Economy

Economy

Shares struggled to rise on the HCM Stock Exchange on Thursday as investor sentiment turned negative on the current market trading condition.

|

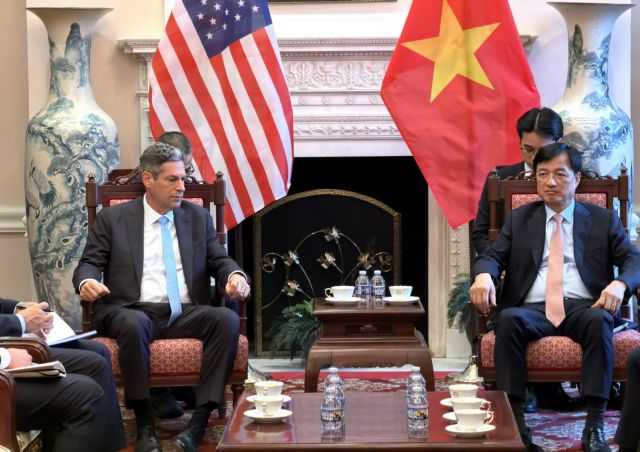

| Investors check stock prices at MayBank Kim Eng Securities Company in HCM City. — VNA/VNS Photo Hoàng Hải |

HÀ NỘI — Shares struggled to rise on the HCM Stock Exchange on Thursday as investor sentiment turned negative on the current market trading condition.

The benchmark VN Index inched up 0.15 per cent to close at 828.93 points, narrowing its growth from the intraday highest rate of 0.46 per cent.

HCM City’s stock index was down 0.07 per cent on Wednesday.

More than 169.3 million shares were traded on the southern market, worth VNĐ4.1 trillion (US$182.4 million).

The figures represented a decline of 14.8 per cent in volume and 13.8 per cent in value compared to Wednesday’s numbers.

The market breadth was negative with 142 declining stocks, 124 gaining ones and 58 shares ending unchanged.

The current market condition suggested investors exercise caution over the performance of large-cap stocks, which would have a big impact on the movements of the market index, according to Bảo Việt Securities Co (BVSC).

The VN30 Index, which tracks the performance of the 30 top companies by market capitalisation and trading liquidity, narrowed its gain from 0.5 per cent to only 0.07 per cent at the end of Thursday’s session.

Thirteen companies in the VN30 basket saw share prices drop against 14 gaining stocks.

The best-performing stocks included FLC Faros Construction (ROS), DHG Pharmaceutical Co (DHG), Bình Minh Plastic Co (BMP), food producer Kido (KDC) and digital retailer Mobile World (MWG).

Those were the companies that either have reported higher-than-expected earnings for the third quarter and nine months or are expected to release good reports for the periods.

Kido has announced its pre-tax profit in the nine-month period exceeded the year-targeted number by 9 per cent to reach VNĐ535 billion.

KDC rose 1.2 per cent after having fallen total 4 per cent in the previous five sessions.

On the opposite side, financial-banking stocks suffered from profit-taking as investors continued to look for profits after those stocks had made recent gains.

The worst decliners in the sectors were MBBank (MBB), Saigon Securities Inc (SSI) and HCM City Securities (HCM).

BVSC analyst Trần Xuân Bách said in a note that investors were quite indecisive and unwilling to make new purchases at the moment.

If current conditions continue, it may signal the market could face a short-term downtrend, Bách said, adding that the VN Index could fall back to the range of 818 and 822 points.

On the Hà Nội Stock Exchange, the HNX Index fell 0.31 per cent to end at 109.08 points. It lost 0.38 per cent on Wednesday.

Nearly 49 million shares were exchanged on the northern bourse, worth VNĐ585.6 billion. — VNS