Economy

Economy

|

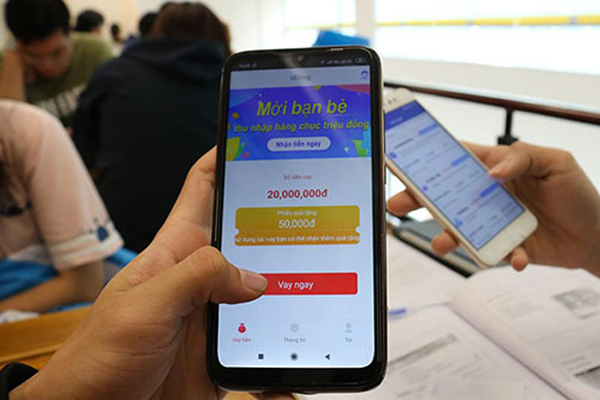

| A lending app. Việt Nam needs to develop a legal framework for peer-to-peer lending. — Photo enternews.vn |

HÀ NỘI — Internet users are often bombarded with attractive advertising, offering loans in five minutes, no mortgage, no lender fees and no commission.

However, borrowers must be careful if they don’t want to pay interest rates of up to 1,000 per cent per year.

Recently, more than 60,000 people across 63 provinces and cities in Việt Nam became debtors suffering cutthroat interest rates of 1,095 per cent per year from a payday loan ring headed by Chinese nationals. The ring was recently broken up by police in HCM City.

According to the police, five suspects were arrested and further investigation on the case was ongoing. The payday loan shark ran three companies named Vinfin, Beta and Đại Phát, headquartered in Bình Tân District, which offered cash loans via smartphone apps Vaytocdo, Moreloan and VD online at unreasonably high rates.

In nearly six months in operation, there apps lent a total of VNĐ100 billion (US$4.3 million) to about 60,000 people. To get the cash, borrowers had to create accounts to provide personal information and allow these apps access to contacts on their phones.

Experts warned that people must be vigilant in borrowing money from online lending platforms.

Economic expert Cấn Văn Lực said that there were a number of loopholes in lending via smartphone apps in which the risk was more on the debtors, especially vague details on interest rates.

Trần Việt Vĩnh, CEO of lending platform Fintech Fiin, said to enternews.vn that there was a lack of legal framework for peer-to-peer lending.

Many took advantage of the lack of detailed regulations to run usury businesses, which eroded the trust of the people in online lending, Vĩnh said, adding that this caused fintech companies to lose the opportunity for development.

The lack of a legal framework also causes difficulties for fintech companies in raising capital and running new services.

The State Bank of Việt Nam has urged credit institutions to be cautious in cooperating with peer-to-peer lending companies.

The central bank in March disclosed that it was developing a project for the pilot implementation of peer-to-peer lending in the country.

Statistics showed that there were about 40 peer-to-peer lending firms officially licensed in Việt Nam. — VNS