Economy

Economy

Asia’s first and only metasearch engine in insurance and banking, GoBear, has tied up with smartphone-based alternative credit scoring provider CredoLab to launch Easy Apply, an app that enables financial institutions to extend credit to a larger pool of customers.

|

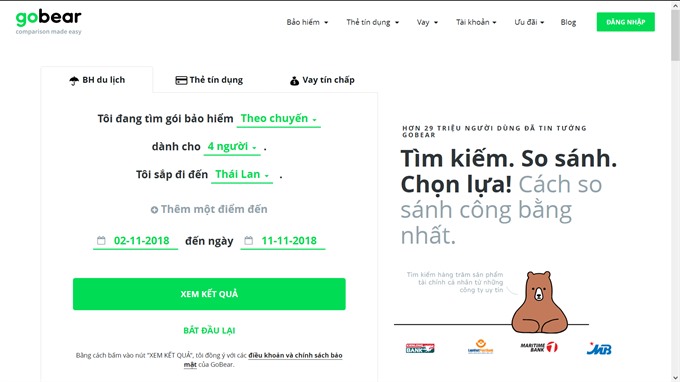

| GoBear and CredoLab launch a new phone application to evaluate the credit scores of prospective borrowers. — VNS Photo |

HCM CITY — Asia’s first and only metasearch engine in insurance and banking, GoBear, has tied up with smartphone-based alternative credit scoring provider CredoLab to launch Easy Apply, an app that enables financial institutions to extend credit to a larger pool of customers.

The partnership signified important headway in making financial services accessible to unbanked people in Việt Nam, GoBear said.

Besides Việt Nam, the app will also be launched in Indonesia, the Philippines and Thailand.

GoBear said the app utilises CredoLab’s AI-based proprietary algorithms that extract and analyse tens of thousands of data points from applicants’ smartphones, turning these anonymised ‘digital footprints’ into predictive credit scorecards to be used for their credit card, loan or insurance applications.

The use of non-traditional smartphone data for credit scoring provides applicants from all demographics, including unbanked people who have little to no traditional credit history, greater access to financial services including unsecured credit, the company said.

According to GoBear, there is a massive market opportunity in Southeast Asia to improve financial inclusion by innovating solutions.

Bao Nguyen, country director, GoBear Vietnam, said: “We are very pleased that Việt Nam will be one of the first markets to launch the Easy Apply app.

“With new technology, we will be able to help our partners better serve the unbanked, and enable our users to access useful and affordable financial products at the same time.

“Improving financial inclusion and serving unbanked consumers is very important in an emerging market like Việt Nam.”

Easy Apply will first be used in the credit cards segment before application in personal loans, insurance products and other lines of credit in future. — VNS