Economy

Economy

Việt Nam has set itself a target of increasing the ratio of processed coffee from the current 10 per cent to 30-40 per cent by 2030 to add value, the Việt Nam Coffee Week heard in HCM City yesterday (December 4).

|

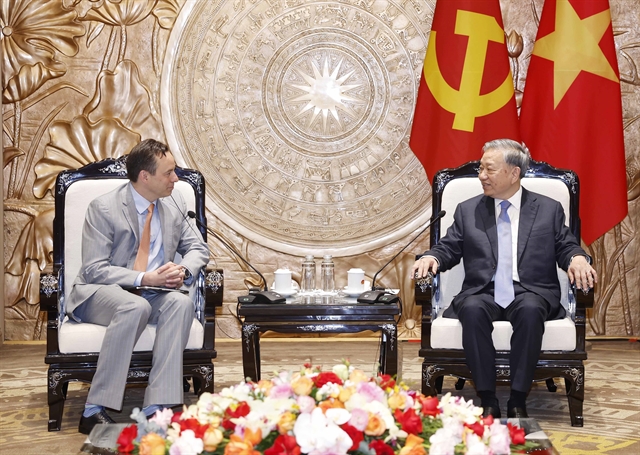

| A panel discussion held on the sidelines of Việt Nam Coffee Week in HCM City on December 4. — VNS Photo |

HCM CITY — Việt Nam has set itself a target of increasing the ratio of processed coffee from the current 10 per cent to 30-40 per cent by 2030 to add value, the Việt Nam Coffee Week heard in HCM City yesterday.

Speaking at the conference, Dr Nguyễn Đỗ Anh Tuấn, director general of the Ministry of Agriculture and Rural Development’s international cooperation department, said Việt Nam is the world’s second largest coffee exporter and tops in robusta production and export, with about 1.5 million tonnes of coffee exported each year, fetching a revenue of US$3.5 billion.

But the exports remain in the form of unprocessed beans with little value addition, he said.

To improve this situation and develop the industry in a sustainable manner, the sector plans comprehensive measures such as expanding processing, building brands for its products and strengthening linkages in the value chain, he said.

Lương Văn Tự, chairman of the Việt Nam Coffee and Cocoa Association, said coffee exports in the 2018/19 crop were 1.7 million tonnes worth US$3 billion, a year-on-year decrease of 2.9 per cent in volume and 14.4 per cent in value.

Exports of roasted, soluble and mixed coffee accounted for 8 per cent, he said.

“More and more local and foreign firms are investing in roasted and ground coffee and soluble coffee,” he said.

There are over 620 roasted coffee factories with a capacity of over 73,000 tonnes a year, he said.

Soluble coffee factories have a capacity of over 47,000 tonnes a year, with some new ones being set up by companies like TATA Group (India), Tín Nghĩa Corp and Intimex, he said.

Foreign investors are increasingly investing in processing to take advantage of the plentiful availability of premium coffee, a large domestic market with a population of 97 million, and tax breaks through 40 free trade agreements the country has signed.

“Processed coffee enjoys preferential tariffs of from 0 to 5 per cent when exported to markets that have FTAs with Việt Nam,” he said.

Coffee consumption has increased significantly in the domestic market though per capita consumption remains low compared to the world’s average, he added.

Đỗ Hà Nam, chairman and general director of Intimex Group, said: “Local and foreign firms continue to invest in soluble coffee plants and coffee shop chains.”

Local coffee shops and chains continue to gain its popularity and expand, he said

“Domestic coffee consumption is expected to increase by 5-10 per cent a year. Exports of instant coffee will continue to grow rapidly.”

Nam said around 200,000 metric tonnes of green bean robusta and arabica are sold in the domestic market, mostly to soluble coffee plants for processing.

Robusta coffee

Bernard Cremieux, managing director of Bero Coffee Singapore, and country manager of Neumann Gruppe Vietnam Co Ltd, said robusta production has been rising faster than arabica production globally.

“Of the 45 million extra bags of robusta produced since 1990, 28 million have come from Việt Nam, 15 million from Brazil and 2.5 million from Indonesia.”

“Global robusta demand has grown faster than arabica in the last 10 years at a compounded annual rate of 3 per cent compared to 1.9 per cent [for the latter].”

Robusta exports have been growing steadily as also its share of soluble and processed coffee. Over 20 per cent of robusta exports is now in soluble form.

Brazil is still the largest exporter of soluble coffee (33 per cent), but India (17 per cent) and Việt Nam (14 per cent) are growing their exports rapidly.

Robusta demand will further expand and productivity is the real farm income. But farmers and firms must pay more attention to sustainability, traceability and food safety, Cremieux said.

Nam said Việt Nam’s robusta production in the 2019-20 crop is expected to be unchanged or increase by 5 per cent.

The harvest would be delayed due to the weather and lack of labour and high labour cost, but the coffee would be of good quality, he added. — VNS