Economy

Economy

The International Monetary Fund (IMF) has forecast Việt Nam's economic growth at 6.3 per cent in 2017 against the Government’s 6.7 per cent target, but noted that ambitious reforms could raise the country’s growth potential.

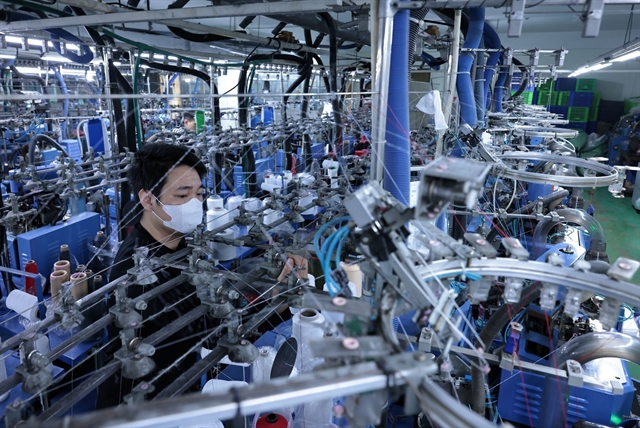

|

| The International Monetary Fund has forecast Việt Nam’s economic growth at 6.3 per cent in 2017. - Photo vov.vn |

HÀ NỘI — The International Monetary Fund (IMF) has forecast Việt Nam’s economic growth at 6.3 per cent in 2017 against the Government’s 6.7 per cent target, but noted that ambitious reforms could raise the country’s growth potential.

Under a report released on its website on Wednesday, IMF also projected the country’s headline inflation to stabilise at some 5 per cent as administered prices continue to be adjusted. The current account surplus is expected to decline somewhat, reflecting stronger imports.

According to the IMF, while the near-term outlook is positive, there are downside risks, including from high public debt, slow non-performing loans resolution, tighter global financial conditions and shocks to external demand, as well as rising protectionism and the failure of the Trans Pacific Partnership.

However, it noted: “Successful implementation of the authorities’ ambitious reform agenda could raise growth potential and increase resilience to shocks. Fast implementation of the Viet Nam-EU and other bilateral trade agreements would fuel exports and FDI.”

The IMF Executive Board encouraged authorities to expand the scope of reforms to safeguard hard-won macroeconomic stability, raise growth potential and upgrade the growth model to enhance sustainability and productivity.

IMF’s directors considered the tightening of the fiscal stance as appropriate and welcomed the authorities’ intention to ensure that consolidation is growth-friendly.

They also concurred with the intention to reduce the deficit to 3.5 per cent of GDP by 2020 and to maintain public debt below the legal limit of 65 per cent of GDP.

The directors stressed on the importance of revenue-enhancing measures, including unifying VAT rates, higher excise, environmental protection taxes and a property tax, besides the need to reduce exemptions and incentives and improve tax administration.

Reforms to raise cost recovery in public services were welcomed but needed to ensure equity, protect the poor and raise service quality.

They noted that monetary policy should remain on hold but be alert for signs of rising core inflation. Vigilance would be needed to contain rapid credit growth and credit allocation must be made more market-based, which would improve efficiency in supporting growth.

The directors underscored that modernisation of monetary policy management, including greater exchange rate flexibility and a gradual shift to using inflation as the nominal anchor would enhance resilience to external shocks.

They noted Viet Nam’s strong external position and called for policies over the medium term to gradually reduce the imbalance through stronger domestic demand and investment, a lower saving rate and greater exchange rate flexibility.

While welcoming progress made in banking sector reforms to address impaired assets and increase provisioning, the directors stressed that the pace of reforms should be accelerated and their scope broadened to include development of a legal framework for bank resolution, strengthening of the Vietnam Asset Management Company and implementation of further reforms to strengthen debt enforcement and market discipline.

Enhancing the Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) framework and its effective implementation would also support financial stability, they said.

They also welcomed ongoing structural reforms and underscored that Việt Nam would need to build a sustainable, modern economy before the demographic tailwinds fade. For this, according to the directors, more extensive policy action is needed to reform institutions and raise potential growth. Reforms of the state-owned enterprise sector and improved outcomes from vocational and tertiary education will also be critical. — VNS