Economy

Economy

|

| Việt Nam’s electric vehicle annual sales projection. - Illustrative photo of HSBC |

HÀ NỘI — The rise of electric vehicles (EVs) in Việt Nam, is already reducing carbon emissions and producing green economic growth, according to a report released by HSBC Vietnam.

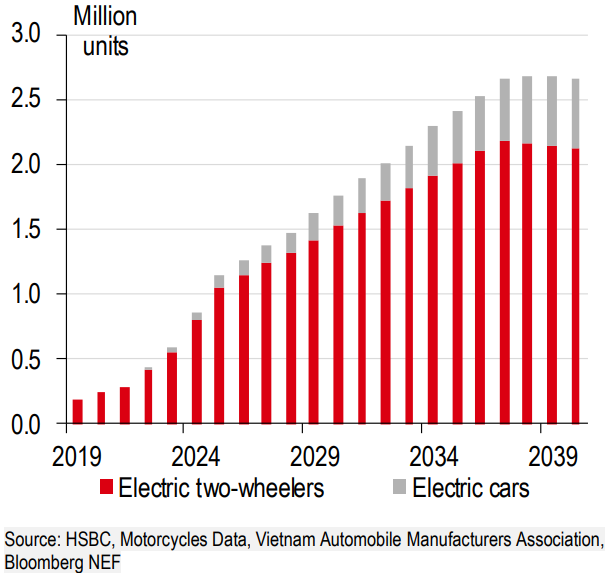

Local EV makers have been particularly successful in electrifying two-wheelers (E2Ws), but growth will eventually slow while four-wheel cars pick up the slack. Although it is difficult to project the future of a rapidly evolving industry, it is estimated that Việt Nam’s annual E2W and electric car sales could rise from less than one million in 2024 to over 2.5 million by 2036.

Crucially, Government policies are encouraging EV production and consumption, but as the report says, more investment is required in infrastructure and critical supply chain segments, such as rare earths. Traditionally, Japanese firms have led the two-wheel market in Việt Nam, but local EV players, such as VinFast, are rapidly growing, in partnership with Chinese EV and battery companies.

VN’s green energy transition

Energy transition has been a key focus in Asia in recent years and Việt Nam is no exception. As early as 2021 during the COP26 summit, Việt Nam set a target to achieve carbon net zero by 2050. In December 2022, the G7 announced a package of US$15.5 billion to assist the country’s decarbonisation efforts. Last May, the long-anticipated Power Development Plan 8 (PDP8) for 2021-30 was released, setting out a roadmap for Việt Nam’s renewable energy goals.

Fortunately, the rise of electric vehicles (EVs) is contributing to carbon net zero and propelling a sustainable source of long-term economic growth for Việt Nam. Local EV makers have been particularly successful in electrifying two-wheelers.

Today, Việt Nam’s electric two-wheeler (E2W) market is the largest in ASEAN and second-largest worldwide, just behind China. Looking ahead, Việt Nam’s EV market has ample room for further growth. While projecting the future of a rapidly evolving industry is difficult, the estimate is that Việt Nam’s annual combined E2Ws and electric car sales could rise from less than one million in 2024 to over 2.5 million by 2036 — a rough sense of this industry’s market potential in Việt Nam.

|

| Southeast Asia’s vehicle annual sales projection. — Illustrative photo of HSBC |

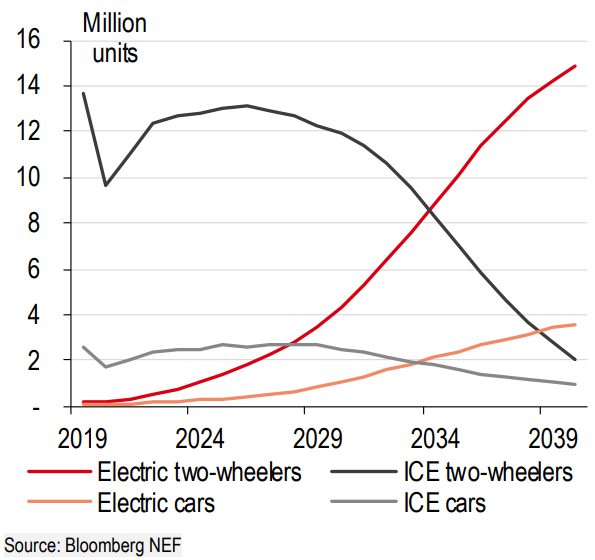

According to the report, E2Ws will lead the way in Việt Nam’s EV surge. Compared to electric cars, E2Ws are more affordable with greater vehicle component similarity, and which already boast a high rate of local production. Vietnamese consumers transitioning to EVs will also be more accustomed to two-wheelers, which outnumber the relatively pricier four-wheel cars by 30 to 1.

In fact, the predominance of two-wheelers—in both electric and fossil fuel varieties—is not limited to Việt Nam. By the late 2030s, however, HSBC’s experts expect E2W sales to flatten out in Việt Nam as the local two-wheel market saturates. Meanwhile, they think Việt Nam’s electric car market has enormous untapped potential given that over 60 per cent of the population owned a motorcycle in 2020, compared to only 5.7 per cent that owned a car. Many in the industry are confident that Việt Nam can fulfil its electric car potential. For example, the Việt Nam Automobile Manufacturers Association has estimated that the country will have 3.5 million electric cars on the road by 2040.

Domestic Vietnamese EV makers, such as the industry leader VinFast, will face challenges replicating E2W success in the electric car segment. Hesitant Vietnamese consumers often cite high prices, range anxiety, battery concerns and inadequate charging station infrastructure as concerns.

Some of these EV adoption barriers can be overcome through Government policy support. For example, Việt Nam has implemented a battery electric vehicle (BEV) registration fee exemption, reduced BEV import duties and exempted BEV investment projects from corporate income tax. The Ministry of Transport also proposed a policy to provide a subsidy worth $1,000 to each electric car buyer, but faces resistance from the Ministry of Finance.

In addition, Việt Nam can also enhance the domestic EV ecosystem by leveraging its plentiful rare earth reserves, with the world’s second largest source in the world after China.

The success of Việt Nam’s green automotive transformation also depends on continued foreign investment and partnerships with local firms. Japanese and Korean multinational companies have historically played a significant role in Việt Nam’s automotive industry. VNS