Economy

Economy

|

| VIB’s 2023 General Meeting of Shareholders took place in HCM City. — Photo courtesy of the bank |

HCM CITY — Vietnam International Bank (VIB) held its 2023 General Meeting of Shareholders (AGM) in HCM City on Wednesday.

During the event, shareholders approved the goal to increase charter capital to over VNĐ25.36 trillion in 2023, up 20.36 per cent year-on-year.

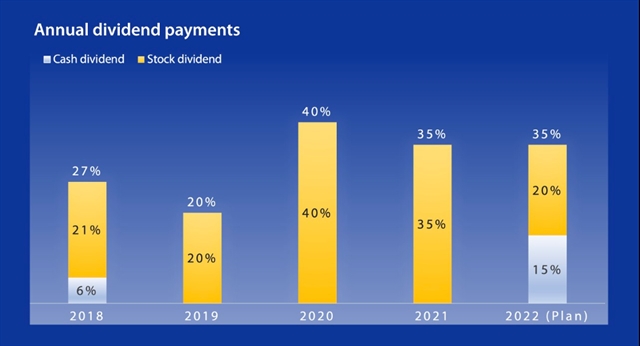

The plan to pay 35 per cent dividend to shareholders, with a maximum of 15 per cent cash dividends and 20 per cent bonus shares, was also approved by shareholders.

VIB has established a solid foundation for outstanding growth in scale, quality and brand value during the first six years of the 10-year strategic transformation roadmap (2017-26), according to the report delivered by the Board of Directors at the event.

That has helped VIB become one of the leading banks in terms of business efficiency, asset size and revenue growth, effective cost management, and tight risk control.

VIB's profit has grown at an annual compound growth rate (CAGR) of 57 per cent per year over the past six years. The bank has also recorded its return on equity (ROE) ratio at over 30 per cent for three consecutive years, far exceeding the average rate of the Top 10 listed banks.

VIB currently has the leading retail proportion in the industry thanks to its strategy of becoming the leading retail bank in terms of scale and quality. The bank’s outstanding retail loans account for over 90 per cent of its total loan portfolio.

|

| VIB's dividend payout ratio over the years. — Source: Documents of the Annual General Meeting of Shareholders in 2017-22. |

According to VIB, the high dividend payout ratio has been maintained over the years, increasing shareholders' trust in the bank.

In the next period, VIB sets sustainable growth targets, pioneers a strong governance foundation and leads in digitalisation. The bank said it is always consistent to become a leading retail bank in terms of quality and scale in Việt Nam.

VIB aims to attract 10 million customers by 2026, and an annual compound profit growth of 20-30 per cent each year from now to 2026, thereby sustainably increasing the market capitalisation for shareholders.

To this end, VIB’s Board of Directors will focus on seven directions including excellent and highly competitive product suites, innovative and tailor-made solutions for customers and partners, best-in-class technology and digital bank, human capital development, leading brand, leader in international standard applications and robust risk management and compliance.

At the meeting, shareholders voted to elect the Board of Directors and Supervisory Board for the IX term (2023-27). They approved five members of the Board of Directors, including one independent member and two members of the Supervisory Board. — VNS