Economy

Economy

|

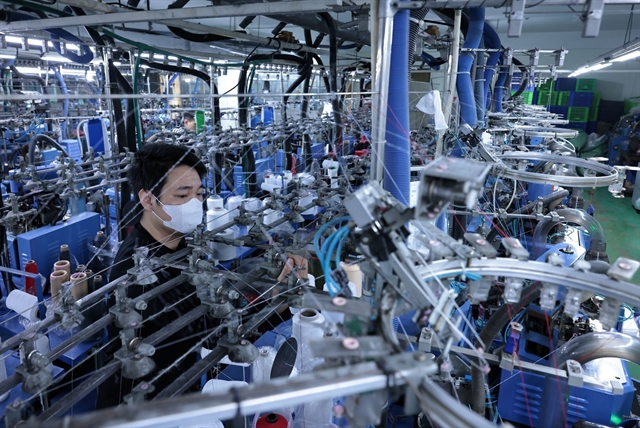

| An overview of the conference. VNA/VNS Photo |

HÀ NỘI – More than 100 businesses and 43 investors of industrial clusters and nearly 20 commercial banks participated in a conference to connect local firms in Hà Nội with commercial banks and the Hà Nội Development Investment Fund (HANIF).

The event, launched on August 15, was jointly held by the city's Department of Industry and Trade, the Hà Nội Branch of the State Bank of Vietnam, and the Hà Nội Association of Main Industrial Products (HAMI).

Addressing the event, Trần Thị Lan Phương, Acting Director of the Hà Nội Department of Industry and Trade, said that the conference aimed to provide a chance for banks and investment funds to introduce soft loans and support programmes to businesses, helping them overcome difficulties and develop.

In order to launch infrastructure projects in industrial parks and clusters in the city, the Hà Nội Department of Industry and Trade suggested that businesses should coordinate closely with credit institutions to access capital sources to serve their production and business activities.

According to the department, in the first seven months of this year, total retail revenue of goods and services rose about 22 per cent year on year. Meanwhile, the index of industrial production (IIP) of the city increased by 7.2 per cent over the same period last year, and the export revenue was estimated at US$9.84 billion, up 17.2 per cent year on year. In the first seven months, the consumer price index (CPI) of the city increased 3.38 per cent year on year.

According to the Hà Nội Industrial and Export Processing Zones Authority (HIZA), the capital city is now home to 10 operating IPs, covering a total area of over 1,347 ha. Nine of them have an occupancy rate of nearly 100 per cent.

Despite complicated developments of the COVID-19 pandemic, the city's IPs and EPZs lured nearly $40.7 million invested in seven new projects and an additional US$198 million poured into 23 existing projects in 2021.

Industrial parks in Hà Nội had attracted 303 foreign direct investment projects worth nearly $6.1 billion and 399 domestic projects with total registered capital of almost VNĐ18 trillion ($788 million) by the beginning of December last year.

At the conference, participants noted that the disbursement of capital supporting the socio-economic recovery and development programme had remained slow, while businesses’ access to credit policies and other policies had been modest.

HAMI Vice Chairman Lưu Hải Minh said that without assistance from banks, production businesses would face many difficulties.

He said that HAMI members hoped to receive preferential loans from banks to speed up the renovation and application of technological advances.

Agreeing with Minh, Nguyễn Vân, from the Hà Nội Association of Support Industries, said that after two years of being impacted by the COVID-19 pandemic, technology firms were in need of financial support from banks with long-term loans at low interest rates to boost production activities.

Nguyễn Minh Tuấn, Director of the Hà Nội Branch of the State Bank of Vietnam, affirmed that the banking sector and business community shared symbiotic relations, and the banking sector had exerted efforts to support businesses through stable interest rates and rein in inflation at the same time.

Tuấn called on banks to give the best support to enterprises and expressed his hope that the city's Department of Industry and Trade and HANIF would work more closely together to hold more such conferences to give chances for businesses and banks to meet and explore each other’s demand, thus seeking the best solutions to deal with difficulties facing companies, and contributing to the socio-economic development of the capital city.

Within the conference’s framework, the city's Department of Industry and Trade and HANIF signed a cooperation agreement on information exchange. HANIF, commercial banks and businesses also inked a deal on collaboration in supporting businesses to access soft loans. VNS