Economy

Economy

Masan Group Corporation's consolidated net revenue increased by 13.3 per cent in Q1 to VNĐ19.977 trillion (US$862.53 million), primarily due to double-digit organic growth in its branded consumer and meat businesses and 178.2 per cent growth by Masan High-Tech Materials (MHT) due to H.C. Starck (HCS).

|

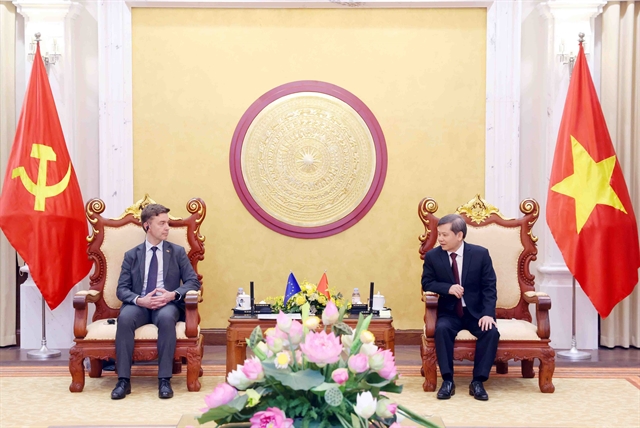

| Masan owns many popular consumer brands. — Photo courtesy of Masan |

HCM CITY — Masan Group Corporation's consolidated net revenue increased by 13.3 per cent in Q1 to VNĐ19.977 trillion (US$862.53 million), primarily due to double-digit organic growth in its branded consumer and meat businesses and 178.2 per cent growth by Masan High-Tech Materials (MHT) due to H.C. Starck (HCS).

Its consolidated earnings before interest, taxes, depreciation, and amortisation (EBITDA) in the first quarter grew 62.2 per cent year-on-year. Its EBITDA margin was 15.7 per cent as against 11 per cent a year earlier.

In the first quarter EBITDA margins improved to 1.8 per cent at VinCommerce (VCM) and remained stable at Masan Consumer Holdings (MCH) and Masan MEATLife (MML). But MHT saw lower margins as a result of the consolidation of HCS and the lag effect of the recent price recovery, which is expected to be realised in the following quarters.

MSN delivered VNĐ187 billion ($8.08 million) in net profit post minority interest. Profitability is expected to grow faster than topline, due to total commercial margin (TCM) improvement by VCM, stable margins at MCH and increased profitability at MML and MHT.

Among its affiliates, the CrownX delivered EBITDA of VNĐ1.216 trillion ($52.6 million), or double the VNĐ614 billion ($26.6 million) achieved in the same period last year as EBITDA margin expanded by 5.1 precentage points to 9.7 per cent.

VinCommerce has delivered two consecutive quarters of positive EBITDA, improving from 0.2 per cent in the fourth quarter of 2020 to 1.8 per cent in Q1 this year.

VCM completed negotiations with strategic suppliers representing 40 per cent of sales in Q1, increasing TCM by 1 per cent on a run rate basis. VCM still targets to enhance TCM by 2.5-3 per cent for fiscal year 2021.

“VCM’s Q1 results demonstrate our capability to run a scalable and profitable retail platform,” Dr Nguyễn Đăng Quang, MSN chairman, said.

“We are now laser focused on re-expanding our footprint nationwide to serve 30-50 million consumers by 2025. By year end our store network will be at least equal to the network we acquired. The only difference is our expansion plans will also deliver profits.”

Masan Consumer Holdings posted 18.8 per cent topline growth and EBITDA margin of 20.8 per cent despite higher raw material costs. Topline expansion was driven by an innovation-led growth strategy as 42 per cent of growth in Q1 was contributed by new products launched in 2020.

The beverage segment recovered and grew by 35.5 per cent while growth of convenience foods slowed as expected due to COVID-19 related stockpiling by consumers in Q1, 2020. Management expects to raise profitability levels back to 2020 levels in the following quarters as it optimises brands and selling expenses.

On April 6, 2021, SK Group of Korea, a major shareholder of MSN, acquired another 16.26 per cent stake in VinCommerce for a total cash consideration of $410 million. SK Group’s investment is not only a testament to the company’s execution capabilities but also its vision of creating a ‘Point of Life’ off to online platform to serve consumers’ grocery, financial and entertainment needs.

Masan MEATLife delivered stable EBITDA margins of 10.6 per cent in Q1 in spite of a rising soft commodity price environment. MML delivered 38.5 per cent revenue growth versus Q1 2020 as branded meat sales doubled and feed volumes increased by over 20 per cent due to a recovery in the pig population.

Techcombank, which is associated with MSN, delivered profit before tax growth of 76.8 per cent underpinned by its consumer-centric financial services strategy. Current account and savings account (CASA) represents approximately 44 per cent of the funding base contributing to a strong NIM of 5.8 per cent.

Masan High-Tech Materials delivered 178.2 per cent growth in topline driven by pent-up customer demand post-COVID and consolidation of HCS.

Its EBITDA margin reached 16.1 per cent but the company still reported a loss for the quarter as higher commodity prices during the period will not be fully realised until the next quarter.

However, MHT reported a net profit of approximately VNĐ70 billion in March 2021. Management forecasts higher commodity prices in the following quarters.

MSN expects topline growth to pick up in Q2, with a new innovation pipeline from MCH, LFL growth in VCM and store expansion plan, MML’s meat business scaling up, and MHT benefiting from higher commodity prices. — VNS