Economy

Economy

|

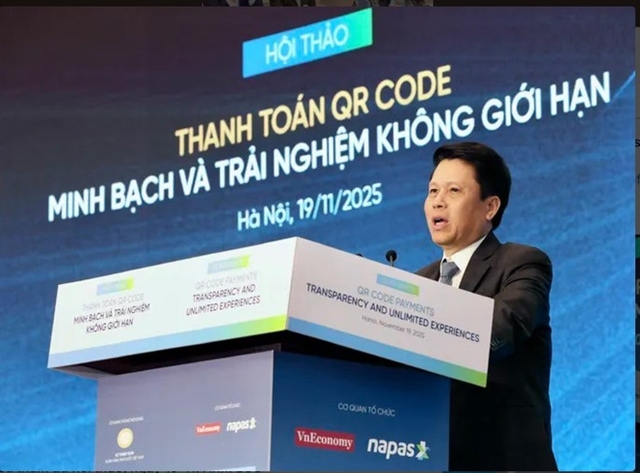

| SBV Deputy Governor Phạm Tiến Dũng speaks at the event. — Photo sggp.org.vn |

HÀ NỘI — Nearly 18 billion cashless transactions were recorded in the first nine months of this year, with total value surpassing VNĐ260 quadrillion (nearly US$10 billion), according to the State Bank of Vietnam (SBV)’s Payment Department.

The figures were released at a seminar jointly organised on Wednesday by the Payment Department, the National Payment Joint Stock Company of Vietnam (NAPAS) and the Vietnam Economic Magazine (VNEconomy). The event, themed “QR Code Payments: transparency and unlimited experiences”, highlighted the strong momentum of digital payments in the country.

SBV Deputy Governor Phạm Tiến Dũng said QR Code payments have expanded rapidly and become a mainstream method of transactions nationwide.

He attributed this growth to three main factors, including the government and the SBV's consistent policies on promoting cashless payments, the rollout of a unified QR code standard that removed interbank barriers, and broad market adoption across commercial banks, retailers and consumers.

Director of the Payment Department Phạm Anh Tuấn detailed the structure of the 18 billion transactions, including internet-based payments exceeded 3.4 billion transactions worth more than VNĐ76 quadrillion, while mobile-based payments accounted for nearly 12 billion transactions with a total value of over VNĐ64 quadrillion. QR Code payments alone reached more than 337 million transactions worth VNĐ 288 trillion.

At NAPAS, the system processed over 8.3 billion transactions by the end of September this year, approaching VNĐ48 quadrillion in value. On peak days, the platform handled up to 43 million transactions while maintaining nearly 100 per cent availability.

Experts noted that QR Code payments have grown in popularity thanks to their simplicity, swift processing, high security and the readiness of credit institutions’ technological infrastructure.

However, they cautioned that several challenges persist. A large number of vendors still use personal QR codes to receive payments, attracted by the convenience, speed and lack of service fees. Yet this method creates regulatory gaps, offers no consumer protection in case of disputes and is incompatible with bilateral QR systems used for cross-border transactions.

Tuấn said regulators are shaping solutions to address these gaps. To enhance international connectivity, strengthen anti-money laundering efforts and improve state budget oversight, Việt Nam aims to accelerate the shift from transfer-type QR codes to payment-type QR codes (QR Pay), in line with global practices and modern management requirements.

Việt Nam has already implemented cross-border QR payment links with Thailand, Laos and Cambodia, enabling two-way transactions for individuals and businesses. In the next phase, cooperation will extend to China, the Republic of Korea, Singapore, India and Taiwan (China) to meet rising cross-border payment demand. — VNS