Economy

Economy

|

| A logo of VIB seen at its head office in HCM City. — Photo courtesy of the bank |

HÀ NỘI — Vietnam International Bank (VIB) had a great performance in 2021 with a profit exceeding VNĐ8 trillion (over US$343 million), up 38 per cent year-on-year, according to its business results released on Wednesday.

Especially in the fourth quarter, VIB experienced a strong recovery with a profit of nearly VNĐ2.7 trillion, the highest level in the bank's history and following the double growth in profit of over 60 per cent for five consecutive years.

Last year, VIB's total operating income saw a positive yearly increase of 33 per cent to hit nearly VNĐ15 trillion. Twenty per cent of which came from fee income thanks to its leading market share in many product and service segments such as bancassurance and cards.

Meanwhile, the bank's net interest income topped VNĐ12 trillion, up 39 per cent year-on-year thanks to its net profit margin expansion of 4.4 per cent and funding costs which decreased 1.1 percentage point compared to the previous year.

As of December 31, 2021, VIB's total assets reached nearly VNĐ310 trillion, up 27 per cent compared to the beginning of the year. Its outstanding credit balance hit more than VNĐ200 trillion, up 19 per cent.

According to the data, total deposits also grew strongly by 27 per cent year-on-year to VNĐ280 trillion in 2021. Current account savings account (CASA) deposits rose 55 per cent year-on-year, accounting for over 16 per cent of customer deposits.

The retail segment continued to be the main driver of the bank's growth last year as its retail loan balance grew by double digits, reaching 24 per cent, making nearly 90 per cent of the total outstanding credit balance. That affirmed its position as one of the banks with the highest retail loan proportions in the market.

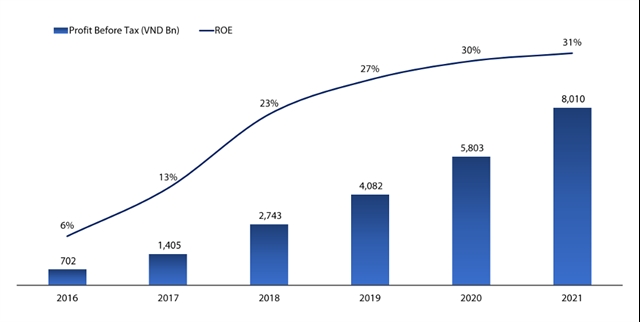

VIB said the recovery of the national economy and credit room extensions for some banks in the year-end period along with the bank's strategy of developing strong digital products and platforms helped make an impressive business breakthrough for the bank after the pandemic so that it continued to lead the industry in terms of operational efficiency with a return on equity ratio of 31 per cent.

|

| A chart shows the profit and returns on equity ratio of VIB in 2016-21. — Photo courtesy of the bank |

Advantage from pioneering digitisation and strong governance

Being a pioneer in the application of international governance standards, VIB's capital adequacy ratio according to Basel II was at more than 11 per cent and the loan-to-deposit ratio at 71 per cent in 2021.

At the same time, VIB's cost-to-income ratio dropped sharply to the lowest level of 35 per cent thanks to its efforts in accelerating the digitalisation application from sales to operations and in constantly optimising operating costs. Amid the pandemic, VIB customers could make online transactions easily from opening cards, accounts and deposit savings to making loans and accessing insurance solutions.

The bank also pioneered the application of leading technologies like Big Data, AI, and cloud computing into the credit card approval and issuance process so that customers could register and receive digital credit cards with a limit of up to VNĐ200 million in just 30 minutes instead of going to the bank's offices, meeting the staff and proving their income.

In September, VIB became one of the first banks in Việt Nam to deploy a multi-cloud strategy that aimed to apply outstanding technology from the world's leading technology partner into financial products and services and to improve the Vietnamese customer experience.

The dynamism, creativity and flexible adaptation, along with the pioneering digitalisation strategy, helped VIB maintain its growth even during the social distancing period and then recover strongly after the fourth wave of the pandemic.

The strong governance foundation, high and stable growth momentum and the flexibility to adapt well to the pandemic brought VIB into Việt Nam's Top 50 best-listed companies in 2021 and Top 10 prestigious public companies in Việt Nam in 2021.

VIB also had a double win at an international credit card awards: Best New Card Offering - VIB Online Plus 2in1” and “Most Innovative New Credit Card Service - Việt Nam 2021."

It was also honoured with the ‘Innovation in Digital Banking 2021’ award and won a silver award in Lead Generation Category at MMA SMARTIES Awards 2021.

With Việt Nam's positive economic prospects in 2022, VIB - a pioneer in terms of strong governance foundation, high and stable growth rate for many consecutive years, along with effective digitalisation strategy consistent with the sustainable growth goal - is well on track to become the leading retail bank in terms of quality and scale in the country. — VNS