain lengthy.

From the initial investment approval to contract signing with an investor, a social housing initiative takes nearly 300 days. Additional steps, including project formulation, appraisal, investment approval, construction design approval, and project initiation, require at least another 300 days. Even under the most favourable conditions, it takes over 500 days to break ground on a social housing venture under current regulations.

“This prolonged timeline discourages investors, as social housing projects typically have relatively low profit margins,” Thanh said.

To address these challenges, he recommended preferential policies and streamlined regulations, including direct contractor selection for qualified investors, eliminating unnecessary bidding procedures, and expediting approvals.

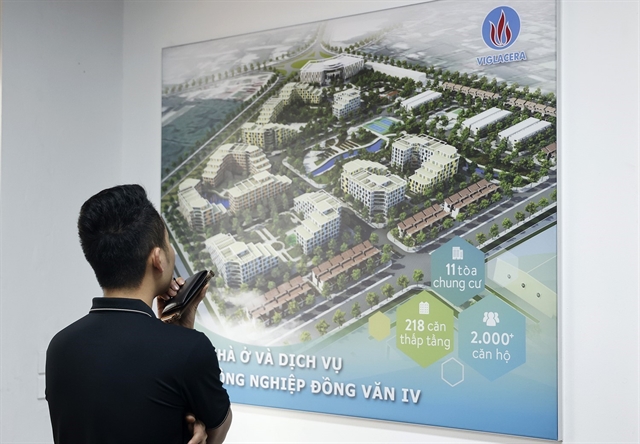

|

| A resident learns about social housing at Yên Phong Industrial Park in Bắc Ninh Province. VNA/VNS Photo Tuấn Anh |

Representatives from the Urban Infrastructure Development Investment Corporation (UDIC) also proposed a fast-track approval mechanism and prioritising social housing projects in key investment categories to speed up implementation. UDIC reported that it had successfully reduced project timelines for social housing developments, such as the Hạ Đình Urban Area in Thanh Trì, Hà Nội. Instead of the original 36-month timeline, the project is now being completed within 24 months.

The Viglacera Corporation, which is currently developing 10 social housing projects with a total of 17,200 units, also noted inefficiencies in the approval process. A representative proposed that pre-approved projects with finalised designs and pricing should not require bidding, allowing for direct assignments to qualified developers to accelerate progress.

A representative from Vingroup, which has committed to building 500,000 social housing units by 2030, also called for granting local authorities the power to directly select contractors and investors. He suggested allowing parallel processing of administrative procedures to shorten project timelines.

"If the Government, banks and businesses work together, we can not only meet our targets but also deliver results more efficiently and with greater social impact," he said.

Access to funding

Several businesses reported difficulties in accessing funding due to procedural barriers and challenges in proving project feasibility.

Lê Hoàng Châu, chairman of the HCM City Real Estate Association, proposed that the Việt Nam Bank for Social Policies provide preferential loans for social housing investors. He also urged the State Bank of Việt Nam (SBV) to guide commercial banks in implementing the VNĐ145 trillion ($5.69 billion) credit package and lowering lending rates.

A UDIC representative noted that large-scale credit packages often faced complicated appraisal procedures and lengthy processing times, making it difficult for businesses to access preferential capital.

SBV Governor Nguyễn Thị Hồng said it was crucial to assess housing demand and available resources in each locality. She suggested that Project 06 of the Ministry of Public Security could help identify individuals in need of housing, classified by ownership, purchase, or rental needs.

For businesses, Hồng called for supportive policies on land tax, interest rates, investor selection, and procedural simplifications to encourage greater investment in the sector.

Highlighting risk management, she noted that banks primarily mobilise short-term deposits, while housing projects would require long-term financing. She said that balancing liquidity was crucial to financial stability, meaning bank capital should supplement rather than drive social housing development.

To address funding challenges, Hồng proposed allocating state budget funds through entrusted loans from banks and establishing a dedicated housing fund managed by banks, allowing for longer loan terms and lower interest rates.

She added that under SBV's two ongoing programmes, including the VNĐ145 trillion credit package and a special loan programme for individuals under 35 years old, banks had been urged to take responsibility in implementing the Government’s directives. These programmes would offer preferential interest rates as low as 1-3 per cent, significantly lower than standard rates.

"Currently, nine banks have committed to providing VNĐ45-55 trillion in loans, with terms of up to 15 years at interest rates 1-3 per cent lower than usual," Hồng said.

With a strong commitment to addressing bottlenecks, Prime Minister Phạm Minh Chính issued a series of directives at the March 6 conference on social housing development. He instructed authorities to review the current 10 per cent profit margin for social housing projects, considering potential adjustments while ensuring efficiency and timely implementation.

To ensure funding reaches the right beneficiaries, Chính ordered the establishment of a National Housing Fund by March 2025. He also mandated the approval of priority housing beneficiaries based on an integrated national population database to ensure transparency and fairness.

Additionally, he highlighted the importance of public-private partnerships, land tax incentives, and lower interest rates to attract more businesses to the sector. Local budgets would also be allocated through the Việt Nam Bank for Social Policies, alongside land clearance and the development of a clean land fund to accelerate implementation.

The Prime Minister stressed the urgent demand for social housing, urging authorities to take proactive action. He reaffirmed that social housing development was not just an economic task but a political mission, where every policy must be centred around the people. VNS