Economy

Economy

|

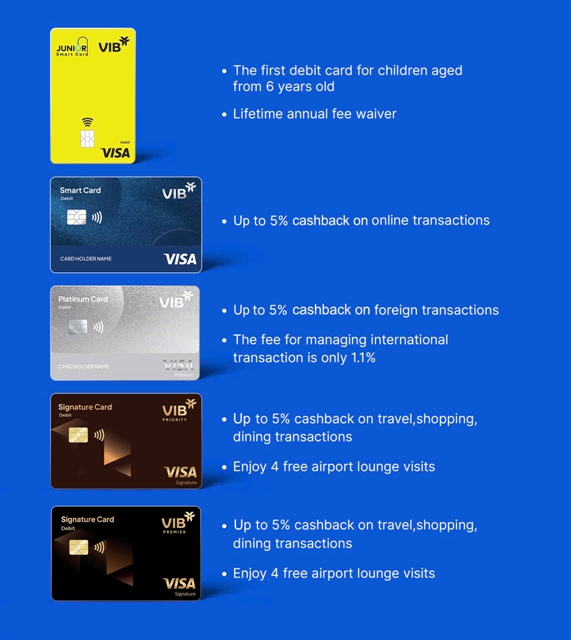

| VIB's new suite of international debit cards offers market-leading cashback rates of up to 5 per cent. —Photos courtesy of VIB |

HÀ NỘI — Vietnam International Bank (VIB) is raising the stakes in the domestic banking sector with its launch of a new range of international debit cards offering market-leading cashback rates of up to 5 per cent and no minimum spending requirement. This game-changing move is set to redefine how debit cards are used in Việt Nam.

Traditionally seen as tools for cash withdrawals and basic transactions, debit cards now have a smarter role. VIB’s latest offering turns debit cards into powerful financial instruments, allowing users to earn generous rewards directly from their current accounts — making every purchase count.

“Consumers today are shifting toward a new spending trend - balancing lifestyle and experiences with effective personal financial management to achieve greater goals," said Deputy CEO of VIB Tường Nguyễn. "The launch of this debit card suite further affirms VIB’s strategy of leading card trends."

"Going beyond basic payment functions, VIB’s debit card lines offer outstanding cashback value, a wide range of options tailored to different customer segments, and easy accessibility. By maximising benefits for customers right on their own current accounts, we aim to pioneer the new consumer spending trend,” she said.

Elevating payment card experience

As the Vietnamese market continues to focus on credit cards and QR code payments, debit cards have remained largely underutilised, typically serving basic functions such as ATM withdrawals and cash management. This limited utility has left a significant gap in customer experience and choice within the segment.

Vietnam International Bank (VIB), guided by its vision of 'Leading card trends' is taking bold steps to redefine that narrative. Building on its strong reputation in the credit card sector, VIB is now turning its attention to revolutionising the debit card experience.

Smart Card not only provides up to 5 per cent cashback with no minimum spending requirement but also positions debit cards as a smarter, more rewarding payment tool for everyday transactions.

As part of the new suite, VIB has introduced standout products tailored to specific customer needs. The Junior Smart Card is the first debit card in the Vietnamese market designed specifically for children as young as six years old.

Meanwhile, the Platinum Card offers up to 5 per cent cashback on international transactions and includes two complimentary airport lounge visits, with the option for unlimited additional access based on spending levels.

Rounding out the new debit card suite are the Premier Signature and Priority Signature Cards, developed exclusively for VIB’s priority banking customers. These premium offerings deliver elevated benefits including up to 5 per cent cashback in high-spending categories such as dining, travel and shopping, along with four complimentary airport lounge visits per year. Customers can also enjoy unlimited additional lounge access depending on their annual spending volume.

With each card line tailored to distinct spending habits and lifestyle preferences, VIB’s new debit card suite helps customers unlock meaningful financial benefits directly from their current accounts. Notably, these cards are issued without income verification or complicated registration procedures.

|

| The banks' five distinct debit card lines. |

Exclusive privileges with VIB debit cards

With five distinct card lines, VIB’s new debit card suite positions itself as a comprehensive and modern spending solution that caters to a wide range of customer segments, from children and digitally savvy young users to affluent high-net-worth clients.

What sets this suite apart is its delivery of credit card equivalent privileges without the usual barriers. Customers can enjoy market-leading cashback of up to 5 per cent, complimentary airport lounge access and a range of other premium lifestyle benefits, all without the need for income verification or credit approval.

Adding to their appeal, VIB’s new debit cards feature a competitive and highly flexible cashback mechanism. Unlike many existing products that require a minimum spending threshold to unlock rewards on future purchases, VIB’s system ties cashback benefits directly to the customer’s current account balance.

The model is simple. The higher the balance, the higher the cashback rate, with rewards reaching up to 5 per cent. Every transaction, regardless of size, qualifies for cashback, allowing customers to earn up to VNĐ900,000 per month (equivalent to VNĐ10.8 million per year). This structure ensures that users receive real, daily financial value from everyday spending.

VIB’s debit card suite also offers synergistic privileges through an integrated spending and account management model. Customers can seamlessly combine benefits across the bank’s ecosystem. For instance, by pairing their debit card with VIB’s Super Account, which offers returns of up to 4.3 per cent per annum, even on one-day deposits.

To enhance user experience, all VIB debit cards come equipped with advanced payment technology integration. Cardholders can make seamless contactless transactions through a wide range of platforms, including Apple Pay, Google Wallet, Samsung Pay, Garmin and fast QR code payments.

|

| Privileges provided by five VIB debit cards. |

The missing piece completing VIB’s personalized financial ecosystem

The launch of VIB’s new debit card suite represents more than just the addition of a convenient payment option; it serves as a key pillar in the bank’s personalised financial ecosystem. By enabling customers to maximise benefits across a unified platform, the suite moves beyond traditional banking products that operate in isolation.

For younger customers who have not yet met the eligibility criteria for credit cards or those who simply have no current need for one, VIB’s new debit card suite offers an ideal entry point into the bank’s broader financial ecosystem. With market-leading cashback benefits and no minimum spending requirement, these cards provide a practical yet rewarding solution for everyday transactions.

Additionally, their versatility sets them apart: full compatibility with leading e-wallets and international payment gateways ensures a seamless, globally connected payment experience, something not offered by standard QR code payment methods.

For existing payment cardholders, VIB also provides upgrade programmes and the opportunity to open a credit card, enhancing flexibility and financial control. Customers can take advantage of 'spend now, pay later' options, with interest-free periods of up to 55–57 days, as well as the ability to convert large purchases into instalment payments directly on the card.

|

| VIB is introducing an attractive promotional programme for new customers. |

By flexibly combining debit cards with credit cards, the Super Account and other digital financial products such as Super Cash – a fully online, unsecured personal loan offering up to VNĐ1 billion – VIB customers can intelligently manage cash flow, optimise spending and maximise access to exclusive privileges within the bank’s growing financial ecosystem.

To further enhance accessibility, VIB offers a fully digital card issuance process through its MyVIB and Max Powered by VIB digital banking apps. New customers can register, receive a virtual card and begin spending within just five minutes.

To celebrate the launch, VIB is introducing an attractive promotional programme for new customers. Those who meet a minimum spending of just VNĐ1 million will enjoy a waived first-year annual fee on their debit card. In addition, eligible customers will have the opportunity to open a complimentary VIB Cashback credit card, effectively doubling their benefits. — VNS