Economy

Economy

Capital divestment from State-owned enterprises had slowed and was still facing difficulties, said Đặng Quyết Tiến, director of Corporate Finance Department under the Ministry of Finance.

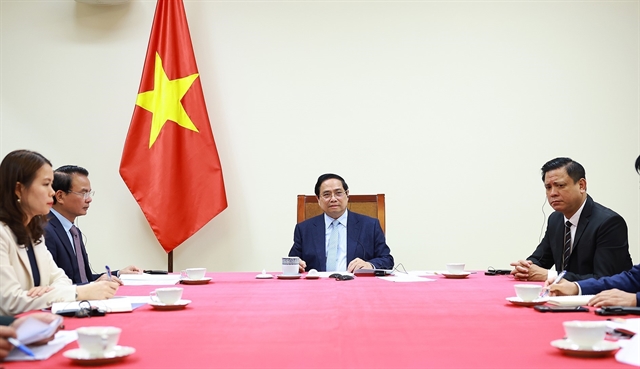

|

| A production line of the Sài Gòn Beer, Alcohol and Beverage Corporation ( Sabeco). State divestment of Sabeco helped the State collect about US$5 billion. — Photo sabeco.com.vn |

HÀ NỘI — Capital divestment from State-owned enterprises had slowed and was still facing difficulties, said Đặng Quyết Tiến, director of Corporate Finance Department under the Ministry of Finance.

The process needed to be sped up and avoid corruption that led to loss of state capital, he said.

According to the target set by Prime Minister Nguyễn Xuân Phúc, the State had been tasked with divesting from more than 400 SOEs over 2017-2020. In 2018 alone, the State should have divested capital from 181 enterprises, followed by 62 enterprises in 2019.

However, Tiến said the progress of State divestment had fallen short of the target.

In 2018, the divestment was carried out at only 54 enterprises, and no more movement had been seen in the early months of 2019, including the 127 enterprises that delayed divestment in 2018.

Đỗ Văn Sinh, permanent member of the Economic Committee of the National Assembly, said many businesses could not find a way to avoid losses from divestment.

He believed that share sales in lots was a successful method for capital divestment. State divestment of the Saigon-Beer-Alcohol-Beverage Corporation (Sabeco) helped the State collect about US$5 billion, and the deal for Việt Nam Dairy Products Joint Stock Company (Vinamilk) also brought in about VNĐ9 trillion.

The application of this method could help firms avoid losses, Sinh said.

In addition to capital divestment, the value of businesses who suffered losses was even more difficult, Tiến said.

Tiến said the process of divesting from units with loss-suffering projects was always difficult. For example, Phương Nam Pulp Mill, a subsidiary of the Việt Nam Paper Corporation (Vinapaco), had been put up for auction several times without success.

Another notable problem was that a large part of post-equitised enterprises had not registered for trading or listing on the stock market.

A report by the Ministry of Finance showed that in 2018, there were 667 enterprises that had already been equitised but not yet registered for listing on the stock market.

Lê Thị Thu Hà, deputy director of the Securities Offering Management Department under the State Securities Commission, said stock listings had not been attached to equitisation process as businesses were not aware of the benefits of listing shares.

Sluggish listings had affected the openness and transparency of the market, thus limiting the supervision of enterprises.

According to Deputy Minister of Finance Vũ Thị Mai, the ministry would direct the State Securities Commission to impose sanctions on equitised firms that did not register to list shares on time.

Land use rights was also another problems for divestments, Mai said.

According to banking and finance expert Cấn Văn Lực, the approval process was still slow, leading to a situation that when a project is approved, the price of assets had already changed due to market conditions, making it difficult for buyers to decide.

Cấn said the State should take drastic action to withdraw capital to mobilise resources for development and investment, promoting the country's economic growth and reducing public debt.

In order to help reach divestment targets in 2020, Tiến said ministries, branches and localities must instruct firms to accelerate the divestment process.

At the same time, enterprises should set up usage plans for their land in accordance with the law. — VNS