Economy

Economy

|

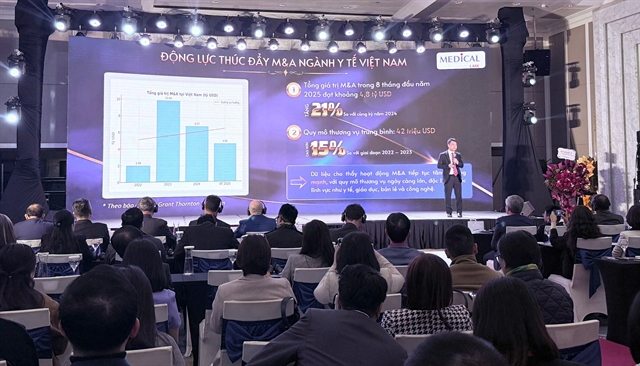

| The first international conference on mergers & acquisitions in healthcare held in Hà Nội on Friday morning. — Photo baochinhphu.vn |

HÀ NỘI — The healthcare merger and acquisition (M&A) market is gaining strong momentum, driven by rising investor appetite, rapid expansion of private healthcare and growing demand for high-quality medical services.

However, alongside that momentum, the sector is confronting significant legal and procedural hurdles that experts say must be addressed to unlock its full investment potential.

The first international conference on mergers & acquisitions in healthcare (HIMA 2025), held in Hà Nội on November 21, marked an important step in establishing a dedicated forum for dialogue among regulators, businesses and investors at a time when healthcare M&A is evolving rapidly both globally and in Việt Nam.

Speaking at the event, Nguyễn Toàn Thắng, deputy chief of Office at the Ministry of Health, said the conference offers a comprehensive view of the healthcare M&A landscape and helps identify emerging trends and opportunities through actual transaction experiences.

He added that M&A has become a strategic tool enabling Việt Nam's healthcare ecosystem to grow faster, more sustainably and in line with international standards, while also strengthening the flow of foreign investment into the country.

Việt Nam is increasingly viewed as a promising destination for healthcare M&A thanks to a fast-growing private sector, rising middle-class demand and more open government policies. Recent data from Medicallaw shows that total M&A value in the first eight months of 2025 reached US$4.8 billion, up 21 per cent year-on-year, with the average deal size rising to $42 million, a 15 per cent increase compared to 2022–23.

The broader market context reinforces this momentum.

The country's healthcare market expanded from $18.5 billion in 2022 and is projected to exceed $25 billion in 2025, while the pharmaceutical sector continues to grow at an annual 11.1 per cent.

Demographic shifts, including rapid population ageing and the expansion of the middle class that is expected to reach 23.3 million people by 2030, are also driving long-term demand for quality care.

Major barriers

However, experts warn that despite rising deal volume and strong fundamentals, Việt Nam's healthcare M&A market is still constrained by regulatory complexity and inconsistent legal frameworks.

At the conference, specialists pointed to gaps in licensing procedures, valuation standards, administrative processes and governance rules that frequently delay or complicate transactions.

According to Assoc Prof Dr Đặng Đức Nhu, senior advisor at Medicallaw and former official of the Ministry of Health's Medical Services Administration, due diligence in healthcare is far more complex than in other sectors, involving professional practice licences, facility operating permits, fire safety and environmental standards, high-level personnel assessment, drug lists, medical equipment and health insurance compliance.

International experts echoed that perspective.

Brian K. Langenberg, partner at ONEtoONE Corporate Finance, described M&A as a journey built on absolute confidentiality, adherence to global standards, transparency and professional conduct.

He emphasised that valuation plays a decisive role, noting that it depends not only on physical assets but also on client volume, revenue and operational performance.

"There will be transactions with valuations far higher than expected, but also cases where valuations fall significantly below assumptions," he said.

Global healthcare M&A trends provide additional context. After a boom period in 2020-21, with first-half 2021 deal values reaching $330-340 billion, activity slowed between 2022 and mid-2024 due to the absence of mega-deals. Recovery began in late 2024 and early 2025, with global values rising to $115-120 billion.

In pharmaceuticals and life sciences, transaction value fell from $60 billion to $40 billion, while healthcare services saw deal value surge from $40 billion to $60 billion despite fewer transactions, reflecting a shift toward larger, more strategic deals.

|

| Patients at a Trung Son pharmacy store for a free health check. — Photo trungsoncare.com |

Việt Nam has already seen several high-profile transactions. Thomson Medical Group's US$381.4 million acquisition of FV Hospital became one of the largest healthcare M&A deals in Southeast Asia in 2023.

In pharmaceuticals, China's Livzon Group is investing $240 million to acquire nearly 65 per cent of Imexpharm, while South Korea's Dongwha Pharm has committed $30 million for a 51 per cent stake in the Trung Son pharmacy chain.

Nevertheless, regulatory modernisation remains essential.

Nguyễn Toàn Thắng said that healthcare is a field requiring the highest level of transparency, professionalism, and legal-risk management.

Only when legal processes, audits, valuation criteria and operational standards are fully standardised will enterprises be ready for investment, partnership or IPO.

HIMA 2025 aims to accelerate that reform process by fostering open discussion between government and industry and by identifying policy solutions that promote a transparent, efficient and investor-friendly environment.

The Ministry of Health's strategic goals toward 2030, expanding public-health programmes, strengthening medical services, ensuring health, security and resilience and improving climate-change response, will increasingly depend on strong investment flows and an enabling legal infrastructure, Thắng noted.

The conference also highlighted the importance of administrative reform, transparent licensing, improved drug and equipment procurement procedures and stronger domestic manufacturing capacity, all viewed as critical to the long-term competitiveness of Việt Nam's healthcare ecosystem. — BIZHUB/VNS